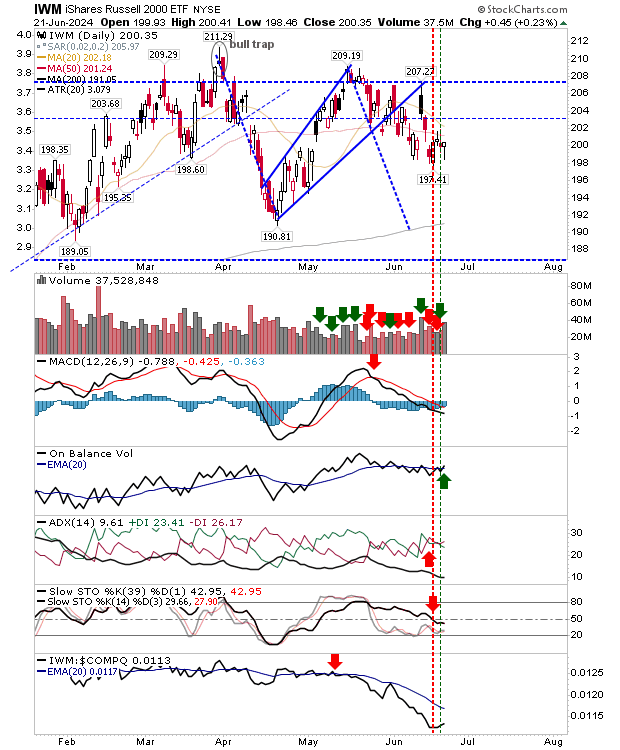

Options expiration clouded the volume action, but there was some positivity from the indexes. The Russell 2000 (IWM) closed with a bullish 'hammer', but as with bearish candlesticks within the current trading range, Friday's bullish one comes with the same caveats about its potential to mark a reversal. The candlestick appeared below 20-day and 50-day MAs, so this adds to the challenge. And the index is sharply underperforming against peer indexes.

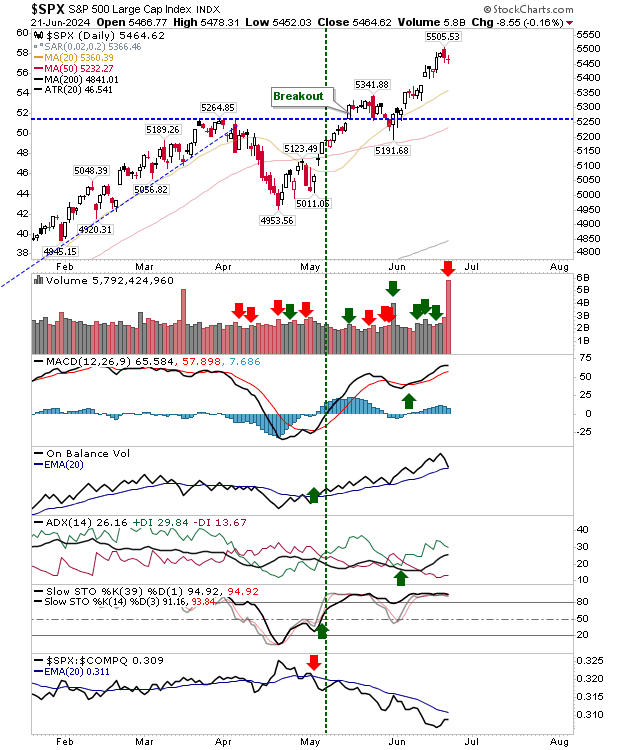

There was less to say about the S&P 500 or Nasdaq. The S&P 500 closed with a doji on bullish technicals, but it is underperforming the Nasdaq so it may struggle to attract enough buyers to break out of its neutral predicament. Indecisive buyers may wait for a test of the 20-day MA before committing.

