- Wall Street’s third-quarter earnings season kicks off today.

- Analysts expect annualized profit growth of 4.2% and an increase of 4.7% in revenue growth.

- I used the InvestingPro stock screener to search for companies poised to deliver double-digit earnings and sales growth amid the current climate.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $8 a month!

Wall Street's Q3 earnings season unofficially begins today, when notable banks like JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and BlackRock (NYSE:BLK) deliver their latest financial results.

The following week sees high-profile names like Taiwan Semiconductor (NYSE:TSM), Netflix (NASDAQ:NFLX), ASML (AS:ASML), Bank of America (NYSE:BAC), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), American Express (NYSE:AXP), UnitedHealth (NYSE:UNH), Johnson & Johnson (NYSE:JNJ), Procter & Gamble (NYSE:PG), and United Airlines (NASDAQ:UAL) report earnings.

Source: Investing.com

The earnings season gathers momentum in the final week of October when the mega-cap tech companies, including Tesla (NASDAQ:TSLA), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), and Apple (NASDAQ:AAPL) are all scheduled to release their quarterly updates.

Investors will be closely watching the earnings reports as companies reveal how they have navigated the challenging macroeconomic environment marked by elevated inflation, high interest rates, and ongoing geopolitical risks.

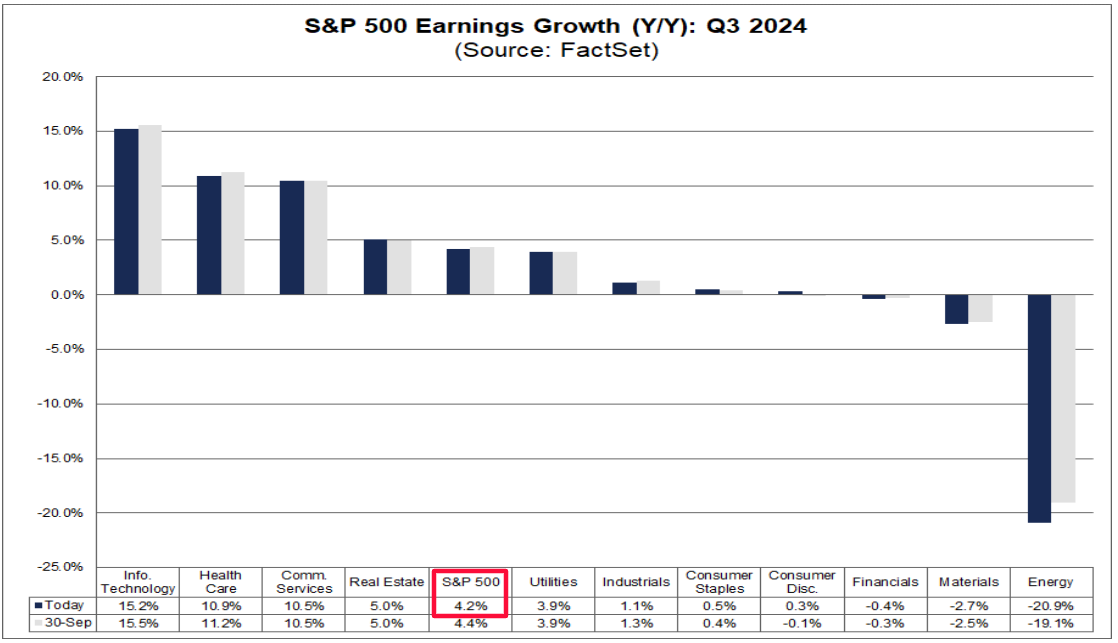

According to FactSet estimates, earnings per share for the S&P 500 are expected to grow +4.2% in the third quarter when compared to the same period last year. Estimates have steadily come down since the start of the period, with the current growth pace down from +7.8% at the start of July.

Source: FactSet

As the chart above shows, the Information Technology (NYSE:XLK) sector is expected to report the largest annualized earnings growth rate of all eleven sectors, at +15.2%. The space includes high-profile companies such as Google parent Alphabet, Facebook owner Meta Platforms, Netflix, Walt Disney (NYSE:DIS), as well as Verizon (NYSE:VZ), and AT&T (NYSE:T).

