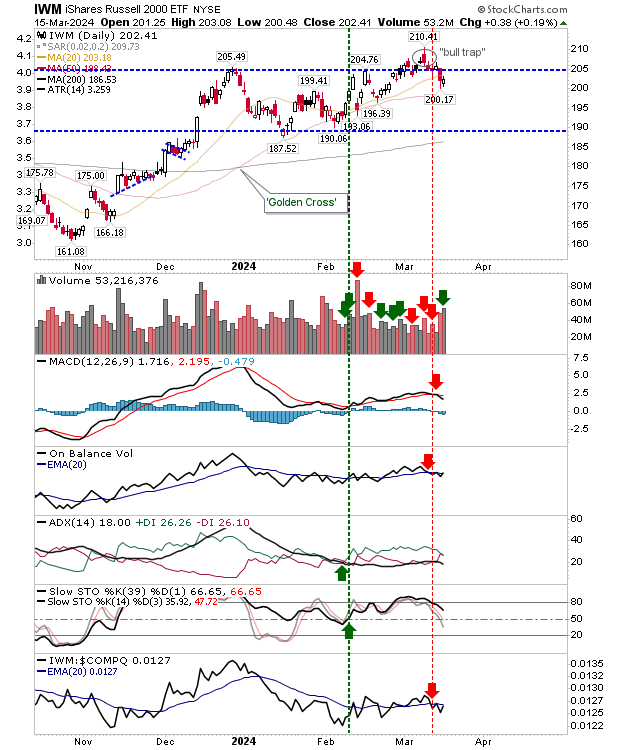

Options expiration will have clouded Friday's volume, but Friday's buying in the Russell 2000 (IWM) did not do enough to challenge the "bull trap" or the loss of the 20-day MA.

The index deals with 'sell' triggers in the MACD, On-Balance-Volume, and relative performance against the Nasdaq.

The expected result of the 'bull trap' is a move back to - then below - support defining the trading range off which the original breakout emerged. For the Russell 2000 ($IWM), this means a move back to $188s.

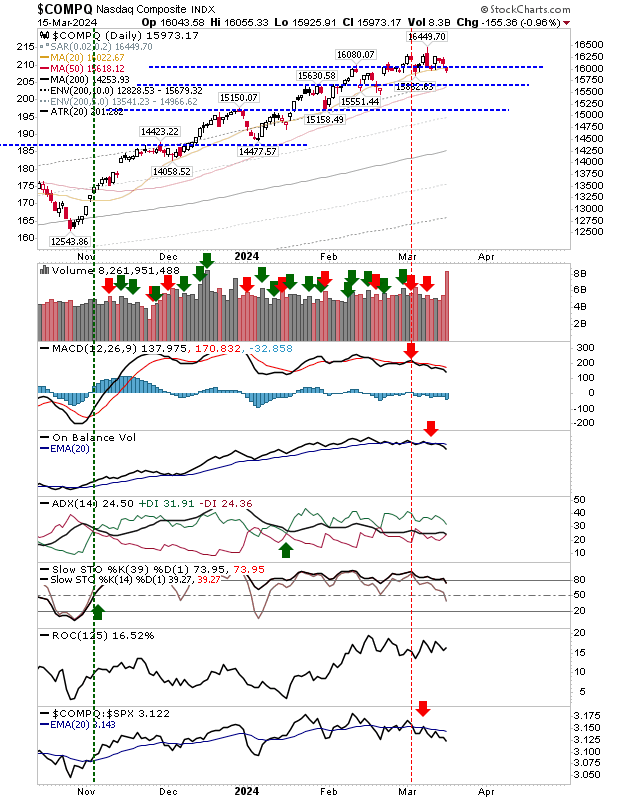

The Nasdaq has just drifted below breakout support and its 20-day MA, enough to count as a "bull trap". If there isn't a return above 16,055 today it will effectively confirm the "bull trap", but there is still time for the index to get out of this.

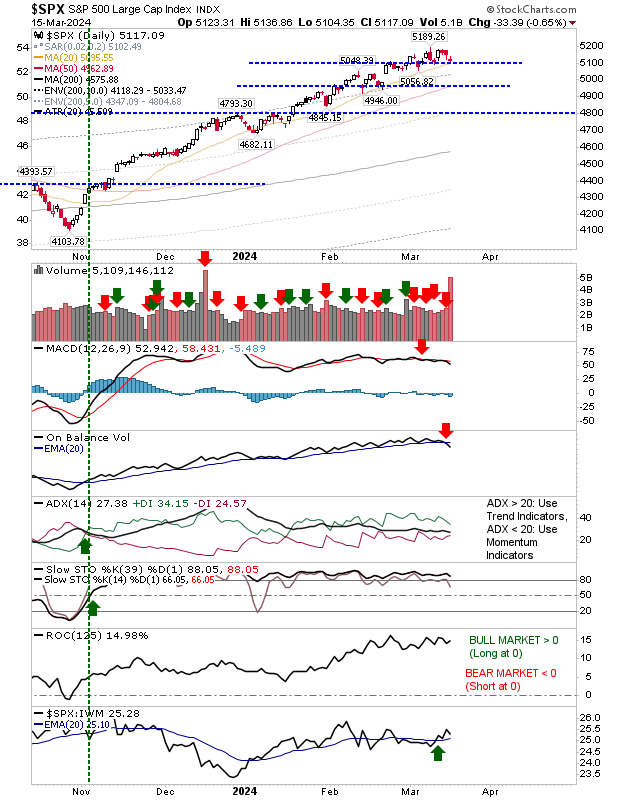

The S&P 500 was the index not to flag a 'bull trap' and could potentially lead a recovery off its 20-day MA. If there is a long play today it will be in this index.

For today, we will want to see a positive open, especially in the S&P 500. Given the vulnerabilities of the Nasdaq and Russell 2000, a gap higher on the open would likely lead to more selling, so a slow-and-steady approach is perhaps preferred.

As the Russell 2000 ($IWM) is furthest away from prior breakout resistance, it's most likely to see a short-attack on a return to this level.