- The Q4 earnings season kicks off this week, with several major banks due to publish their results tomorrow.

- JP Morgan, Bank of America, and Citigroup will publish their quarterly results on Friday before the market opens.

- In this article, we will try and analyze which bank has the best pre-earnings profile.

- Navigate this earnings season at a glance with ProTips - now on sale for up to 50% off!

Earnings season is set to kick off with results from some of America's biggest banks, including JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), and Citigroup (NYSE:C) - due tomorrow before the market opens.

To better evaluate how these companies look going into the reports, we will take a look at their strengths and weaknesses using our new flagship tool: ProTips.

For those that don't know, ProTips, available only to InvestingPro subscribers, are quick, digestible information points designed to simplify the complex data history of an asset, enabling you to swiftly assess risks and reveal hidden trends.

Designed for both retail investors and pro traders, ProTips avoids calculations (and reduces workload) by translating a company's data into synthetic observations.

It is therefore recommended to take a close look at ProTips when analyzing a company, particularly given its quarterly earnings releases. In this piece, we'll show you how to do it by evaluating the best bank going into earnings season.

Details to watch out for in bank results

Overall, Wall Street is optimistic that the banking sector will make a comeback this year, boosted by a growing IPO market and increased bond issuance.Therefore, results and analysis of these activities could provide valuable clues to which stocks are a buy and which are a sell.

In addition to the core metrics of EPS and sales, investors should pay particular attention to net interest income and net interest margin, which measure what banks earn from their lending activities.

Strong credit could lead to higher earnings estimates for the rest of the year. Also, keep an eye on the investment banking activities of financial institutions.

Let's dig into these metrics with ProTips:

JP Morgan (JPM)

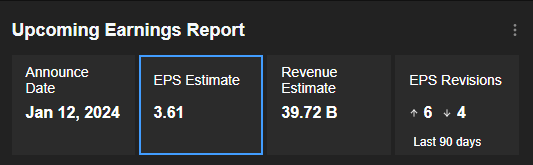

The results are expected on Friday and the analyst consensus forecasts EPS of $3.61, down from $4.33 in the previous quarter, but slightly up on the same quarter a year earlier.

Source: InvestingPro

Revenues are expected to reach $39.72 billion, slightly less than in the previous quarter, but 15% more than the previous year.

InvestingPro data shows that JPM's results have exceeded expectations in terms of EPS and revenues by a wide margin for the last 5 consecutive quarters.

What does ProTips tell us about JP Morgan's strengths and weaknesses?

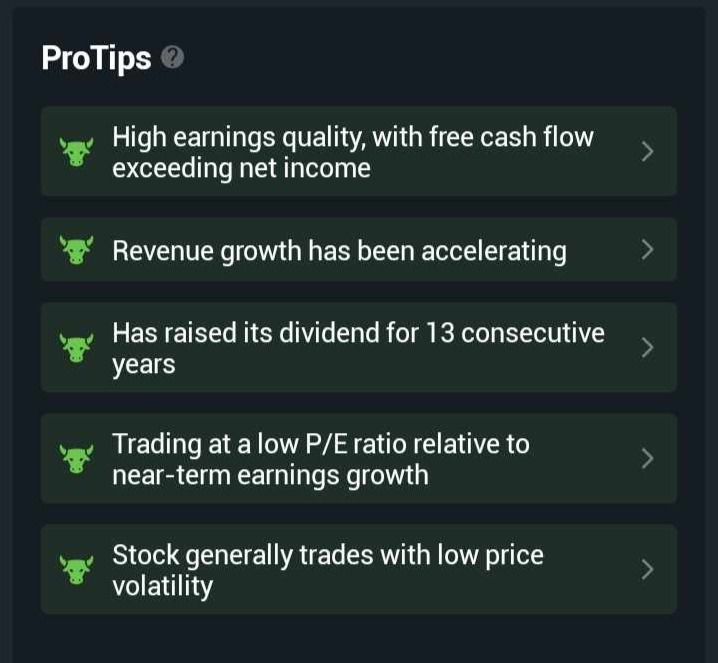

As you can see from the image below, all the ProTips for JP Morgan are quite positive.

