Last week’s news that the Federal Reserve left interest rates steady, followed by a slower-than-expected rise in payrolls in October, revived animal spirits.

Now comes the hard part: Was it noise, or did Friday’s broad-based rally signal a turning point in favor of the bulls?

The shot of adrenaline jacked up the risk appetite on Friday, lifting all but one of the major asset classes (commodities were the downside outlier) for the week, based on a set of ETFs.

Leading the way: property stocks: Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) surged 8.9% in the trading week through Nov. 3.

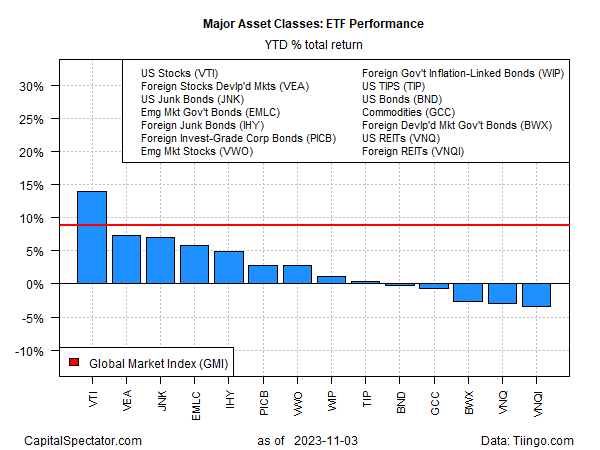

The year-to-date results, however, still reflect a mixed picture, leaving investors to wonder if the latest pop is something more than a temporary bout of volatility in a run of selling that started in the summer.

One analyst expects that the market correction of late has run its course. Larry Adam, chief investment officer at Raymond James’ private client group, advises clients that current conditions mark a buying opportunity. He outlines five reasons in a research note published on Friday, including his forecast that rate hikes have peaked.

“Yes, supply/demand dynamics have been driving interest rates lately, but the macro drivers of softer economic growth and continued disinflation should drive interest rates significantly lower over the coming months,” Adam explains.

Morgan Stanley (NYSE:MS) strategist Mike Wilson, however, still favors a cautious outlook and tells investors not to read too much into the latest slide in Treasury yields.

“The drop in Treasury yields was more related to the lower than expected coupon issuance guidance and weaker economic data as opposed to the bullish interpretation (for equities) that the Fed is going to cut rates earlier next year,” says Wilson.

For another perspective, keep an eye on the market trend. The S&P 500 Index, for example, has impressed Wall Street with last week’s powerful rebound. But the 5.9% weekly surge by itself doesn’t reverse a downside bias that’s dominated for several months.

If this is a genuine turning point, prices will stabilize if not rally in the days and weeks ahead. Incoming economic data will likely be crucial for determining the market’s next moves.

This week’s schedule, however, is light. The main event: the weekly release of jobless claims on Thursday (Nov. 9), which will offer an update on the view that the labor market is cooling.

Meanwhile, GDP nowcasts are pointing to a slowdown in economic growth after the red-hot Q3 report. The Atlanta Fed’s GDPNow model is currently estimating that output will sharply decelerate to a modest 1.2% pace from 4.9% previously.

On the interest-rate front, Fed funds futures this morning are pricing in a 90% probability that the central bank will leave its target rate unchanged again at the next FOMC policy meeting on Dec. 13.

To the extent that bullish forecasts will draw strength from softer economic activity and more clues that rate hikes have ended, the week ahead is off to an encouraging start.

It’s premature to conclude that this is enough to end the recent slide in stock and bond prices, but the case for optimism is a bit stronger vs. this time last week.