Despite the stock market rally so far in 2023, the S&P 500 Index has not come close to regaining its all-time high put in early last year.

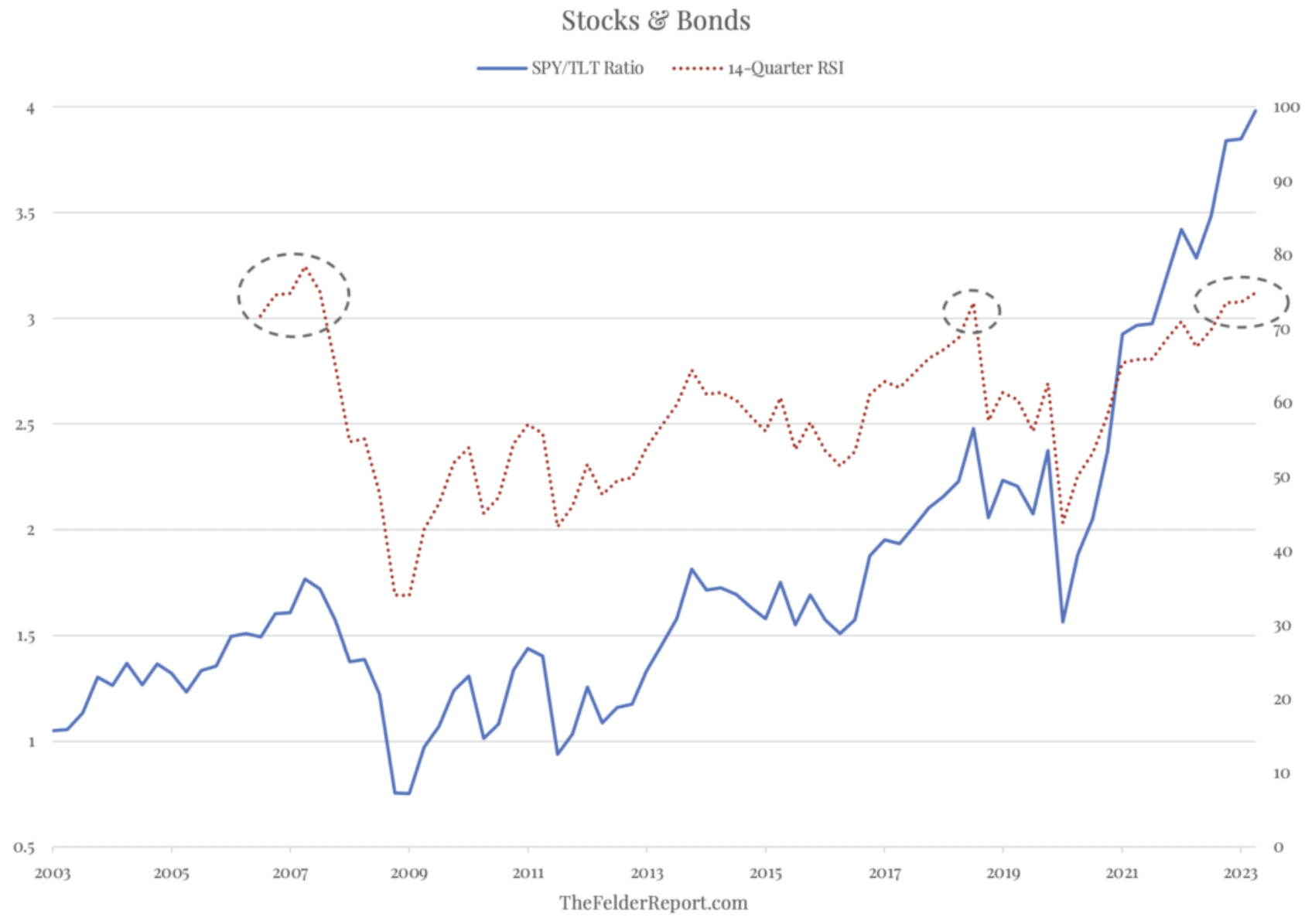

What has soared to new highs, however, is the stock/bond ratio. In fact, its ascent has been so strong that, over the past two decades, the SPY-to-TLT ratio has only been as overbought (as measured by quarterly RSI) as it is today at the 2007 top heading into the GFC. It came close back in late 2018, just before the steep fourth-quarter selloff that year, but didn’t quite manage to reach the level we see currently.

So it would appear that stocks need bonds to rally hard and soon in order to justify current levels. However, if bonds rally because the economy weakens significantly, that would likely not be bullish for equities subject to significant earnings downgrades.

And if bonds can’t rally, whether the economy falters in a meaningful way or not, that too could prove problematic for a stock market that appears far out of equilibrium with competing financial assets. In short, it looks like Mr. Market is still in denial over TINA’s (There Is No Alternative) passing.