Oil saw its largest daily sell-off since July 2022 yesterday, with Brent settling 5.62% lower. This was despite no change in OPEC+ output policy, whilst the Saudis and Russia reaffirmed that their additional voluntary cuts will continue through to year-end. The current rates environment and weak gasoline market appear to have been the catalyst.

Weak gasoline weighs on crude

On the surface, it is difficult to pin yesterday’s sell-off on the EIA’s weekly inventory report. US commercial crude oil inventories fell by 2.22MMbbls over the week, whilst crude stocks at Cushing, the WTI delivery hub, increased by a modest 132Mbbls. So, nothing glaringly bearish in these numbers.

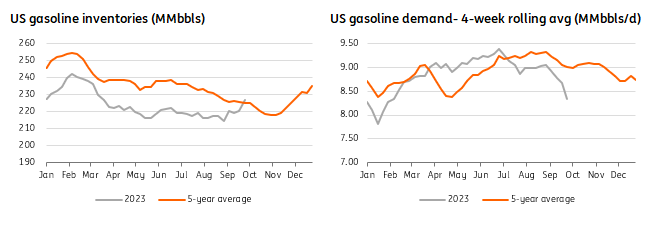

However, what was more bearish in the release were the gasoline numbers. US gasoline inventories increased by almost 6.5MMbbls over the week- the largest increase since January 2022. This move has helped to take total US gasoline inventories back above the five-year average for this time of year. This large build occurred even though refiners reduced operating rates by 2.2pp over the week to 87.3%. Therefore, it was weaker demand which was behind the large gasoline stock build. Seasonally, it is normal to see gasoline demand falling during this time of year with the driving season well and truly behind us. However, even factoring in this seasonality, implied demand was very weak over the last week. Implied gasoline demand fell by 605Mbbls/d WoW to 8.01MMbbls/d. This is the weakest demand for this time of year since the early 2000s. The four-week rolling average demand number has also been trending below the five-year average since July and this latest data point has dragged it to the lowest levels since 2000. This is likely raising concerns over demand, particularly in this higher price environment.

This weakness has weighed heavily on the gasoline market and this is nothing new with the prompt RBOB gasoline crack falling from more than US$40/bbl in mid-August to less than $8/bbl currently. The weakness in gasoline has fed through to weaker refinery margins, which appears to have ultimately fed through to crude oil.

US gasoline stocks move higher, whilst demand trends lower

The rates environment is not helping oil

The more recent price action in oil also suggests that the rally we saw over much of the third quarter has exhausted itself. The current rates environment along with the USD strength has only provided stronger headwinds to the market. US 10-year Treasury yields have hit their highest levels since 2007 this week, whilst the USD index is at its strongest levels since November 2022. Until we start to see a shift in the ‘higher for longer’ narrative when it comes to rates, the oil market will likely struggle to push significantly higher.

Clearly, the exhaustion of the recent rally will also give Saudi Arabia and Russia confidence in their decision to continue with their additional voluntary supply cuts through until year end. We still forecast a large deficit for the remainder of this year, which suggests that prices will remain relatively well supported. We continue to expect ICE (NYSE:ICE) Brent to average US$92/bbl over 4Q23.

First published on Think.ing.com.