- MCD has maintained earnings in the face of rising inflation

- Shares are expensive

- Consensus rating is bullish

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

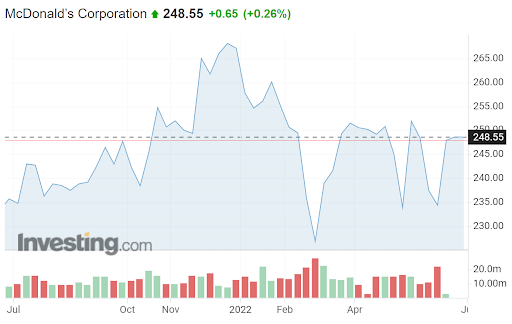

While McDonald’s (NYSE:MCD) shares have fallen 7.8% since the 12-month high close on Jan. 6, they have substantially outperformed the broader U.S. equity market over the past year. MCD’s total 12-month return is 8.6%, compared with -6.93% for the SPDR® S&P 500 (NYSE:SPY) over the same period. The restaurant industry group (as defined by Morningstar) has a trailing 12-month total return of -13.1%.

Current economic conditions are challenging for restaurant chains because of the shortage of service workers and because inflation is driving up the price of food items which tends to squeeze margins. Despite the tight labor market, McDonald’s managed to increase its labor force in 2021 by offering competitive wages and a range of incentives. The company is also carefully managing price increases to reduce the shock to customers. In addition, rising restaurant prices are likely to encourage people to look for lower-cost options, and McDonald’s may benefit from this effect.

Source: Investing.com

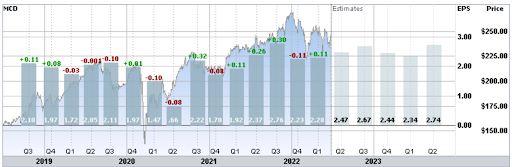

McDonald’s strategies and positions appear to be working, with Q1 earnings (reported on April 28) beating expectations by 5.2%. Q1 earnings per share (EPS) was higher than in 2019 (e.g. pre-COVID) and, not surprisingly, came in above Q1 EPS for 2020 and 2021. Even though McDonald’s exit from Russia is expected to dent earnings, the outlook for earnings is stable. The consensus estimate for EPS growth over the next three to five years is 7.3% per year.

Source: E-Trade

Green (red) values are amounts by which EPS beat (missed) consensus expected values

MCD’s valuation is high, with P/E of 26.2. While the P/E has fallen from an all-time high of almost 33 at the end of 2020, the current level is near the top of the historical range. The supportable P/E for a stock depends on anticipated earnings growth. It is hard to believe that MCD, in the long term, should have a P/E comparable to those of Microsoft (NASDAQ:MSFT) (27.9), Alphabet (NASDAQ:GOOGL) (21.7) or Apple (NASDAQ:AAPL) (23.0).

I last wrote about MCD on October 27, 2021, at which time I assigned a buy rating. At that time, MCD was trading at $238.09. The Wall Street analyst consensus rating for MCD was bullish and the consensus 12-month price target was about 13% above the share price at that time. Earnings showed signs of a robust recovery from the pandemic lows. In addition, the consensus outlook implied by options prices (the market-implied outlook) was solidly bullish. Even though the valuation was very high as compared with values over the past decade, the bullish outlooks from Wall Street consensus and from the options market carried the day. In the period since I assigned the buy rating, MCD has returned a total of 3.4% and the S&P 500 (SPY) has returned a total of -13.5%.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have calculated the market-implied outlook for MCD through the end of 2022 and to the middle of 2023 and I have compared these with the current Wall Street consensus outlook in revisiting my rating on the stock.

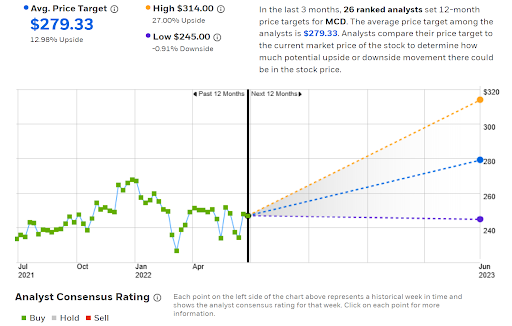

Wall Street Consensus Outlook For MCD

E-Trade calculates the Wall Street consensus outlook for MCD using ratings and price targets from 26 ranked analysts who have published their views over the past three months. The consensus rating is bullish, with a consensus 12-month price target 13% above the current share price. Combined with the dividend yield, the consensus expectation for total return is 15.2%. Of the 26 analysts, 22 assign a buy rating and four give the stock a hold rating. The lowest of the individual price targets is 0.91% below the current share price.