Source: InvestingPro

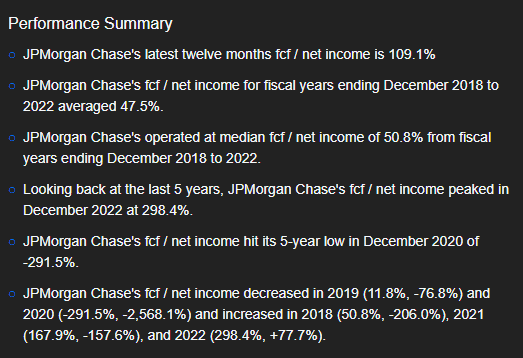

ProTips tell us that the company boasts high earnings quality, with free cash flow exceeding net income.

The detailed FCF/Net Income metric page for JP Morgan shares reveals this:

Source: InvestingPro

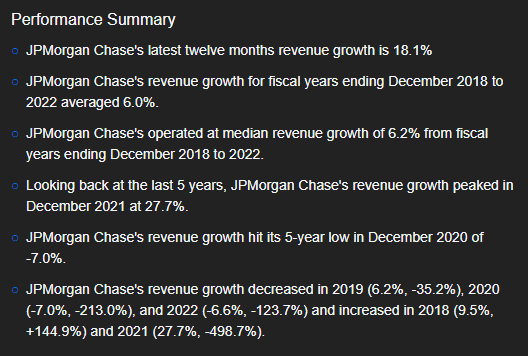

Another strong point highlighted by ProTips is the fact that its earnings growth has accelerated.

ProTips reveal that JPM's 12-month revenue growth was 18.1%, among other key details.

Source: InvestingPro

Bank of America (BAC)

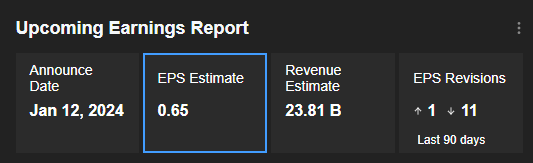

Bank of America's next quarterly results should see EPS fall to $0.65 according to analysts, compared with $0.90 in the previous quarter, and $0.85 last year.

Source: InvestingPro

Revenues are also expected to decline, to a consensus of $23.81 billion, versus $25.167 billion in the previous quarter, and $24.532 billion a year earlier.

What does ProTips tell us about Bank of America's strengths and weaknesses?

Bank of America's profile, based on the ProTips, is a mixed bag:

Source: InvestingPro

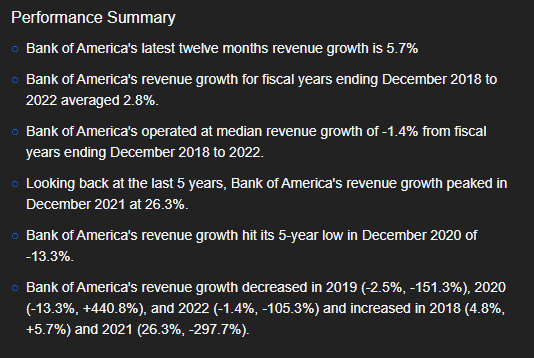

On the positive side, the bank's revenue growth has accelerated by 5.7% over the past 12 months.

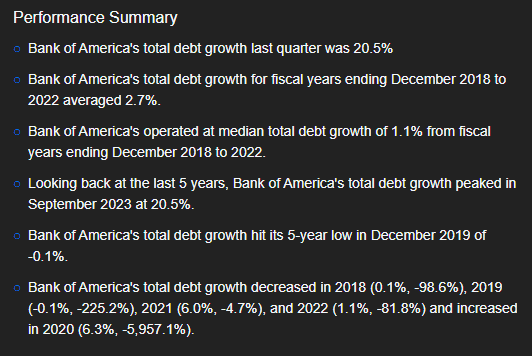

The company's total debt has risen for several years in a row, jumping by 20.5% in the last quarter.

