The USD/JPY currency pair has observed a modest uptick, positioned around 150.16 as the new week of February commences, rebounding after a brief two-day descent. This development underscores the persistent gap in the monetary stance between two of the world's leading economies: the United States and Japan. The disparity in interest rates set by the US Federal Reserve and the Bank of Japan (BoJ) is a critical driver of the yen's ongoing weakness. This situation has placed market observers on high alert for any forthcoming statements from the BoJ that might hint at a shift towards normalizing its monetary policy. Specifically, there is a heightened anticipation for the central bank to provide clearer cues about making its interest rate positive, with many hoping for such revelations by the BoJ's April meeting. Until such guidance is offered, the yen is expected to face sustained downward pressure.

Compounding the currency's challenges are the broader economic difficulties confronting Japan. Recent economic data has cast a spotlight on the nation's struggle to achieve stable growth amidst the backdrop of a weakening yen. Despite concerted efforts at strategic monetary stimulation, the anticipated economic uplift has remained elusive. This situation raises critical questions about the effectiveness of existing policy mechanisms. It suggests that either these strategies are not yielding the intended outcomes or that the Japanese economic system has become so accustomed to these interventions that it no longer responds in the expected manner. The implication is clear: there may be a pressing need for a reevaluation and possible recalibration of Japan's monetary and economic policies to inject new vitality into its growth trajectory and stabilize the yen's value on the global stage.

USD/JPY Technical Analysis

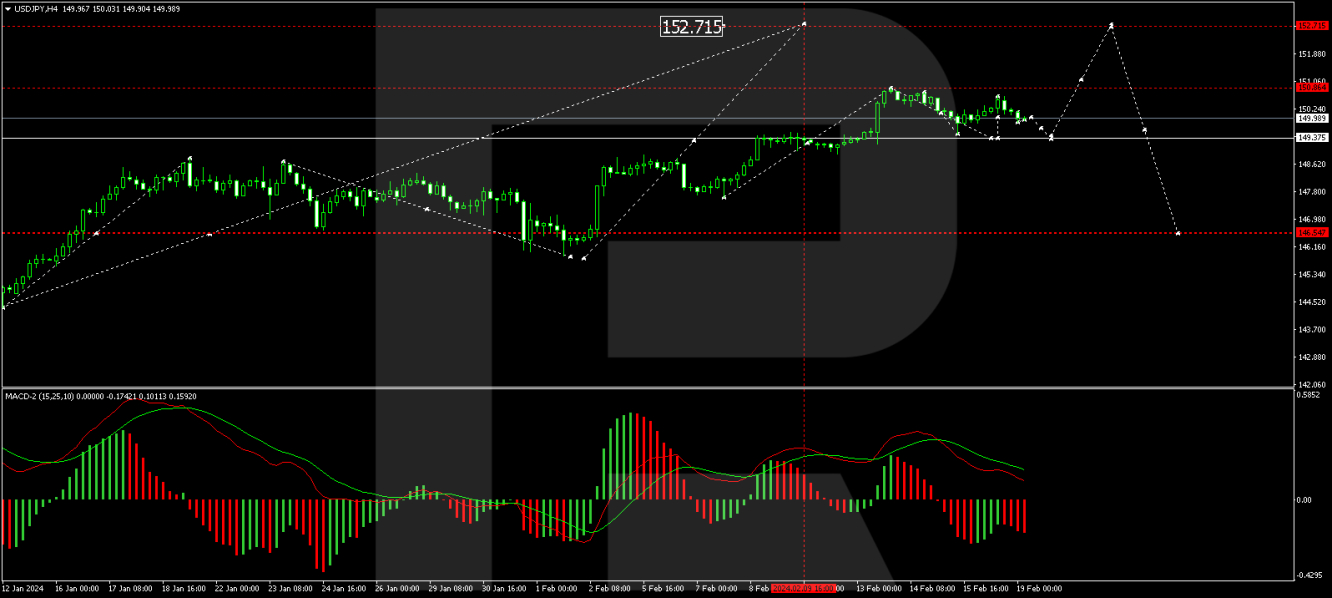

The H4 chart for USD/JPY shows the formation of a correction wave aiming towards 149.37. Following the completion of this correction, a new upward movement towards 152.72 is expected, marking a local target. The MACD indicator, with its signal line currently above zero, is trending downwards towards the zero mark, supporting this potential upward movement.

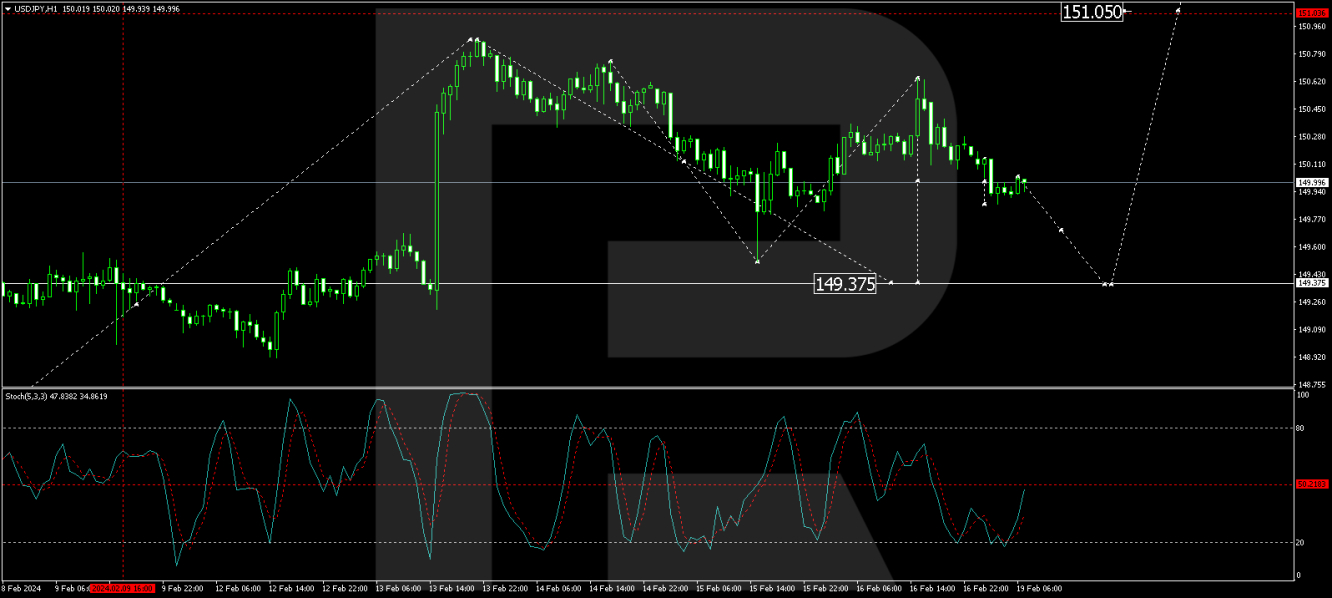

On the H1 chart, the currency pair is undergoing a correction towards 149.37. After this phase, the trend is expected to shift upwards, aiming for an initial target of 151.05. This forecast is corroborated by the Stochastic oscillator, whose signal line is positioned above 20 and is anticipated to climb towards 50 before potentially rebounding back to 20, indicating the possibility of further movements within this trend.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Japanese Yen Struggles as USD/JPY Pair Sees Uptick

Published 19/02/2024, 10:07

Japanese Yen Struggles as USD/JPY Pair Sees Uptick

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.