The Health Care sector (NYSE:XLV) is forecast to come in second, with +10.9% year-over-year EPS growth. Eli Lilly (NYSE:LLY), Merck (NYSE:MRK), Unitedhealth Group (NYSE:UNH), Johnson & Johnson, AbbVie (NYSE:ABBV), Amgen (NASDAQ:AMGN), Pfizer (NYSE:PFE), and Moderna (NASDAQ:MRNA) are included in this sector’s mix.

Elsewhere, the Communication Services sector (NYSE:XLC) is expected to report the third-highest annualized earnings growth rate, at +10.5%. Some of the biggest names in the sector include AI darlings such as Microsoft, Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), Oracle (NYSE:ORCL), Salesforce (NYSE:CRM), Advanced Micro Devices (NASDAQ:AMD), and Super Micro Computer (NASDAQ:SMCI).

In contrast, earnings from the Energy sector (NYSE:XLE), which includes oil and gas giants such as ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), EOG Resources (NYSE:EOG), Schlumberger (NYSE:SLB), and ConocoPhillips (NYSE:COP), are expected to tumble -20.9% compared to last year - the worst drop of any sector by far.

The Materials sector (NYSE:XLB) is projected to report the second worst Y-o-Y earnings slump of all eleven sectors, with EPS set to decline -2.7% from a year earlier, per FactSet. The sector includes companies in the metals and mining, chemicals, construction materials, and containers and packaging industry.

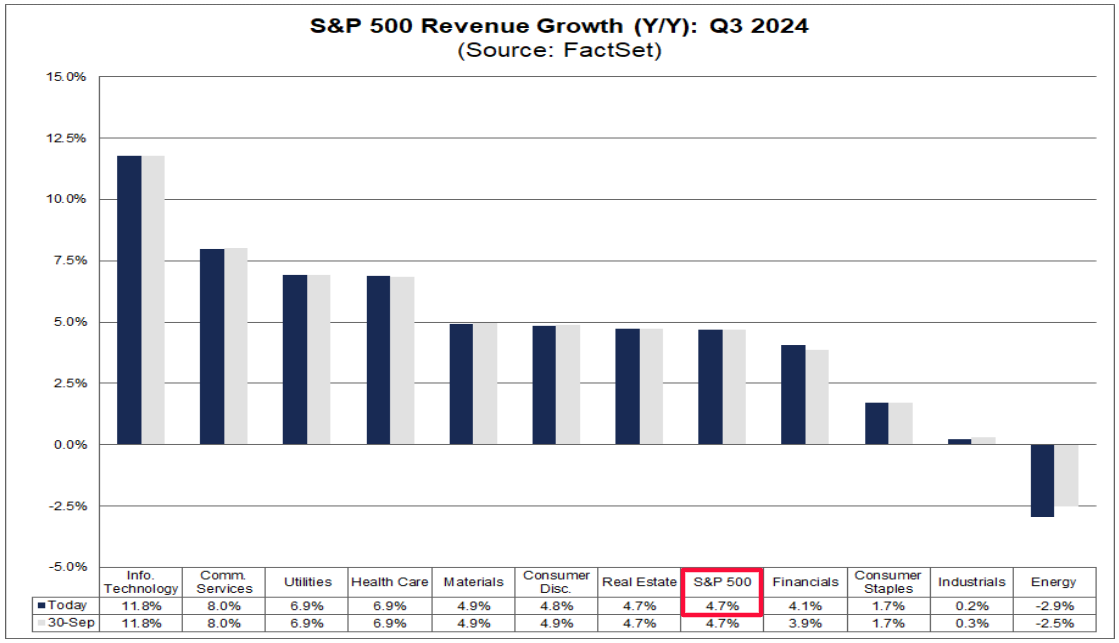

Meanwhile, in terms of revenue expectations, analysts have also decreased their estimates during the quarter. The S&P 500 is expected to report annualized sales growth of +4.7%, compared to expectations for revenue growth of +5.0% on June 30.

Source: FactSet

As seen above, ten sectors are projected to report year-over-year revenue growth, led by the Information Technology and Communication Services sectors, at +11.8, and +8.0%, respectively.

On the other hand, the Energy sector (NYSE:XLE) is predicted to report a Y-o-Y decline in revenues, at -2.9%.

