- Henry Hub’s most-active gas contract up 40% from 3 weeks ago

- Despite outsized demand, gas-in-storage likely rose due to idled Freeport LNG plant

- Focus on US heatwave keeping prices up amid Freeport crisis

From California to New Hampshire and Texas to Oklahoma, a heat wave is searing across at least 28 of the lower United States, turning the natural gas market on its head as domestic cooling demand and Europe’s growing LNG needs push the fuel’s prices up 40% in just three weeks.

From the mid-$5 pricing of late June, the most-active gas futures contract on New York’s Henry Hub breached in the past 24 hours the closely-watched $8 level.

At the time of writing, during Asia’s market hours on Thursday, the August gas contract was back in $7 territory.

But it was well within range of returning to $8 during Thursday’s daytime trade in New York—especially if the weekly gas-in-storage number from the US Energy Information Administration turns out to be smaller than forecast, adding to the market’s bullish fervor.

Analysts said the mood on the gas market has decidedly shifted—from one of uncertainty just weeks ago due to the sudden idling of Freeport LNG, the country’s main liquefied natural gas plant, after an explosion there—to one where life-threatening temperatures were forcing many Americans to keep their air-conditioners running 24/7 and cranked to the max.

Power use in Texas—America’s hottest state in any summer—is expected to break records again this week from air-conditioning overruns, said the state’s power grid operator which largely runs on gas.

