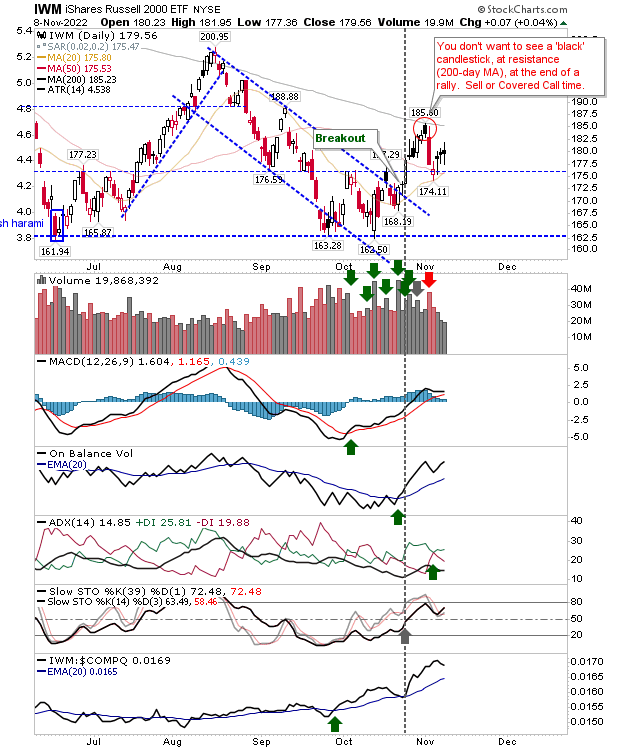

Markets gained yesterday, but it was hardly convincing. The Russell 2000 is the best example as it posted its fourth day of doji/spinning top candlesticks - which post a net gain - but do so from a point of indecision.

Technicals for the Russell 2000 are still net positive, but I'm expecting a big red candlestick anytime soon. Note the falling buying volume, another reason to lack confidence in the current advance.

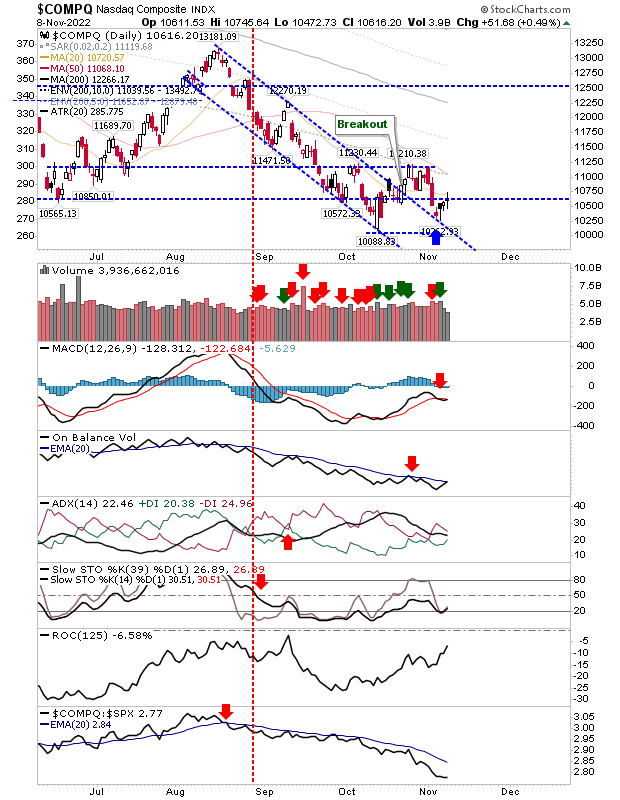

The Nasdaq is bearish in technicals and has run up against resistance of the swing low in June. The spinning top at this resistance is not a vote of confidence in what is normally considered a 'neutral' candlestick. On the positive front, one could argue the bounce has come from a second successful bounce of declining resistance - turned support.

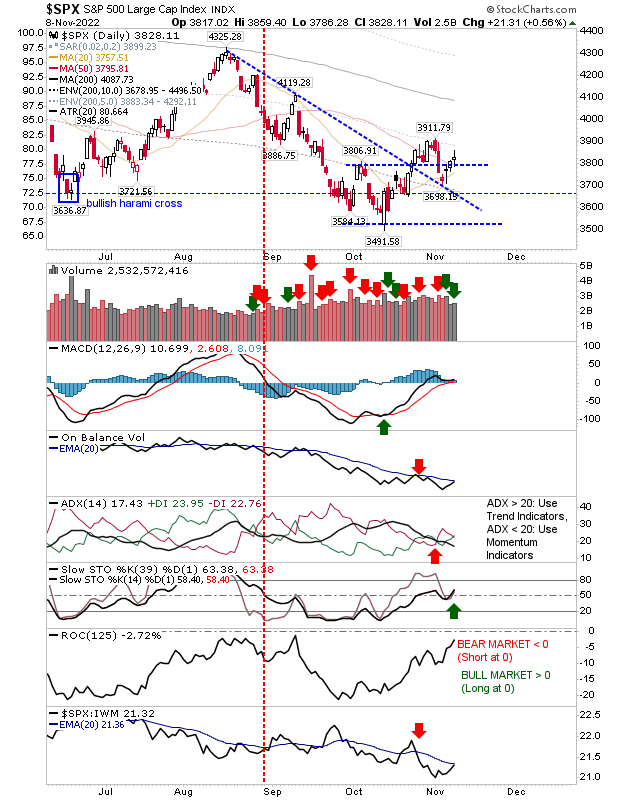

The S&P 500 was perhaps the best of the indices as it enjoyed the stronger of the gains; enough to register an accumulation day in volume and set momentum, as measured by stochastics [39,1], back above the bullish mid-line. The MACD has been on a 'buy' signal for a while, and the accumulation day in volume now means On-Balance-Volume is near a new 'buy' signal, altough the trend metric - ADX - is still bearish.

Given the current state of the S&P, I would be looking to this index, rather than the more net bullish Russell 2000, to guide bulls through the current advance and above the most recent swing high for the indices (in October). Should this be achieved, then I would be looking for a move to 200-day MAs. The Russell 2000 had already achieved this, so for this index I would be looking for a move through this key long term moving average.