- China’s liquidly injection and Evergrande’s payment plan eases market worries

- Reflation trade shows optimism

- Bitcoin’s rebound is suspect

- The Bank of England announces its interest rate decision on Thursday.

- On Friday Federal Reserve Chair Jerome Powell, Fed Governor Michelle Bowman and Vice Chairman Richard Clarida discuss pandemic recovery.

- US new home sales figures are published on Friday.

- The STOXX 600 rose 0.8%

- Futures on the S&P 500 rose 0.6%

- Futures on the NASDAQ 100 rose 0.4%

- Futures on the Dow Jones Industrial Average rose 0.6%

- The MSCI Asia Pacific Index fell 0.6%

- The MSCI Emerging Markets Index fell 0.2%

- The Dollar Index was little changed

- The euro was little changed at $1.1732

- The Japanese yen fell 0.3% to 109.51 per dollar

- The offshore yuan rose 0.2% to 6.4673 per dollar

- The British pound was unchanged at $1.3659

- The yield on 10-year Treasuries advanced one basis point to 1.33%

- Germany’s 10-year yield advanced one basis point to -0.31%

- Britain’s 10-year yield was little changed at 0.81%

- Brent crude rose 1.6% to $75.54 a barrel

- Spot gold rose 0.2% to $1,778.72 an ounce

Key Events

Futures contracts on the Dow, S&P, NASDAQ and Russell 2000 recovered in trading on Wednesday, tracking European stocks higher after a sharp selloff yesterday on concerns that China's second largest property developer, Evergrande would default on its loan commitment and dent global financial markets. Overnight, Evergrande announced it would make a bond payment on Sept. 23, thus avoiding default.

Markets are now awaiting an update from the Federal Reserve on tapering later today.

Global Financial Affairs

Any deviation later today from current market expectations on the Fed's timeline for tapering monetary stimulus will move markets dramatically. This meeting comes after heightened market volatility on concerns that an economic shock from the Evergrande (HK:3333) situation in China could spread to global markets. The key question is whether those worries will influence US policymakers?

All four US equity futures were in the green ahead of the US session open on Wednesday. Contracts on the Dow Jones Industrial Average and the Russell 2000 were in the lead, but only slightly ahead of the S&P 500 futures, while contracts on the NASDAQ 100 lagged.

The return of the reflation trade suggests that investors believe the current economic recovery is sustainable. However, yesterday, US stocks slumped on the belief that a collapse in Evergrande could lead to a global recession, as the demise of Lehman Brothers did in September 2008.

European stocks recovered in similar fashion to US futures—via basic resources and energy shares, sectors sensitive to an expanding economy, which also led the gainers on the STOXX 600 Index as commodity prices found their footing.

On the London Stock Exchange, FTSE 100 listed Flutter Entertainment (LON:FLTRF), an Irish gambling operator, surged over 5% to trade just 5.4% below its Mar. 22 record, after settling a legal dispute.

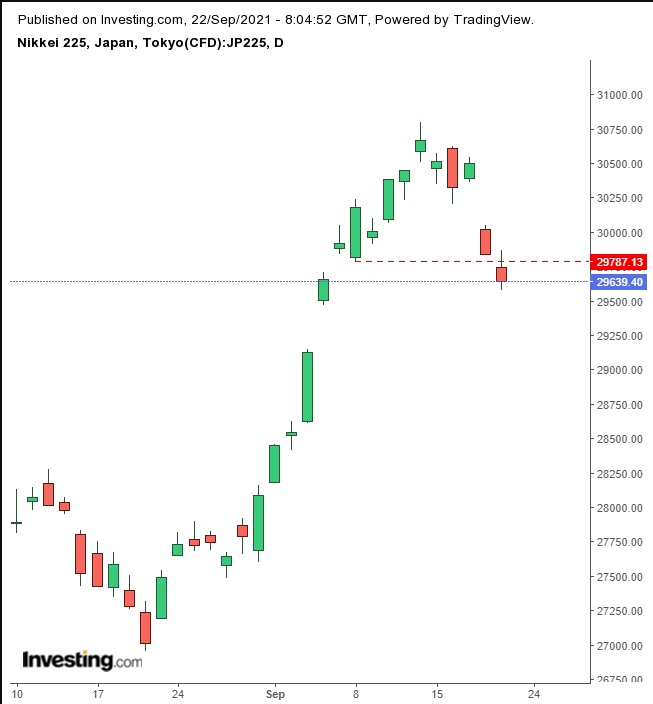

China increased its injection of short-term cash into the country’s financial system to $18.6 billion, following a holiday, which ended the major selloff that had gripped global markets. Still, the MSCI Asia Pacific Index slid for the third straight day, weighed down by Japan’s Nikkei 0.65% decline, bringing the weekly decline for the gauge to 2.8%, for now.

The selloff on the Japanese index completed an Island Reversal.

US stocks rallied in the last few minutes of Tuesday’s trading session after posting the sharpest drop in four months on fears that a Chinese crackdown on the highly leveraged real estate sector would reverberate throughout other sectors and markets. Still US markets finished mixed.

Yields on the 10-year Treasury note were little changed.

The move slightly higher was within an ascending triangle which is seen to propel rates higher.

The dollar tracked the slight rise of yields.

However, the USD is caught between a H&S top and a massive double-bottom.

Gold pared gains after a two-day rally.

The yellow metal is forming the right shoulder of a H&S bottom.

Bitcoin found support at $40,000.

However, the rebound is part of a return-move to a H&S bottom, suggesting another leg down is on the way.

Oil extended its recovery.

The price found support at the bottom of a rising channel.