- Reports fiscal Q2 2022 results on Monday, Dec. 20, after the close

- Revenue expectation: $11.25 billion

- EPS expectation: $0.6308

When the world’s largest sportswear company, Nike (NYSE:NKE), reports its latest earnings later today, investors will likely be told a by-now-familiar story: sales are taking a hit from global supply chain disruptions, exacerbated by COVID-19 outbreaks in Asia.

In late September, the maker of Air Jordan and Air Force 1 sneakers told investors that factory closures in Vietnam, longer transit times, and labor shortages were crimping sales, even as consumers are ready to spend more on sportswear after last year’s lockdowns and gym closures.

During its fiscal second quarter, Nike has been seeing sales that are flat to lower by low single digits. Analysts had been looking for revenue growth of 12% for the year, as well as a 12% increase for the second quarter.

But despite this highly unpredictable environment for companies that sell consumer goods, Nike continues to remain a favorite analyst pick. The expectation is that given soaring consumer demand and the company’s successful e-commerce push there's more NKE upside ahead.

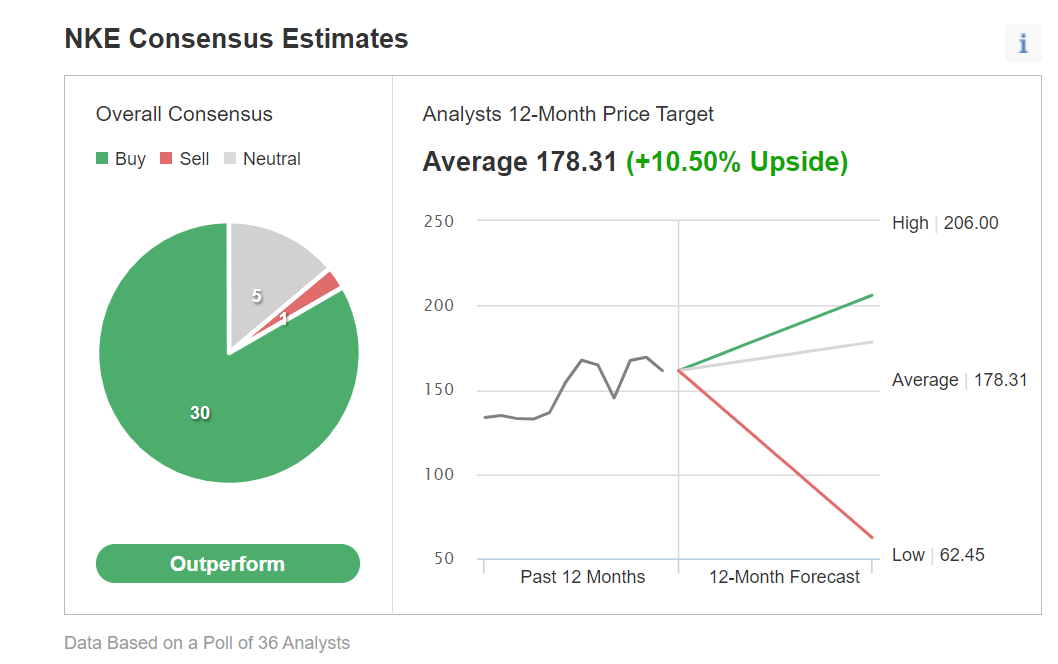

Chart: Investing.com

Indeed, among 36 analysts polled by Investing.com, the stock received an 'Outperform' rating with an average 10.50% upside target on the share price over the next 12 months. Nike stock closed on Friday at $161.36.

To provide perspective, over the quarter that ended on Aug. 31, Nike produced its second-highest, three-month revenue figure while earnings-per-share set a record for the Beaverton, Oregon-based company.

Expanding Online Sales

Another reason making Nike a long-term buy: the global health crisis has accelerated the company's shift to e-tail selling. It has created a direct-to-consumer business that's not just efficient but also responsible for improving the enterprise's profit margins.

For several quarters, Nike’s online sales have surged more than 80%, exceeding the company’s target for revenue from this segment. It now makes up 30% of total sales. Credit Suisse in a note to clients on Friday said it sees upside in shares of Nike after the company lowered its sales forecast. Its note added:

“Our US retailer checks have been strong through the holiday (despite some signs of inventory shortages) and we think inventory reallocated to direct-to-consumer (DTC) will drive upside to Street N. America revenue estimates in F2Q.”

According to Goldman Sachs, the near-term uncertainty over growth shouldn’t discourage investors who have a long-term investing horizon as the company’s stock always recovers after underperforming the market. The investment bank in a recent note said:

“We think there could still be upside to the stock as Nike will likely benefit from more customers focusing on wellness, a likely increased casualization of fashion trends post the pandemic, ... the leveraging of its rich customer data and suite of apps to drive membership and demand globally.”

Goldman Sachs added:

“We note Nike’s brand strength as its number one competitive advantage. While fashion cycles can impact market share in the short term, we note the brand strength will provide support for Nike’s market share gains longer term.”

NKE shares are up 14% this year, after surging 39% in the previous year. The S&P 500 Index, during that period, has gained 23%.

Bottom Line

Nike shares may come under selling pressure in the shorter term as the company continues to face supply-side issues as long as the pandemic is raging. That weakness should be taken as a buying opportunity by investors, given the strength of Nike’s brands and its ongoing push to expand its low-cost online sales.