- Even after CPI, Fed decision, pricing a barrel might not get any easier

- Oil bulls double down on summer demand and tightening inventories

- Bears point to economic uncertainty and supply withstanding Saudi cuts

Once today’s inflation data and Wednesday’s Fed rate decision are both out of the way, oil traders will be left with the daunting business of figuring out the “real” value of a barrel. That’s when it can get really complicated.

As far as oil bulls are concerned, it’s summer and there should be rip-roaring demand for travel-related energy, as well as for cooling in some of the hottest places now. Those should ideally translate to much higher oil prices.

How much higher? Well, if what the Saudis want comes around, Brent, the London-based global benchmark for crude, should be closer to $90 a barrel over the next two months, with the occasional spike to mid-$95 or even $100.

Yet, it’s tough to have such expectations when Wall Street’s biggest cheerleader for commodities is pricing down its own forecast for a barrel. Goldman Sachs, which had a year-end call of $95 for Brent, announced on Monday that it had reduced its expectation to $86.

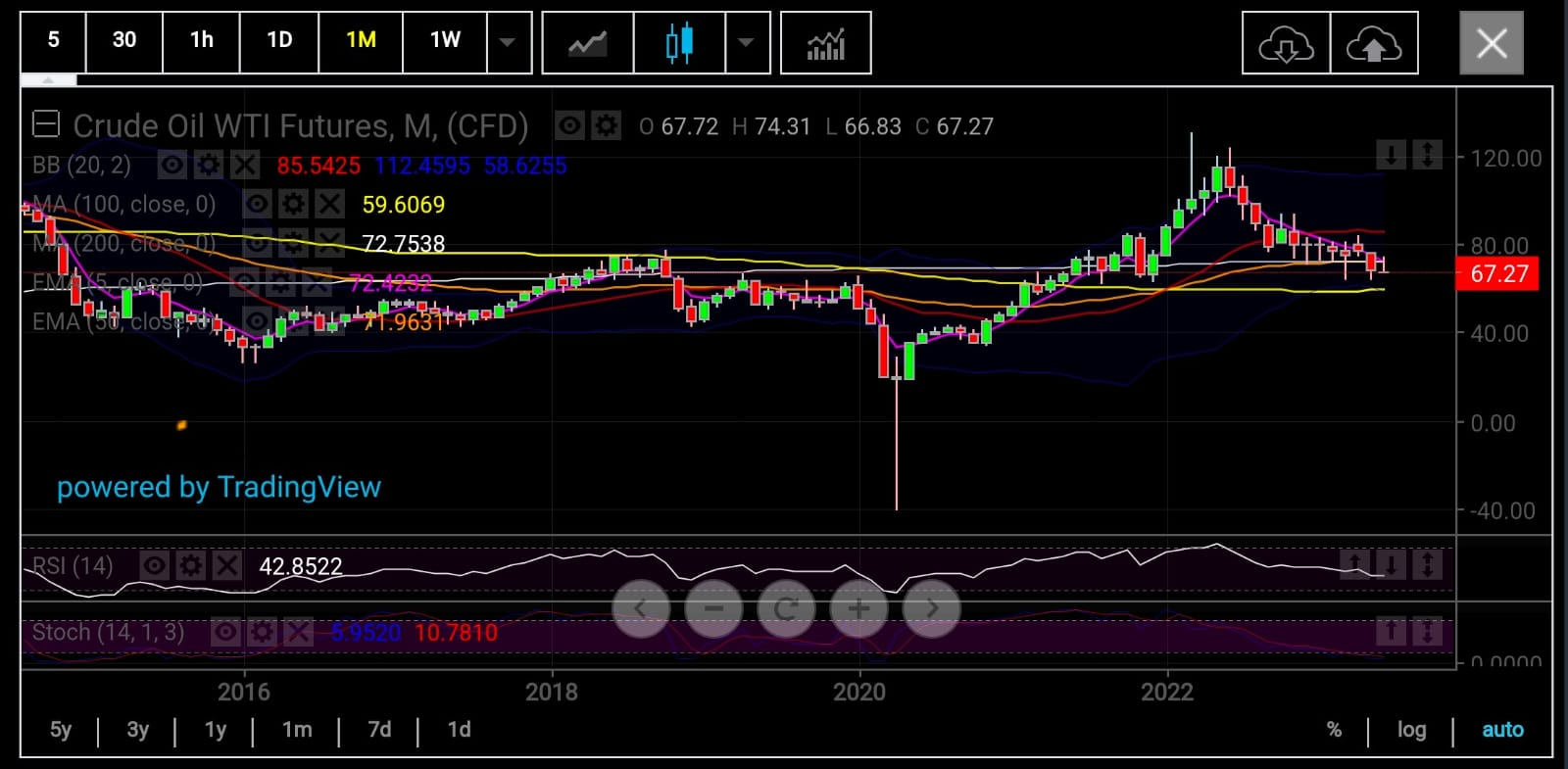

For West Texas Intermediate, or WTI, the U.S. crude benchmark that’s as closely followed, or perhaps more at times than Brent, Goldman cut its forecast to $81, against a previous $89.