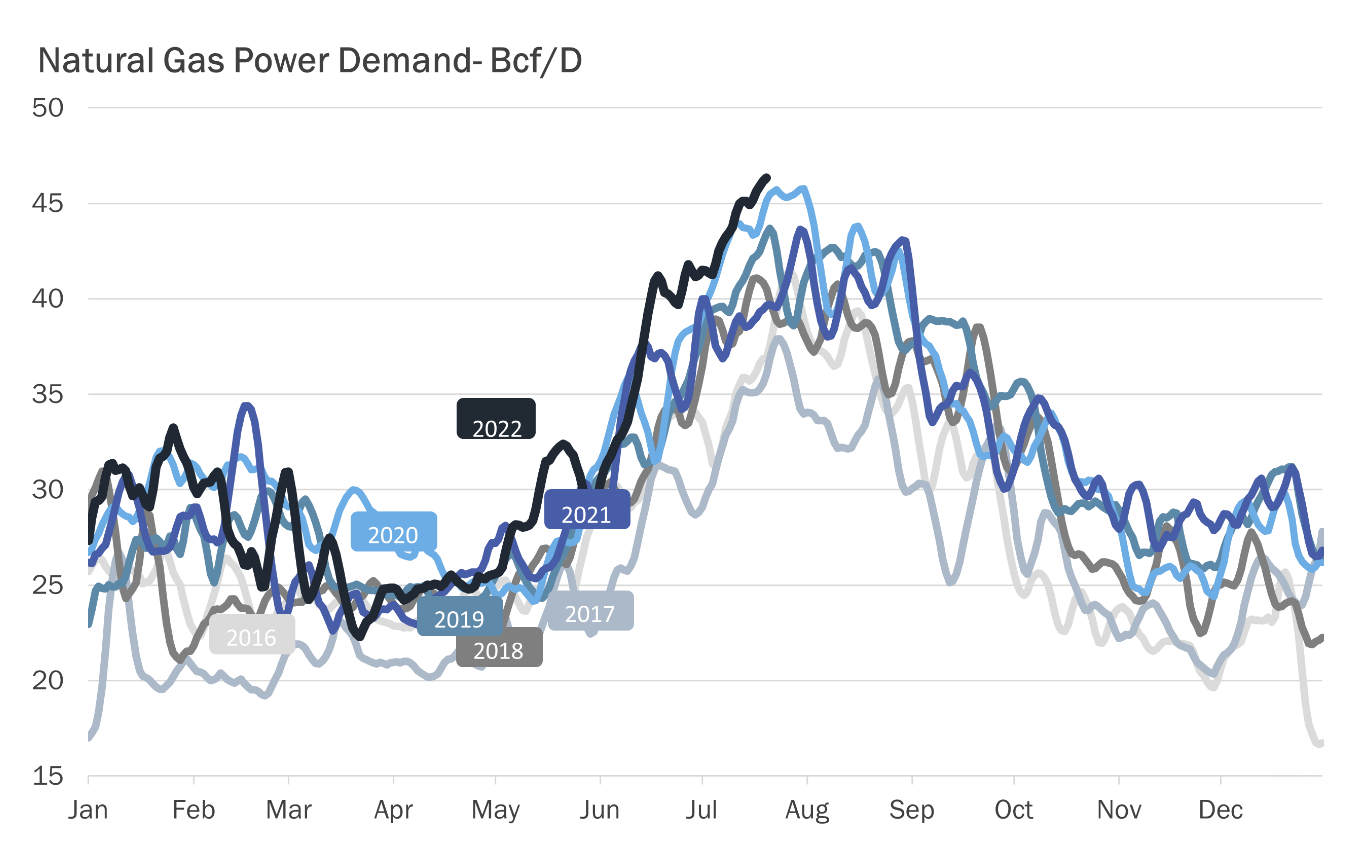

Source: Gelber & Associates

Reuters-enabled data provider Refinitiv said there were around 93 cooling degree days (CDDs) last week, which was more than the 30-year normal of 87 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18 C).

The fundamentals of supply-demand aside, near-term chart signals for Henry Hub’s August gas were skewed to the upside, technical analysts said.

Sunil Kumar Dixit, chief strategist at skcharting.com, said a retest of June’s $9.66 high could not be ruled out, adding:

“Some profit booking from retail traders who initiated the long positions on in the past 24 hours can unwind the momentum and push prices down to $7.50 and $7.20,”

“But the greater possibility is an extension of the upside to $8.30 first, then $8.60 and later $9.”

Houston-based gas markets consultancy Gelber & Associates said the market’s focus was almost entirely on the heat wave—something that would play to the advantage of market longs from a demand perspective.

It added:

“Looking ahead, next week is expected to be the hottest of the season until temperatures are projected to cool in the beginning of August. Both European and American weather models are running extremely hot with American models running slightly hotter. This intense heat wave is likely to temper storage injections.”