Citigroup (C)

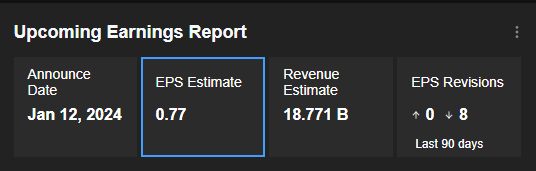

Analysts are forecasting a sharp drop in earnings, with EPS anticipated at $0.77 versus $1.52 in the previous quarter and $1.16 a year earlier.

Source: InvestingPro

Revenues are also expected to fall, to $18.771 billion from $20.139 billion in the previous quarter, but up slightly from $18 billion in the same quarter last year.

What does ProTips tell us about Citigroup's strengths and weaknesses?

According to InvestingPro's ProTips, Citigroup's share profile is fairly negative, with few bullish ProTips.

Source: InvestingPro

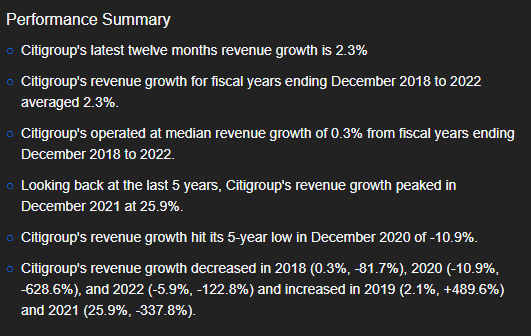

In addition to a share price that has risen strongly over the past 3 months, positive ProTips tells us that revenue growth has accelerated, albeit at a fairly low rate of 2.3% over the past 12 months:

Source: InvestingPro

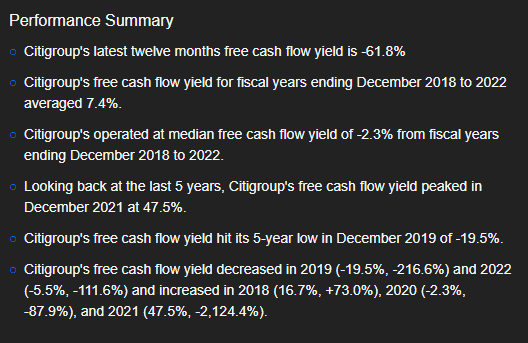

On the negative side, the ProTips note in particular that the company has a valuation that implies a poor cash flow yield, more precisely -61.8% over the last 12 months according to the Tip's details.

Fair value, analyst forecasts, and financial health

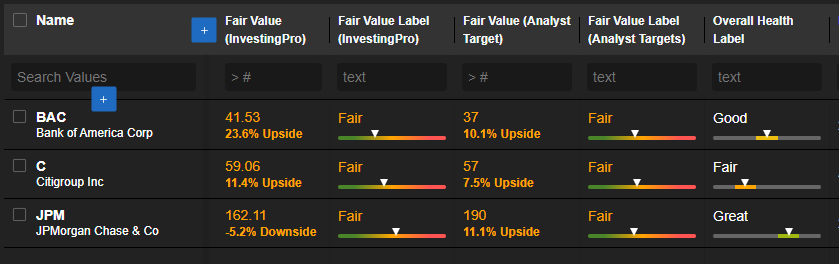

It will also be useful to look at the conclusions of valuation models, analyst forecasts, and the financial health of JPM, BAC, and C.

We have grouped the 3 stocks into an InvestingPro Watchlist, configured to display the details we need:

Source: InvestingPro

Bank of America shows the best potential, being considered undervalued by 23.6%.

JP Morgan has the best potential according to analysts, who forecast that the stock will grow by 11.1% over a 12-month horizon.

Finally, JP Morgan also has the best financial health score, rated "very good".

Conclusion

JP Morgan seems to be the strongest stock among the 3 banks reviewed in this article.

One downside, however, is that the stock is currently considered to be correctly valued by InvestingPro.

It will therefore be interesting to monitor the Fair Value update once tomorrow's results have been taken into account before deciding to invest.

________________________________________________________

Want to start using InvestingPro? Here is a small gift from us! Enjoy an extra 10% discount on the 1 or 2 year plans. Hurry up not to miss the New Year’s sale! You can save almost 60%!

Follow this link for the 1-year plan with your personal discount,

or click here for the full 2-year plan with 60% off!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.