Not much has changed coming into July, as investors are still weighing up a plethora of economic risks including the war in Ukraine, a global energy crisis, lockdowns in China, and raging inflation. Couple this with the backdrop of slowing growth and it seems unlikely that central banks will be able to pull off a so-called “soft landing”.

Despite this, markets have been relatively flat thus far in July after the massive drop we saw in June. The MSCI All Country World Index, which lost 8.5% in June, is down 0.4% month-to-date (MTD). With risk-off sentiment prevailing, emerging markets have been the major drag, with the MSCI Emerging Markets Index losing 3.0% MTD, followed by 0.1% for their developed counterparts (MSCI World Index).

Red-hot inflation data from the US showed that annual CPI accelerated to 9.1% in June, the highest figure since 1981. Of more concern is the fact that monthly inflation is also showing no signs of slowing down after advancing 1.3% as compared with 1.0% in May. Despite signs of an economic slowdown, the US labour market remains extremely tight, with the Labour Department’s report showing that they added close to 400 000 jobs in June. Job openings also remain near all-time highs at over 11 million. Consequently, the Federal Reserve will likely continue to hike rates aggressively following the 75-basis-point (bps) hike done in June. The Fed funds futures market is currently pricing in a 100% chance of another 75-bps hike and an 87% chance of a 100-bps hike at their meeting in July. The near-certainty of another sharp hike pushed the dollar 1-to-1 against the euro for the first time in two decades.

Stock markets came into June with what seemed like renewed optimism surrounding news that China was easing lockdowns and that yields seemed to be coming off recent highs. This has since reversed building up to the inflation report and has seen US stocks end down for three consecutive days. Despite the recent downturn, the S&P 500 and Nasdaq Composite are still up 0.4% and 2.0% respectively (MTD).

Chinese stocks have lost ground after a short-lived relief rally in June, which saw the MSCI China Index up 5.7%. Dragging stocks down is the fear that fresh lockdowns will be initiated due to growing Covid cases and the emergence of a highly contagious Omicron subvariant. Chinese tech stocks were further hurt after Alibaba Group (NYSE:BABA) and Tencent Holdings (HK:0700) received a regulatory fine on past transactions. This has caused Chinese stocks to erase previous gains, with the MSCI China index down 5.2% MTD.

There has been plenty of drama out in the UK as Boris Johnson, the prime minister, announced his resignation following immense pressure from his own political party to do so. More than 50 ministers had quit prior to his resignation, and many MPs had been pushing for Johnson to step down following a string of scandals. The Conservative Party will now elect a new leader who will need to contend with a nation full of political and economic uncertainty.

Otherwise, data from the UK surprised many after showing that the economy grew by 0.5% (month-on-month) in May after contracting for two consecutive months prior. Given that the Bank of England is expecting inflation to climb to over 11% later in the year, the GDP data could prompt them to raise rates by 50 bps at their meeting in August. Despite the GDP reading, the UK economy is still facing numerous challenges and is at high risk of a recession. The FTSE 100, their blue-chip index, has lost 1.1% in July thus far, further adding to the losses seen in June.

Locally, the rand has continued to lose ground against the dollar as risk-off sentiment keeps demand for the greenback high. Also adding to pressures, are the continuing blackouts which are likely to hamper production. Consequently, the rand has lost 5.5% against the dollar to trade above the R17 level. The rand has also weakened 2.6% and 0.9% against the pound and euro, respectively.

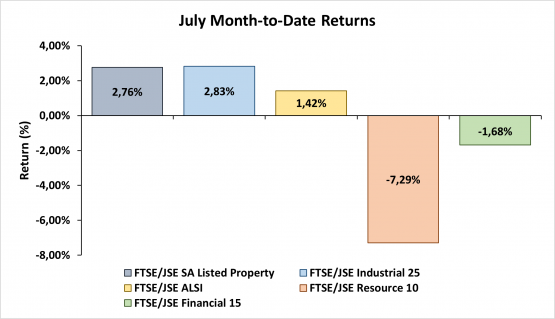

South African equities have rebounded after a big drawdown in June, which saw the JSE All Share Index lose 8.1%. The local bourse has since regained some ground and is up 1.4% MTD. From a sectoral perspective, both industrials are up 2.8% MTD, whereas the resource and financial sectors have both lost 7.3% and 1.7% respectively. SA listed property is also up 2.8%.

Source: Investing.com

Disclaimer: All returns data are in the respective currency of the region mentioned. All YTD and MTD returns are as at time of writing.