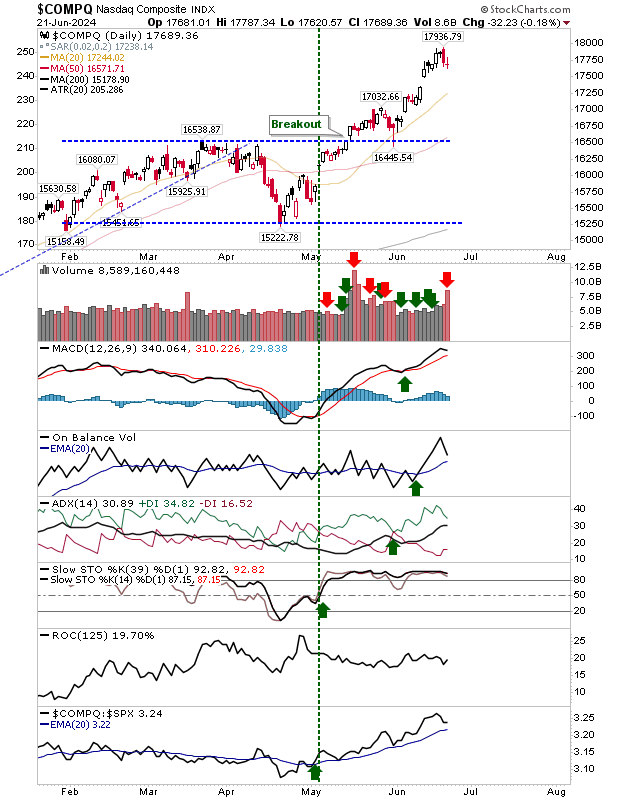

The Nasdaq closed with its doji, but as the leading index in relative performance, it has the best chance of attracting buyers. If it fails to do so, watch for a move back to the 20-day MA.

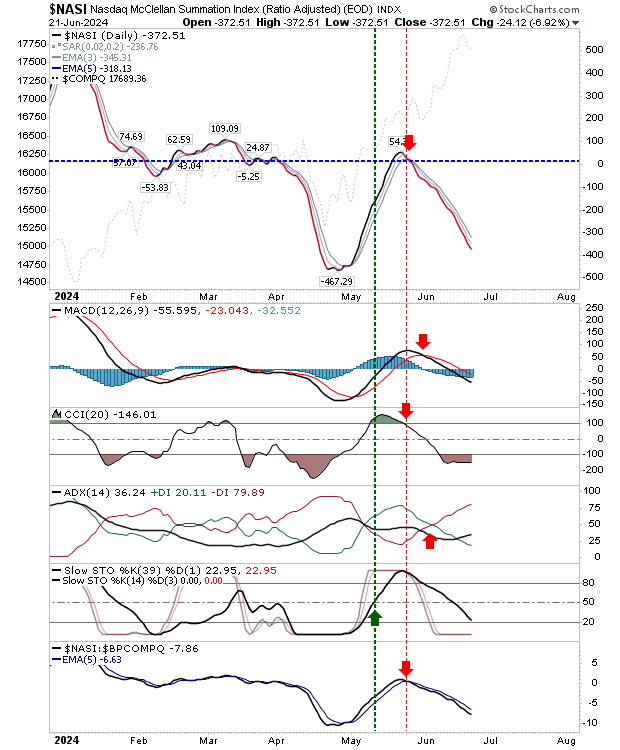

One thing pointing to a further loss is the downtrend in the Nasdaq Summation Index. The downtrend kicked off at the start of June and remained consistent throughout the month, even as the parent index advanced. It seems likely that a sideways move, or worse, is next for the Nasdaq.

For the coming week, watch for a shift sideways or downwards in the Nasdaq. This will have consequences for other indexes because as the lead relative performer it has the potential to suck other indexes down with it. The Russell 2000 has the potential to surprise, only because it is stuck inside the trading range. Current rallies in the Nasdaq and S&P 500 need a holiday, they may be getting one soon enough.