- Have US interest rates peaked?

- When will we see a sustainable recovery in Chinese demand?

- Can we expect energy prices to stabilise going into 2024?

- Is the energy transition enough to boost the need for green metals?

As the metals markets enter the last quarter of another turbulent year, the industry prepares to gather in London for a week of meetings and contract negotiations against a backdrop of a flagging Chinese economic recovery, slowing global growth and high interest rate environment. The uncertainty in the metals markets is far from over. Here’s what we expect people to be talking about.

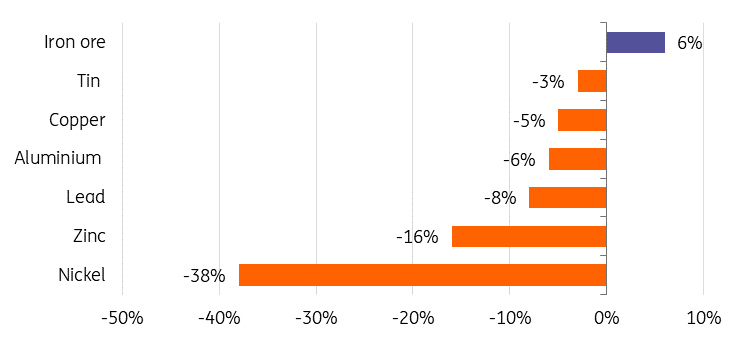

Industrial metals have struggled this year

Have US interest rates peaked?

At the September FOMC meeting, the Federal Reserve left the door open to a further rate rise while signalling it saw less chance of interest rate cuts next year, given that inflation remains above target, the jobs market is tight and activity has proven to be surprisingly resilient.

However, our US economist believes that the Fed is done hiking rates with cuts starting from spring 2024 as challenges continue to mount with real household disposable income slowing, student loan repayments restarting, credit availability drying up and pandemic-era accrued savings being exhausted for many households. With inflation looking less threatening and the economic outlook looking increasingly challenging, our US economist doubts that the Fed will carry through with another interest rate increase.

But if US rates stay higher for longer, this would lead to a stronger US dollar and weaker investor sentiment, which in turn would translate to lower metals prices.

When will we see a sustainable recovery in Chinese demand?

China, the world’s biggest consumer of metals, was anticipated to be a bright spot for metals demand after last year’s stringent lockdowns, but so far it has struggled to revive its ailing economy.

An official gauge of manufacturing activity only just returned to growth for the first time in six months in September. However, all things related to the property market continue to struggle.

Renewed concerns over the fate of China Evergrande (HK:3333) have surfaced following the detention of its chairman. And there are still questions looming over the economy’s largest developer, Country Garden, which faces $14.9bn in further maturing debt next year, amid plunging unit sales, even as it has so far managed to avoid any default.

Over the last couple of months, the Chinese government has moved forward with a series of stimulus measures designed to turn around the flagging economy and its ailing property sector, which accounts for more than a quarter of China’s economic activity. Included in these measures was the decision to cut down payments and lower rates on existing mortgages.

However, these measures are yet to have a meaningful impact on industrial metals demand.

China’s recovery is still uncertain, and metals are likely to see some continued volatility for a while – at least in the near term. For the remainder of this year, the key factor for the direction of metals prices will be whether China is able to stabilise its property market. Until the market sees signs of a sustainable recovery and economic growth in China, we will struggle to see a long-term move higher for industrial metals.

We believe the short-term outlook remains bearish for metals demand and we do not foresee a substantial recovery before next year. Metals prices should continue to trade under pressure in the fourth quarter with the only upside risk being if Chinese demand recovers faster than anticipated.

Can we expect energy prices to stabilise going into 2024?

Despite supply disruptions from Norway due to extended maintenance and Australian LNG supply risks, Europe is still set to go into the upcoming winter in a very comfortable situation. Storage will basically be full ahead of the start of the heating season. This suggests in the very short term we could see a pullback in prices - given that LNG will need to be redirected away from Europe to other regions in the short term.

European gas prices are down 88% from the high in August last year. Despite gas prices trading significantly lower than last year’s peak, we are still not seeing a very strong demand response.

There are a number of reasons for this including fuel switching, weak downstream demand, permanent capacity closure of energy-intensive industries, and the uncertainty over the price outlook, which is likely making some hesitant to restart capacity.

While we see weaker prices in the very short term, once winter gets underway and we start drawing down inventories this should see storage levels at the end of the heating season more aligned with the five-year average. We are assuming a normal winter, which would mean we see a much larger drawdown of storage compared to last year. This means prices should be better supported once we get into the winter and refilling storage next summer will be a more arduous task.

We expect TTF to average EUR50/MWh over the fourth quarter as the market starts to draw down storage over the winter. Europe will still be vulnerable over 2024 given the lack of new LNG capacity coming onto the market, which suggests that prices are likely to remain well supported through next year with 1Q24 averaging EUR55/MWh. Much will also depend on the weather through the 2023/24 winter.

Is the energy transition enough to boost the need for green metals?

Industrial metals like copper, aluminium and nickel are battling disappointing economic activity which is weighing on demand on one side, and the energy transition, which is boosting demand in certain sectors on the other.

While demand for metals in traditional industrial sectors has weakened, governments’ decarbonisation efforts around the world are boosting the need for metals that are key to renewable energy-related manufacturing from electric vehicles to solar panels.

Metals including lithium, nickel and cobalt, provide electric vehicle batteries with the power to store and release energy. Meanwhile, copper is essential in all aspects of the energy transition, from EVs to charging infrastructure to solar photovoltaics (PV).

For aluminium, the highest growth in terms of demand will come from the transportation sector amid the shift to EVs.

Global EV sales exceeded 10 million last year alone – and this level of growth isn't expected to slow any time soon, with almost one in five new cars sold worldwide this year set to be electric.

And as the demand for EVs rises rapidly, so does the demand for the metals inside their batteries.

If we see governments introducing even firmer policies to fight climate change, this will lead to an even faster adoption of EVs and green energy-related infrastructure, which will, in turn, boost the need for green metals.

We expect green energy to drive metals like aluminium and copper in the longer term, with their role in the energy transition appealing to investors, but in the short term, we don’t believe it to be sufficient to drive prices higher.

Meanwhile, the growing decarbonisation focus in the metals industry is only likely to increase further with the implementation of the European Carbon Border Adjustment Mechanism's (CBAM) transitional phase starting this month.

First published on Think.ing.com.