Charts by SKCharting.com, with data powered by Investing.com

It’s not just the Goldman pivot on oil prices that’s concerning.

Even if the May reading for the U.S. Consumer Price Index is benign enough for the Federal Reserve to pause rates for the first time in June after 15 rate hikes, the central bank has signaled it will revert to tightening in July if inflation conditions warrant.

That caution comes as the U.S. economy continues flashing its peculiar signal that it’s coasting along just fine even as recession fears build by the day both at home and in Europe. And for what it’s worth, the European Central Bank has no intent to give up on rate hikes immediately.

Beyond the United States and Europe, mixed signals are also coming out of China, the second-largest economy and biggest buyer of oil and almost all other commodities.

China’s economic data showed that its economy grew 4.5% year-on-year, versus expectations of 4.0%. Yet despite that growth, the oil trade focused on Chinese exports which plummeted 7.5% year-on-year in May versus forecasts for just 0.4% fall and the biggest decline since January.

Oil bulls also have a new problem — or rather, an old problem threatening to become new: An offer by Iran’s supreme leader to reopen negotiations with the West for a nuclear deal that could put some sanctioned Iranian crude back on a market already worried about demand.

Ayatollah Ali Khamenei said that a deal was possible if Iran’s nuclear infrastructure was kept intact. His comments came just a few days after both Tehran and Washington denied reports that an interim nuclear deal was close.

Russia, meanwhile, continues exporting all the oil it can, at the lowest price possible, to India and China. The West also does not seem to mind that sanctioned Russian oil is being repackaged and resold as Indian and Chinese products so long as Moscow doesn’t make more than $60 per barrel — the G7’s stipulated limit.

If that’s not enough, there are reports that Riyadh’s state oil company Saudi Aramco (TADAWUL:2222) has pledged to supply full crude volumes to Asian refiners despite the kingdom vowing to cut 20% of its regular production.

Given their onerous budget requirements, the Saudis need Brent to go to $80 as soon as possible. That also means that New York-traded WTI has to be at around $75, given its typical $5 lag to Brent.

At Monday’s settlement in New York, neither was near those targets. WTI’s front-month settled down 4.4%, at $67.12 per barrel after a session low at $66.83. Prior to that, the U.S. crude benchmark had lost 3.5% over a two-week stretch. Brent officially finished Monday’s New York session at $71.84 per barrel, down almost 4%. It lost 2.8% over two prior weeks.

That was an overwhelming vote of no-confidence in Saudi efforts thus far to boost the market.

In the course of three production cuts announced since October, the Saudis have offered to take 2.5 million barrels off their regular daily production of 11.5 million.

Last week, they offered their latest cut of one million barrels per day. It came after their 12 partners in OPEC, or the Organization of the Petroleum Exporting Countries, and 10 other allies, including Russia, in the wider OPEC+ alliance, decided to stay pat on production.

The Saudi energy minister, Prince Abdulaziz bin Salman, had likened that cut to a “lollipop”, or sweet gift for those requiring higher oil prices. Instead, a week after his bid to pleasantly surprise the oil market, traders were surprised at how far it was going in opposite to Riyadh’s wishes.

Monday’s 4% plunge was an example of a market that has rarely been on the same page with the Saudis for the past seven months.

Since the first of its three-round cuts in October, Brent only briefly crested at nearly $99 before returning toward $70 support on several occasions. WTI’s highest has been almost $94, versus lows of beneath $64 at one point.

Technical charts for both benchmarks suggest bigger drops could happen.

“Oil bears have been eyeing the 100-month Simple Moving Average of $59.60 for WTI,” said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

For Brent, there is increasing possibility “for a drop to the 100-Month SMA of $64 over an extended period of time”, Dixit added.

But oil bulls aren’t giving up hope on the Saudis — not at the cusp of what they say will be elevated summer demand.

Said Phil Flynn, who heads energy research at Chicago-based commodities broker Price Futures Group:

“It continues to be that we expect the market to see tightening supplies and as this year goes on, I think short term increases of Russian supply and the perception that the Chinese economy has hit a brick wall is still giving the market a false sense of security.”

As for reports of Saudi Aramco pledging full crude volumes to Asian refiners despite its promised cuts, he said the reductions would be aimed elsewhere. “Cuts to the U.S. and other places will be much more pronounced. U.S. imports of Saudi crude have already fallen to multi-year lows.”

Flynn also warned that speculator money — critical for balancing the market from overreach either way — was fast drying up, making prices vulnerable to a sharp upward run that cannot easily be stopped. As proof of thinning speculator activity, he pointed to the Oil Price Volatility Index which had hit its lowest since 2019.

“The severe drop suggests that this market is ripe to a turnaround in the very near future. This should be a perfect time if you are bullish just start buying option strategies because they’re the cheapest they’ve been in years.”

***

Disclaimer: The author Barani Krishnan does not hold a position in the commodities and securities he writes about.