Key Stocks to Watch Amid Q3 Earnings Season

The third-quarter earnings season is upon us, and Wall Street is bracing for a key period that could shape the direction of markets for the rest of the year.

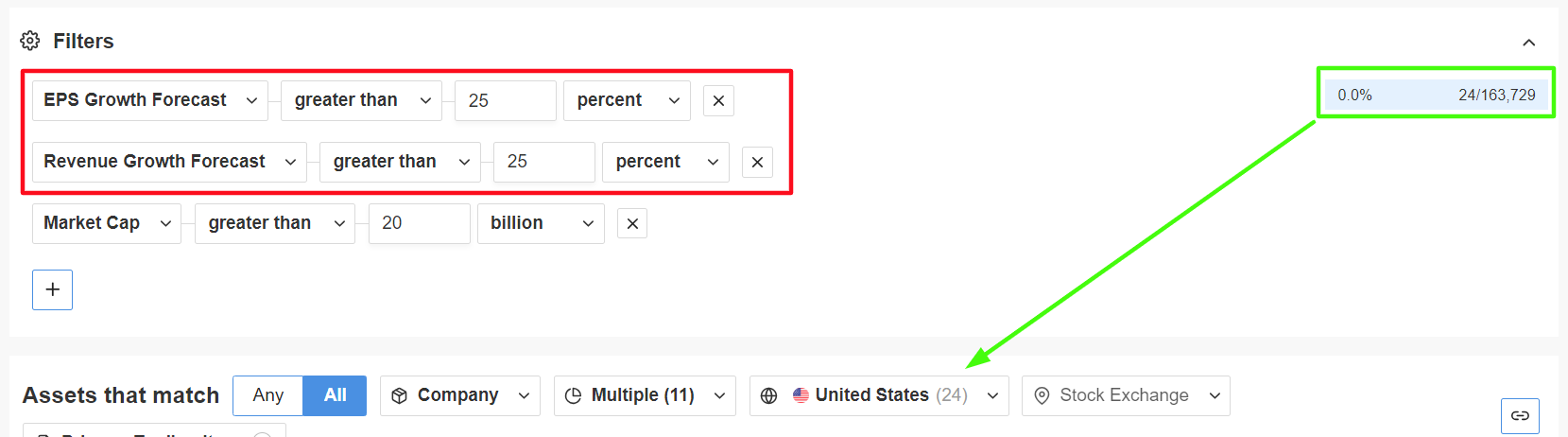

Given concerns in the market about a possible economic slowdown and renewed inflation fears, I used the InvestingPro Stock Screener to search for companies that are poised to deliver growth of 25% or more in both earnings and revenue as the Q3 earnings season kicks off.

In total, just 24 stocks showed up in my screener.

Source: InvestingPro

InvestingPro's stock screener is a powerful tool that can assist investors in identifying high quality stocks that can demonstrate resilience and growth potential in today’s complex macroeconomic environment.

Some of the notable tech-related names to make the cut include Coinbase (NASDAQ:COIN) (+1,479.7% EPS Growth), CrowdStrike (NASDAQ:CRWD) (+907% EPS Growth), AppLovin (NASDAQ:APP) (+523.7% EPS Growth), Western Digital (NASDAQ:WDC) (+411% EPS Growth), Trade Desk (NASDAQ:TTD) (+357.8% EPS Growth), Robinhood (NASDAQ:HOOD) (+266.5% EPS Growth), Cloudflare (NYSE:NET) (+234.3% EPS Growth), Nvidia (+139.5% EPS Growth), Snowflake (NYSE:SNOW) (+124.4% EPS Growth), and Broadcom (+53.1% EPS Growth).

Source: InvestingPro

Meanwhile, Blackstone (NYSE:BX) (+319.1% EPS Growth), Newmont (NYSE:NEM) (+203.4% EPS Growth), Eli Lilly (+183% EPS Growth), Axon Enterprise (NASDAQ:AXON) (+112.1% EPS Growth), First Solar (NASDAQ:FSLR) (+75% EPS Growth), and HEICO (NYSE:HEI) (+46.6% EPS Growth) are a few more stocks to watch out for that are also projected to deliver double-digit Q3 earnings and revenue growth.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Subscribe now to get an additional 10% off the final price and instantly unlock access to several market-beating features, including:

- AI ProPicks: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.