National Grid PLC (LON:NG) has had a noteworthy year in 2024. The company, which plays a crucial role in the UK’s energy infrastructure, has navigated through a mix of challenges and opportunities, maintaining its position as a pivotal entity in the energy sector. This article delves into the company's performance, stock trends, and future prospects, providing a comprehensive overview for investors and stakeholders.

Performance Overview

In 2024, National Grid has demonstrated resilience and adaptability amidst the evolving energy landscape. The company's stock (NG) has shown moderate growth, with notable stability compared to other companies in the sector. As of June 2024, National Grid’s stock has increased by 0.37% to 867.20 points, reflecting investor confidence in its steady performance.

A key factor contributing to this stability is National Grid’s robust operational framework and strategic initiatives aimed at enhancing the UK’s energy infrastructure. The company has continued to invest heavily in renewable energy projects and grid modernization efforts. These investments are not only aimed at meeting current energy demands but also at future-proofing the grid against increasing reliance on renewable sources.

Financial Health and Strategic Moves

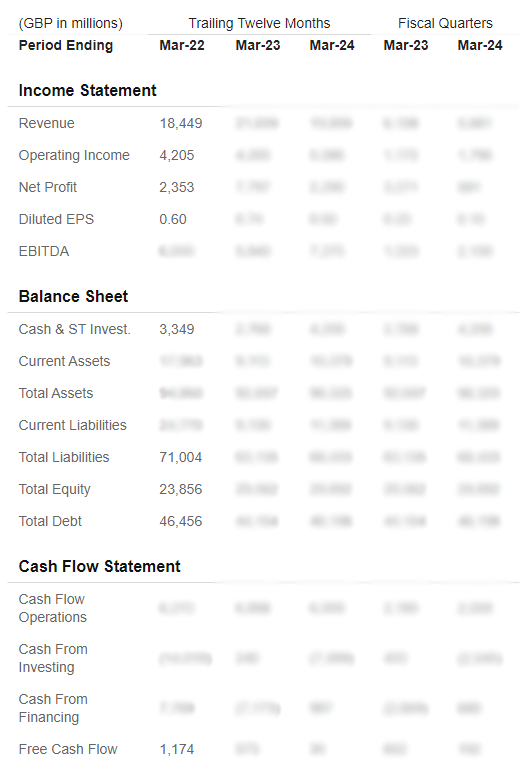

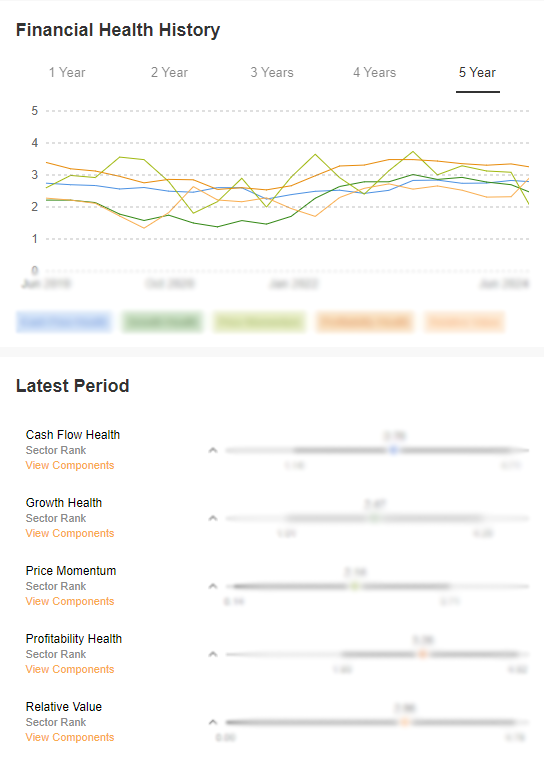

Financially, National Grid has maintained a solid position. The company's annual report highlighted a steady revenue stream, underpinned by regulated earnings from its UK and US operations. In a recent interview with the Financial Times, National Grid's CEO noted, "Our focus remains on delivering reliable and sustainable energy solutions while ensuring value for our shareholders."

One of the major highlights of 2024 has been the company’s progress in its decarbonisation targets. National Grid has committed to a net-zero target by 2050, and this year, significant strides have been made towards this goal. The company’s substantial investments in offshore wind projects and smart grid technologies have been well-received by the market and environmental advocates alike.

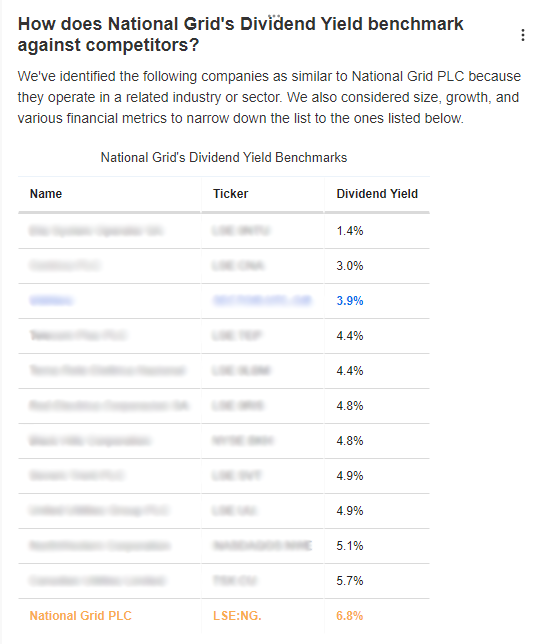

According to InvestingPro, the company has raised its dividend for 5 consecutive years.

Market Sentiment and Analyst Opinions

Market analysts have generally maintained a positive outlook on National Grid. According to a report by Bloomberg, “National Grid’s consistent dividend payments and strategic focus on renewables make it a strong contender for long-term investors.” This sentiment is echoed by analysts at Morgan Stanley (NYSE:MS), who recently upgraded the stock to 'overweight', citing the company’s proactive approach to energy transition and infrastructure investments.

Challenges and Future Prospects

Despite the positive outlook, National Grid faces several challenges. The volatility in energy prices and regulatory pressures pose significant risks. Additionally, the company must navigate the complexities of integrating new technologies and managing the transition from traditional energy sources to renewables.

However, the future looks promising for National Grid. With the UK government’s continued support for renewable energy and infrastructure development, National Grid is well-positioned to capitalise on these opportunities. The company's focus on innovation and sustainability is likely to drive growth and enhance its market position.

Conclusion

In summary, National Grid PLC has had a solid performance in 2024, marked by strategic investments and a commitment to sustainability. While challenges remain, the company’s proactive approach and strong financial health provide a positive outlook for the future. As stated by the Financial Times, “National Grid’s steady performance and strategic initiatives make it a reliable choice for investors looking for stability and growth in the energy sector.”

For investors, National Grid presents a balanced blend of stability and growth potential, making it a compelling addition to any diversified portfolio.

Feel ready to dive into details and start finding interesting stocks to invest? Try our AI supported solution InvestingPro today!

Get an extra 10% discount by applying the code UK10 on our 1&2 year plans. Don't wait any longer!

How to buy pro InvestingPro