All eyes on Europe’s service sector

The heavy focus currently placed on service inflation from both markets and central banks means today’s PMI services should prove an interesting addition to the economic debate. The only problem is, the reports are second releases and so it is doubtful whether they will provide a lot of new information. Still, the fear of slower but more deeply entrenched price rises in that sector makes qualitative indicators all the more useful. The value of their employment component also stems from the lack of timely labour market indicators, especially with the European Central Bank (ECB) intent on making policy decisions on backward-looking indicators such as wages.

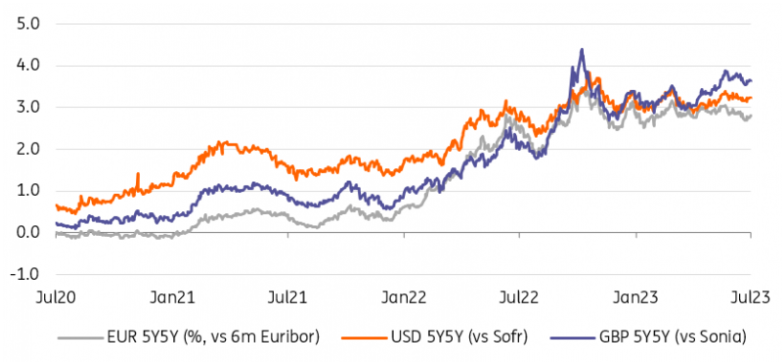

The euro outperformance has in part reverted a hard to justify convergence of forward rates

Despite relative resilience in Europe’s service sector – which is perhaps still riding the post-Covid wave of optimism – the deterioration of the outlook in other sectors has driven the outperformance of euro-denominated government bonds relative to their dollar-denominated peers. At the long-end, the euro outperformance has in part reverted a hard to justify convergence of forward rates; for instance, the 5Y swap rate in five years’ time (5Y5Y). This is not the most spectacular case of rates divergence within the developed market interest rates complex, however.

Torn between contradictory signals of economic slowdown but sticky inflation, sterling rates have risen well past the value of their US dollar equivalents. Despite the significant flattening of the UK curve over the past month, sterling rates are the only ones displaying a clear upward momentum. The fact is that this cycle’s inflation fight will require a more aggressive tightening campaign on the Bank of England’s part, and will probably be more protracted. This doesn’t mean indicators of long-term rates (such as 5Y5Y swaps) should meaningfully rise above that of the US, however.

Divergence in long-term forwards reflects near-term developments

Today’s events and market view

- Ahead of Germany’s factory order and industrial production (IP) to be released tomorrow and Friday respectively, IP figures for France and Spain will be published this morning.

- Services PMI for Europe this morning are all second readings except for Italy and Spain. A further decline in the services index would undermine the ECB’s hawkish message, with employment and price components of particular interest.

- The ECB publishes its monthly consumer survey which includes questions on inflation expectations. The disinflation narrative should receive a boost from Eurozone PPI settling around negative values.

- US data consists of factory and durable goods orders. This will be followed by the minutes of the June FOMC meeting, where the Fed’s committee decided not to increase rates for the first time since early 2022. The Fed will be keen for markets to see the hawkish side of that decision and that it heralds a more protracted tightening cycle. The Fed’s dot plot still implies 100bp of cuts in 2024. Fed communication may well chip away at that message next.

- Bond supply consists of the UK selling 3Y debt.

First published on Think.ing.com.