Source: E-Trade

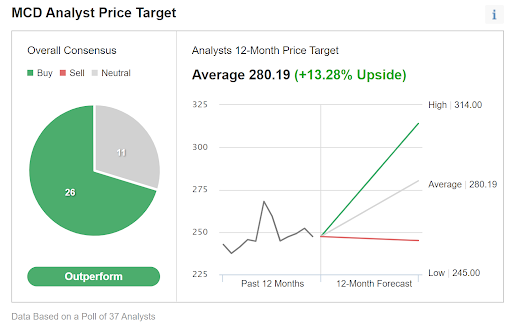

Investing.com’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 37 analysts. The consensus rating is bullish, with a consensus price target 13.3% above the current share price.

Source: Investing.com

The Wall Street consensus outlook for MCD is very similar to the one from October 2021, with a bullish rating and 15.3% expected 12-month return. The consensus price target has risen in tandem with the share price since my last analysis.

Market-Implied Outlook For MCD

I have calculated the market-implied outlook for MCD for the 6.8-month period from now until Jan. 20, 2023, and for the 11.6-month period from now until June 16, 2023, using the prices of call and put options that expire on these two dates. I selected these specific expiration dates to provide a view through the end of 2022 and for the next year.

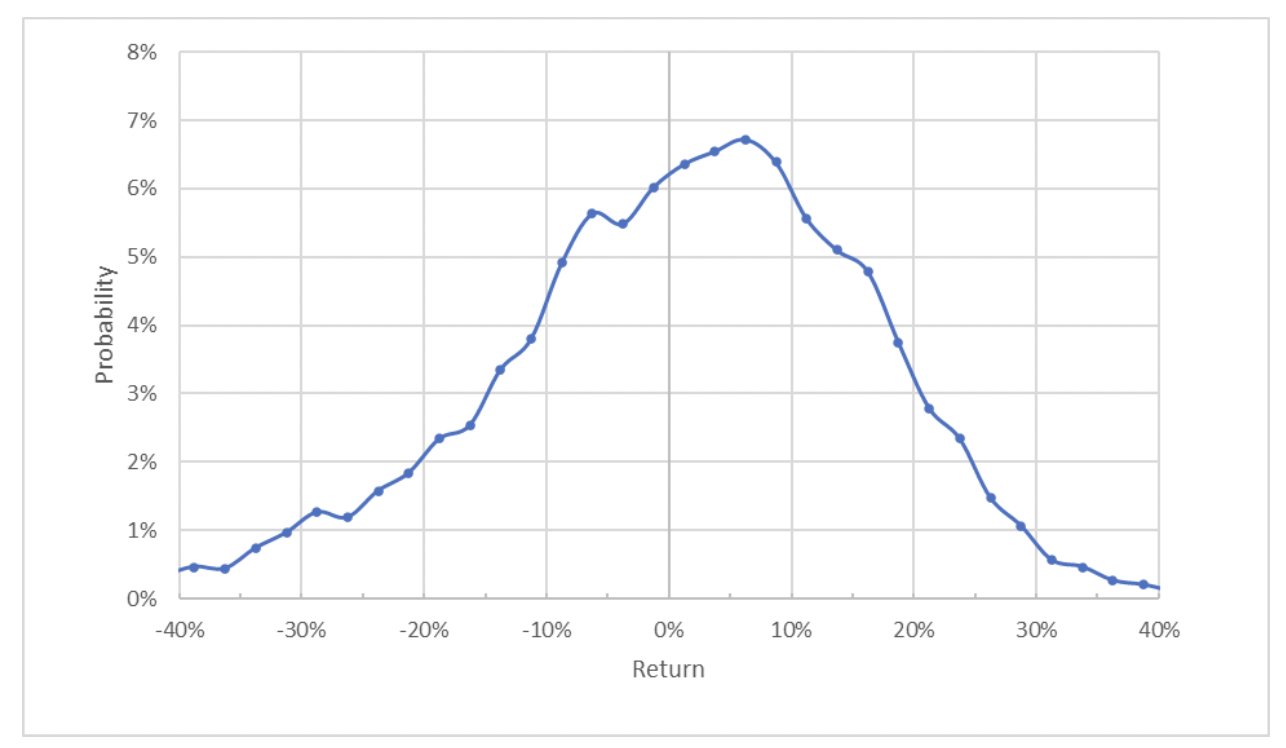

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook is tilted to favor positive returns. The peak probability corresponds to a price return of +6.25% over the next 6.8 months. The annualized volatility calculated from this distribution is 24%, close to the expected volatility that I calculated back in October.