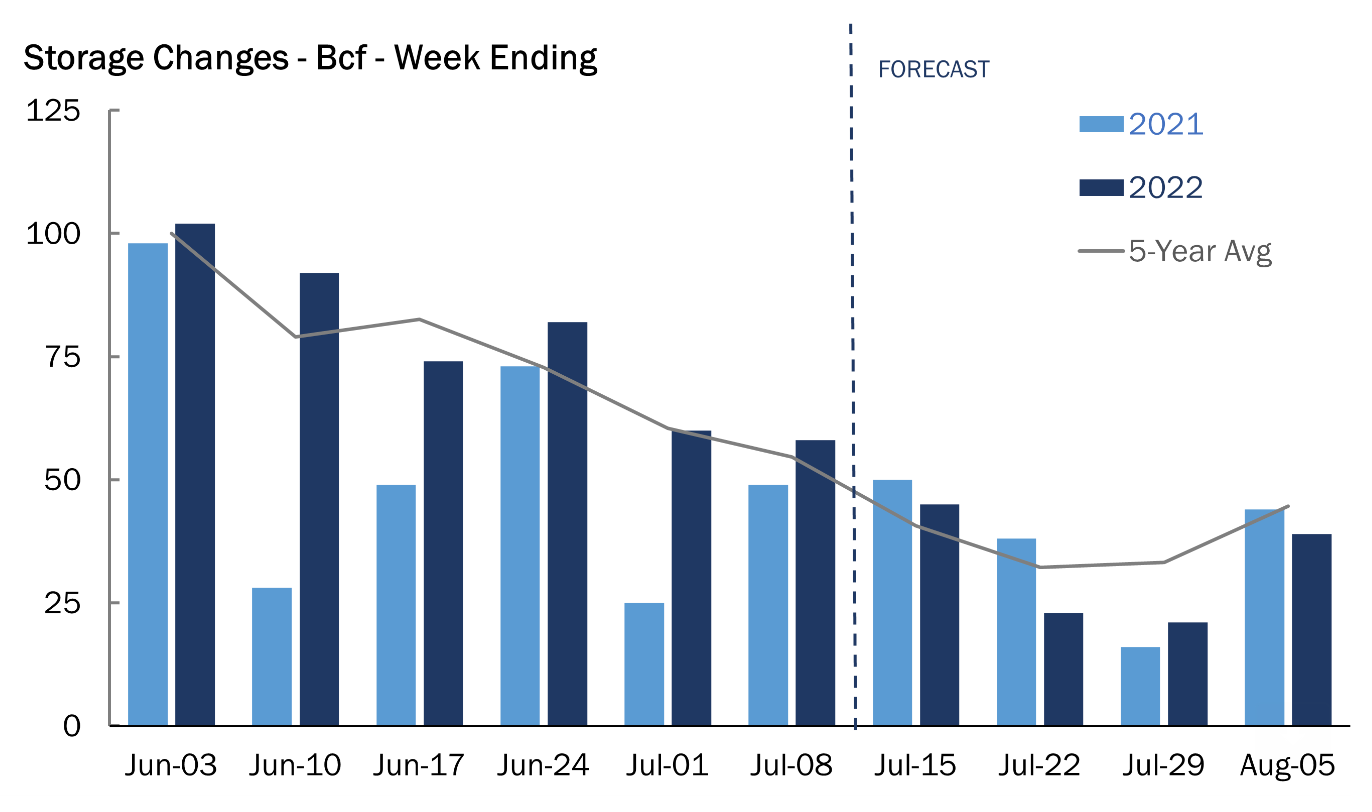

Source: Gelber & Associates

Ahead of the weekly update on gas storage, the consensus by analysts tracked by Investing.com is that there was a likely addition of 47 billion cubic feet (bcf) during the week ended July 15.

That would compare with the 50 bcf during the same week a year ago and the five-year (2017-2021) average injection of 41 bcf.

In the prior week, utilities added 58 bcf of gas to storage.

If the analysts tracked by Investing.com are accurate in their call, the injection for the week ended July 15 would lift gas-in-storage to 2.416 trillion cubic feet—about 11.5% below the five-year average and 9.5% below the same week a year ago.

How gas-in-storage develops over the next couple of months remains a challenge to traders with the Freeport LNG plant expected to return to production only in October.

Freeport used to account for around 20% of all US liquefied natural gas processing, consuming up to 2.1 bcf of natural gas per day. That was before the June 8 explosion that rendered it inoperable. Gas unused by the plant has been piling since, sending the Henry Hub’s front-month crashing from last month’s 14-year high of $9.66 to a 14-week low of $5.32 by the end of June.

European demand for US LNG is only expected to grow in the meantime, amid worries that Russia may further scale back gas flows to the continent via the Nord Stream 1 (NS1) pipeline. Flows on the conduit have been reduced to zero since last week amid annual repair work.

The planned maintenance is slated to end Thursday, but Russian President Vladimir Putin told reporters while visiting Iran on Tuesday that if Kremlin-backed Gazprom PJSC (MCX:GAZP) does not receive a needed turbine from Canada, NS1 would likely resume flows at just 20% of capacity.

Putin said Western sanctions imposed against Russia after its invasion of Ukraine prevented the return of the turbine from Canada, where it had been sent for repairs. European officials have warned that Putin may use the turbine issue as the pretext for protracted natural gas cuts to Europe to punish the continent for opposing the war.

The European Commission on Wednesday unveiled a plan to cut natural gas consumption by 15% until next spring in anticipation of Russia curbing supplies over the long-term.

“Russia is blackmailing us,” the commission’s president Ursula von der Leyen told reporters Wednesday.

“Russia is using energy as a weapon.”

Industry news portal naturalgasintel.com noted that despite the Freeport outage, feed gas volumes at US LNG facilities have held above 11 bcf/d most of July.

It added:

“That puts export levels near capacity … as countries across Europe are clamoring for US LNG to help fill the void.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.