Last weekend, the Organization of the Petroleum Exporting Countries (OPEC) and its allies (known as OPEC+) made an unprecedented decision to cut crude oil production by 1.16 million barrels a day. This decision will have far-reaching implications for global markets, as it will lead to a reduction in the global supply of crude oil by 3.36 million barrels a day, taking into account the failed supply from Kurdistan and the decrease in Russian production.

The decision was surprising, as many analysts were expecting OPEC+ to increase production to meet growing demand. However, concerns about the impact of the COVID-19 pandemic on the global economy and uncertainty over the future of Iran's oil exports led OPEC+ to take this cautious approach.

The structure of the production changes was also made public, with Saudi Arabia and Iraq being the countries that will have to make the biggest cuts. However, it is important to note that most OPEC+ members and affiliates do not exhaust their quotas and produce less crude oil than they are permitted. This means that the decision may have less of an impact on the market than initially anticipated.

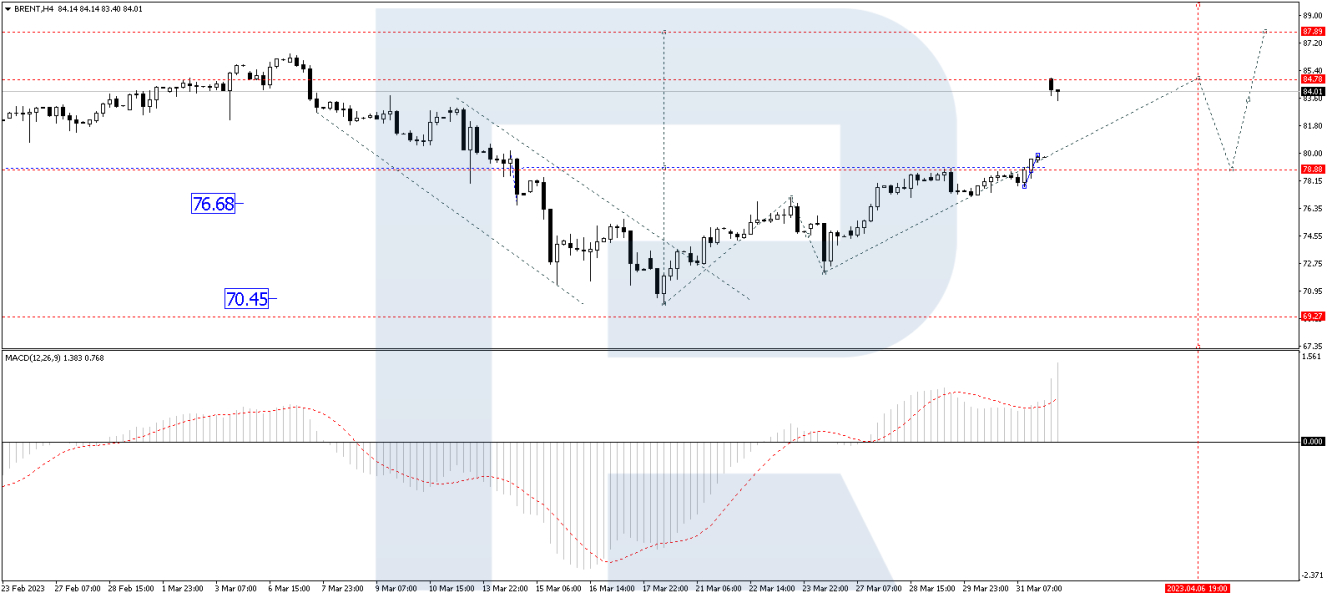

Following the announcement, Brent oil prices surged to $81.70 per barrel on Tuesday, as investors reacted positively to the news. Technical analysis shows that Brent quotes broke the level of $78.47 upwards and reached the local target of $84.74. However, a correction to $80.00 is not excluded, after which a new structure of growth to $88.00 could develop. This scenario is confirmed by the MACD, which shows that its signal line is above zero in the histogram area, implying growth to new highs.

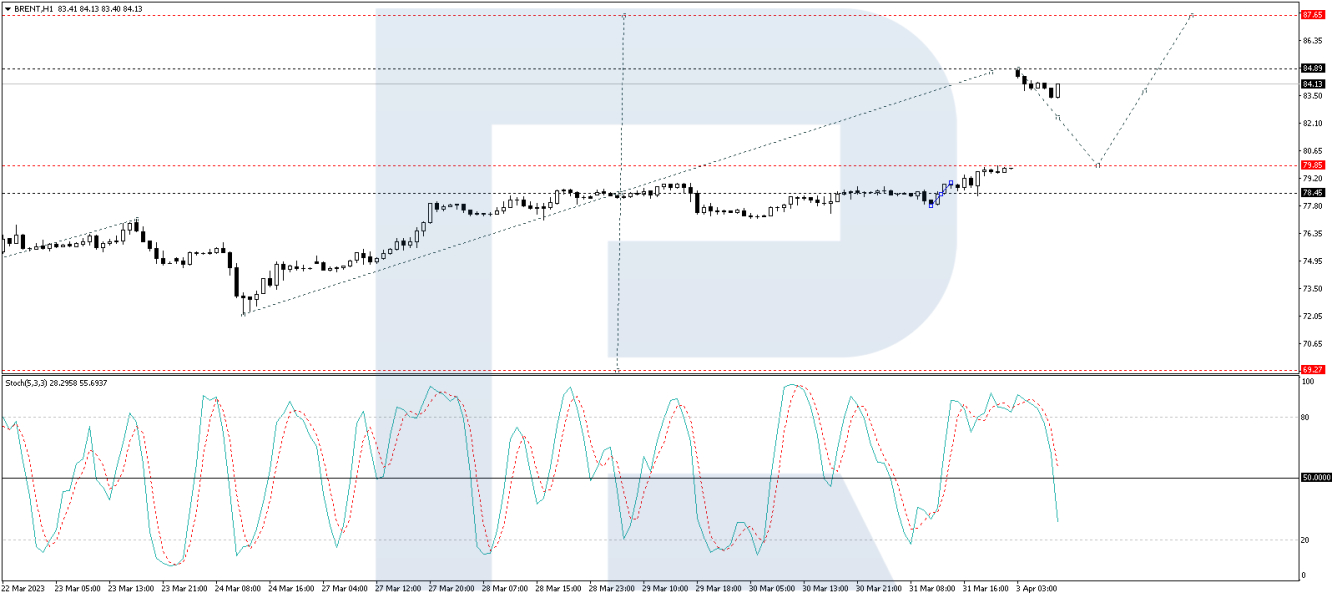

On the H1 chart of Brent, a consolidation range has formed around $78.45, and breaking it upwards, the price reached the target of the wave of growth at $84.84. If the price breaks this level downwards, a correction to $80.00 is likely. However, if the price breaks the range upwards, it will open a pathway directly to $88.00 without any correction, from where the wave could continue to $100.00. This scenario is confirmed by the Stochastic oscillator, which shows that its signal line is under 50 and directed strictly downwards to 20. We expect it to rebound from this level upwards and continue growing to new highs.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

OPEC+ Cuts Crude Oil Production: Implications for Global Markets

Published 04/04/2023, 08:13

OPEC+ Cuts Crude Oil Production: Implications for Global Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.