To make it easier to compare the relative probabilities of positive and negative returns, I have rotated the negative return side of the distribution about the vertical axis (see chart below).

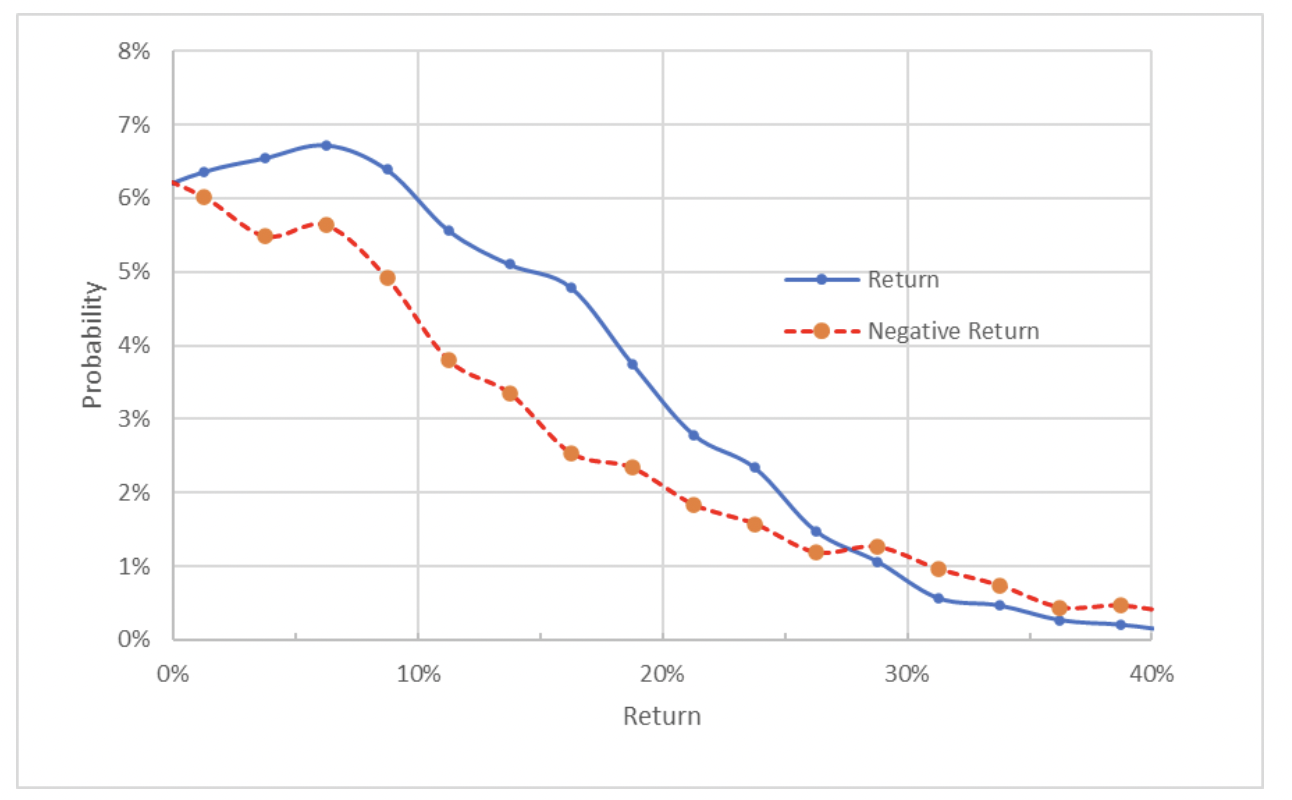

Source: Author’s calculations using options quotes from E-Trade

The negative return side of the distribution has been rotated about the vertical axis.

This view highlights that the probabilities of positive returns are markedly higher than the probabilities of same-sized negative returns, across a wide range of the most probable outcomes. (The solid blue line is well above the dashed red line over the left ⅔ of the chart above). This is a bullish outlook for the next 6.8 months.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and, thus, tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation for a negative bias strengthens the bullish interpretation of this outlook.

