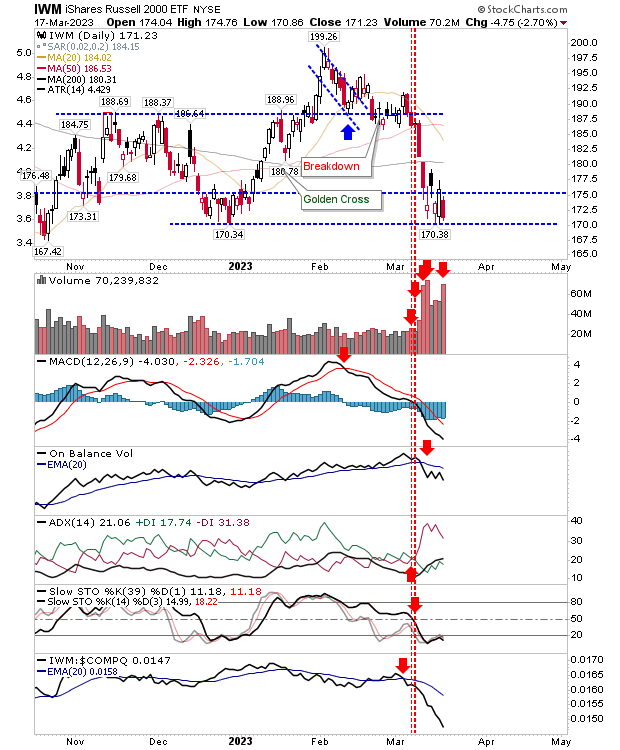

Tricky times for markets, but for the Russell 2000 in particular. Since the start of the Silicon Valley Bank crisis, we have seen a rapid deterioration in the state of the markets, and the vulnerability for a crash, as crashes occur not from highs but when markets are oversold - and that's where we are now.

However, last summer's low is a low of consequence and import, so I would see any additional loss as a temporary loss that should quickly reverse and offer excellent buying opportunities for those willing to take the risk (as a long-term investor). Where it gets more questionable is how far any such sell-off/crash could go.

But before we get there, we need to see a loss of existing support. For the Russell 2000 (NYSE:IWM), this is the $170 level. Selling volume surged last week in confirmed distribution, and technicals are net bearish. Relative performance is also accelerating lower.

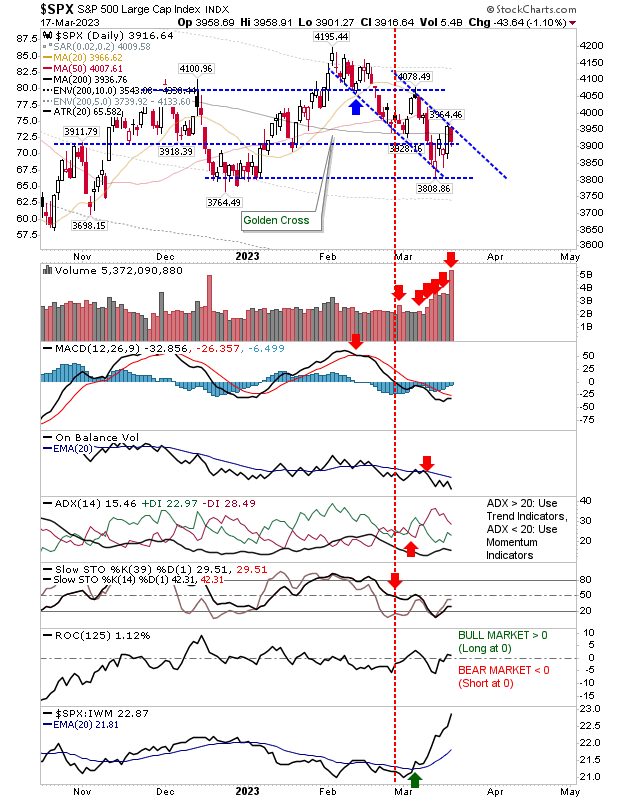

The next index on the line is the S&P 500. I had redrawn the resistance based on the angle of support, and this resistance was tested and rebuffed on Friday. If the Russell 2000 loses $170 support, I would be looking for a similar loss of 3,800 in the S&P 500, even if the S&P 500 is still over 100 points away from this support level.

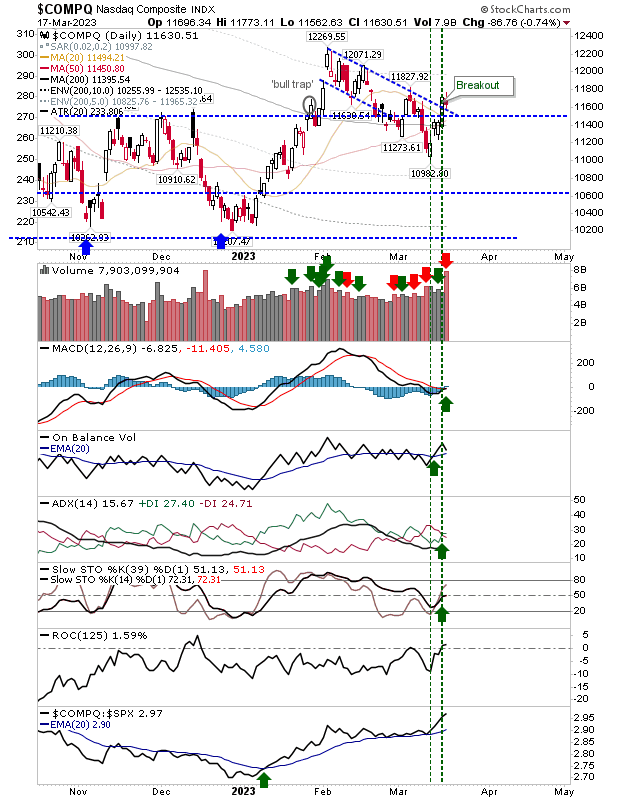

The Nasdaq is the only bright spark of lead indices. It had managed to break resistance on Thursday, and Friday's selling finished with a neutral doji that held on to this breakout. But, if the S&P 500 and the Russell 2000 break down, it would be hard for the Nasdaq to cling on.

For tomorrow, I would be looking for a test of $170 in the Russell 2000 (IWM). An intraday violation would be okay, but the end-of-day close would be the concern here. If that happens, I expect the S&P 500 and Nasdaq to follow suit soon afterward. And when that happens, panic could set in.

However, the next major bottom is probably close; bear market lows typically come 2-1/2 years from the prior peak (all-time high). For us, that high was in November 2021, so if we look for the low of this bear decline, it could be early 2024 by a standard bear count, but it's likely to be sooner. Also, I do not see losses getting anywhere near the generational low of March 2009.

So, where can we expect markets to find support *if* there is a crash? For me, I would look to:

- Russell 2000 (IWM): $110

- S&P 500: 3,000

- Nasdaq: 8,000