This article was written exclusively for Investing.com

Many technology stocks have surged in 2020 as rates have plummeted, and investors have sought safety in their significant revenue and earnings growth rates. Adding extra fuel to the fire was the notion that these stocks posted accelerating growth due to the pandemic. But that trade may now be at the end of the road, as rates slowly creep higher, and expectations are getting tough to beat.

Plenty of these long-term growth stories have fallen apart this week, like Zoom (NASDAQ:ZM), Salesforce (NYSE:CRM), and Splunk (NASDAQ:SPLK), each falling sharply following earnings results

Earnings Yield Game

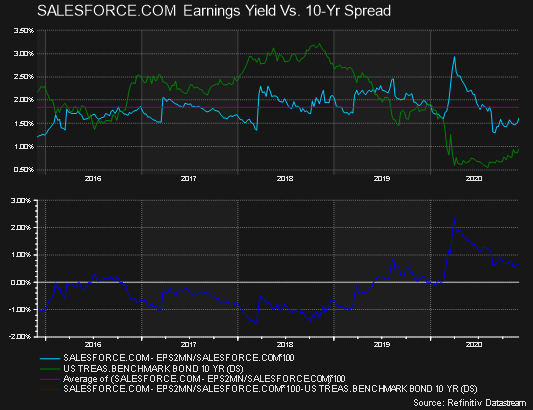

Salesforce's stock saw its earnings yield, which is the inverse of the P/E ratio, fall to its lowest level since 2018—about 1.4% on Sept. 2. In the chart below, one can see how Salesforce's earnings yield had historically averaged around 1.85%. But as the 10-year rate fell to record low levels, it gave investors the ammunition it needed to push Salesforce's earnings yield lower in an attempt to keep the spread with the 10-year yield around the historical norms which sent the stock price sharply higher.

It is essential to understand that the earnings yield narrative is partially the driving force behind some of these advances. Because, if stocks have been rising on the concept of lower interest rates making them more attractive, then rising rates likely mean the exact opposite which will send these stocks lower.

Yields May Rise Sharply

Investors may need to pay attention to this trade now more than ever. Rates on the 10-year may be about to break out, as it is testing a critical downtrend that started in 2018. The only thing standing in the way of rates rising sharply is a level of resistance around 1%. Should the 10-year rate rise above 1%, it could result in a jump up as high as 1.3%. As measured by the relative strength index, momentum is also showing that yields may continue to push higher, with a clear uptrend.

It isn't just rates that can end the party. It seems that some of these stocks have high valuations, which are now being put to the test. For example, Zoom reported better than expected results earlier this week. However, the stock was still hit hard, falling by more than 15%, on concerns over contracting margins. Splunk is another example of a stock that has performed exceptionally well this year and fell by around 20% after it missed analysts' expectations.

Exuberance

Perhaps, these stocks have sold off hard because yields have already risen by around 40 basis points since the summer, making holding them difficult. If companies can't deliver the big earnings beats investors have grown to expect, then it makes it harder to justify the lofty multiples investors have given to these stocks. If consensus earnings estimates are not rising at a pace fast enough to offset rising bond yields, then it makes the justification for owning these stocks much more challenging.

It could just as easily be that investors have finally started to wake up as valuations for some of these companies have simply reached levels where expectations have become too exuberant. Whatever the case may be, it seems pretty clear that some of the exuberance is starting to wear off.