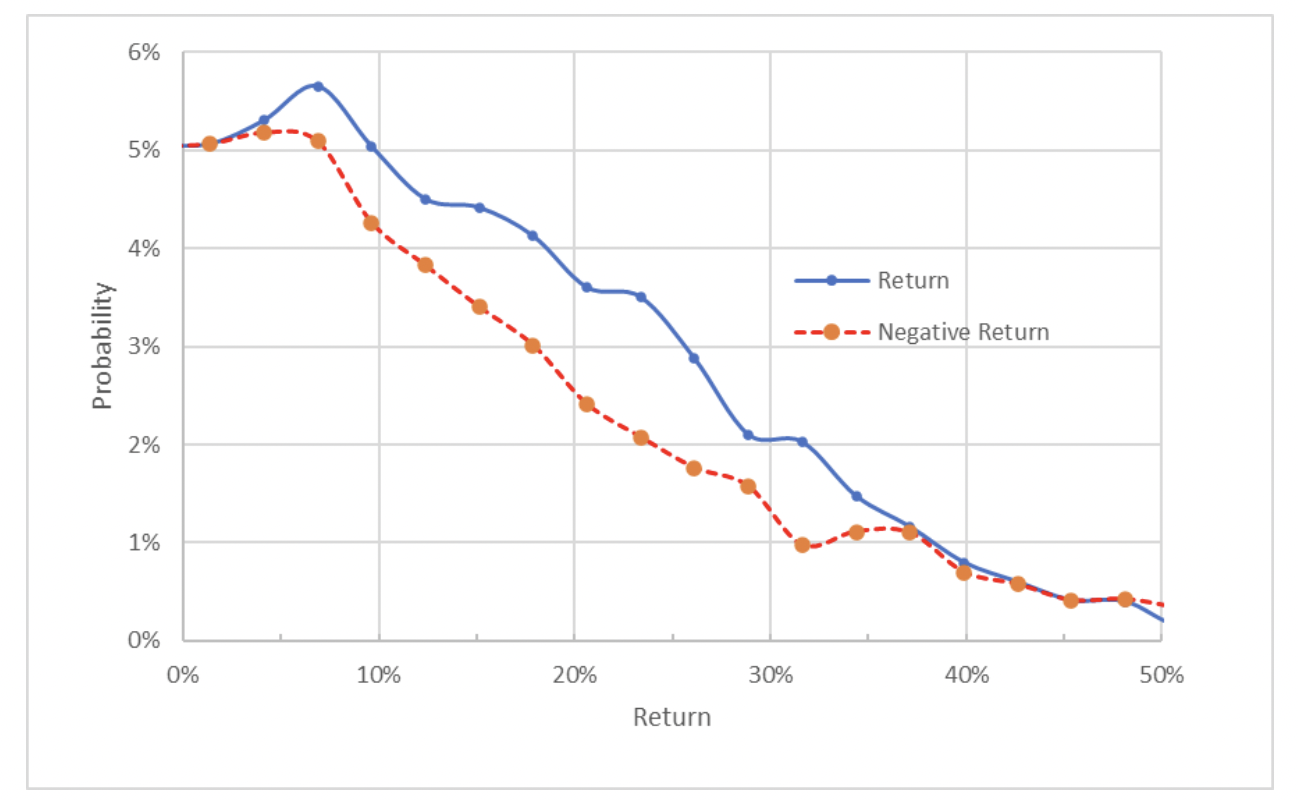

The market-implied outlook over the next year, calculated using options that expire on June 16, 2023, is also bullish, albeit less than the shorter-term outlook. The expected volatility calculated from this distribution is 24.7%. The options trading volume at this time horizon is fairly thin, however, reducing confidence in the predictive value.

Source: Author’s calculations using options quotes from E-Trade

The negative return side of the distribution has been rotated about the vertical axis.

The market-implied outlook for MCD is strongly bullish through the end of 2022 and bullish over the next year. The expected volatility is quite low, but is higher for the 11.6-month outlook than for the 6.8-month outlook.

Summary

From a long-term perspective, MCD looks overvalued. Over the next year, however, economic conditions continue to favor the company. McDonald’s appears to be navigating the challenges of a tight labor force and inflation far better than the restaurant industry as a whole. The Wall Street consensus outlook continues to be bullish, with an expected 12-month total return of 15.3%. As a rule of thumb for a buy rating, I look for expected annual total return that is at least half the expected annualized volatility (24%-25% in this case). MCD meets this criterion. In addition, the market-implied outlook is robustly bullish to early 2023 and bullish from now until mid-2023. I am maintaining my bullish/buy rating on MCD.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »