Smiths News now has contracts in place for 91% of its core revenue to 2029, implying resilience. In addition, its non-core growth activities are beginning to gather momentum, which is already mitigating the structural decline of the core activity. Furthermore, the addressable non-core ‘early morning’ market is sizable and has a profit opportunity of c £160m, which implies that there is potential to more than offset the decline seen in the core operations and could lead to long-term profit growth. This in turn underpins the cash generation and the dividends, and could see further distributions if investment for growth is not required. We have trimmed our forecasts but raise our valuation to 93p/share.

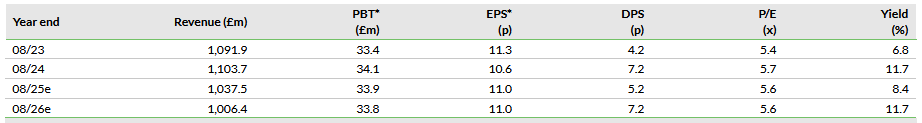

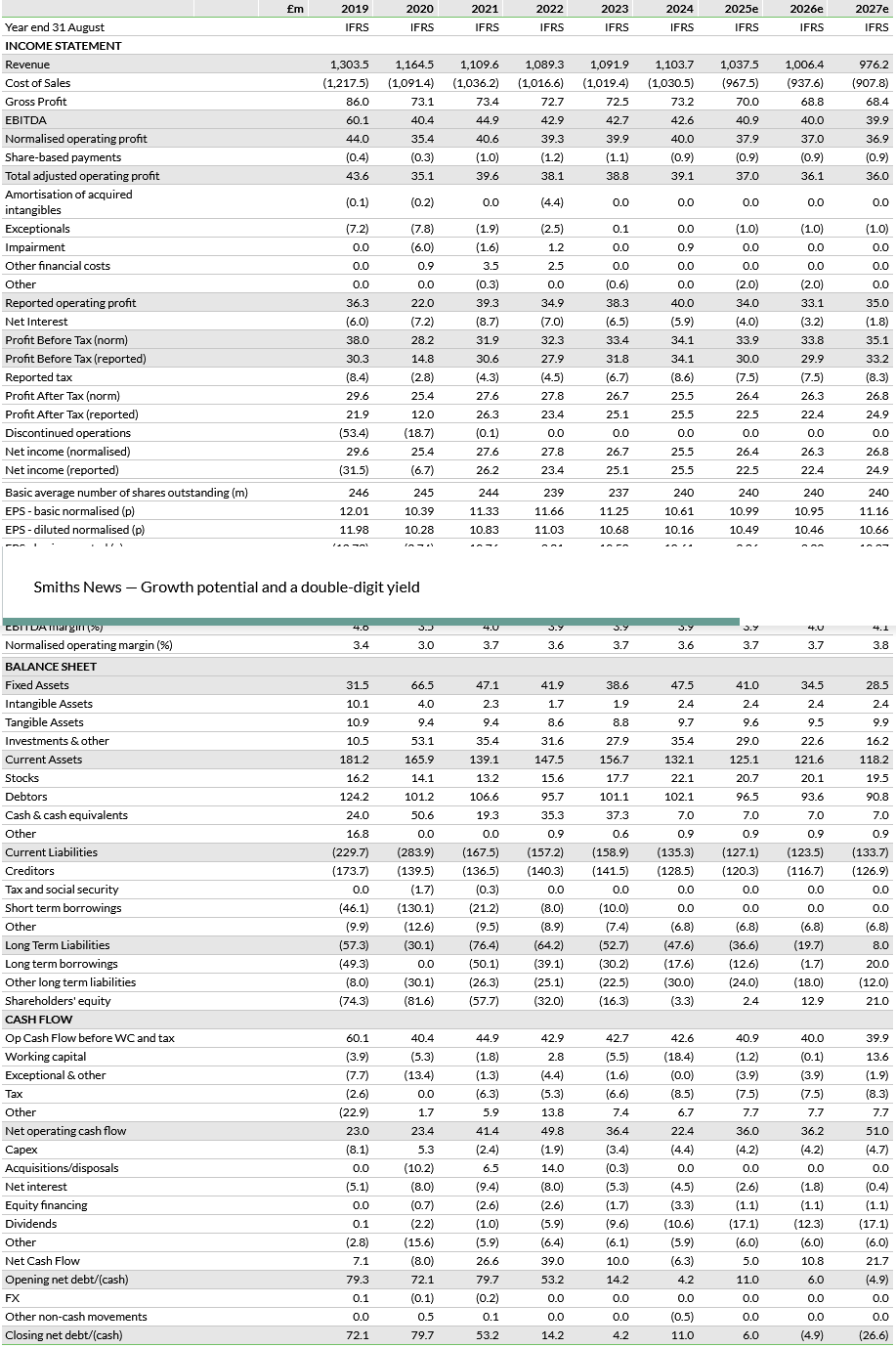

Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments.

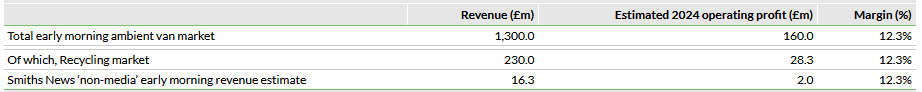

‘Early morning’ market offers profit growth potential

Smith News generated c £2.0m (FY23: £0.7m) of operating profit in FY24 from non-core ‘early morning’ services, including waste collection and recycling. According to CIL Management Consultants, the early morning ‘sack’ recycling market is worth c £230m pa, generates an EBITDA margin of 10–15% and is growing at c 3–5% pa. We believe Smiths has captured c 5.5% of the market so far and could capture considerably more. Furthermore, the total ‘early morning’ ambient van market could be worth £1,300m with a profit opportunity of c £160m. This suggests that the market is there for Smiths News to offset the decline of news and magazine profits, or even to begin to grow group profits after years of slow decline.

Eye-watering dividend-paying potential

We believe that Smiths News generates c £20m of free cash flow annually and that it is currently paying c £13m in ordinary dividends. This suggests, all things being equal, that it will be in net funds in the foreseeable future, hence the decision to pay the 2p ‘special’ dividend (c £5m) in the FY24 results. We are forecasting that in the absence of additional investment or M&A activity, Smiths News may pay another 2p ‘special’ in FY26. Furthermore, we calculate that by FY27 Smiths could declare total ordinary and ‘special’ dividends of over 27p/share, versus the current share price.

Valuation: Pushed up to 93p/share

Our underlying revenue estimates remain unchanged, but we have updated the model for the impact of the UK budget, which adds a higher employers’ National Insurance contribution to the cost base. This implies lower adjusted operating profit, but because we model a lower rate of long-term revenue decline (4% pa, from 5%) in our DCF, our valuation edges up from 90p/share to 93p, representing c 50% upside. Smiths News trades on a P/E multiple of 5.6x in FY25e, which we believe is attractive for a company with such cash-generative characteristics. It also yields 8.4% from its raised and twice-covered ordinary dividend.

Prospect of increased ‘special’ dividends

Smiths News remains a very cash-generative business and, after several years of declining net debt and then the removal of dividend payout restrictions, it has been able to raise its ordinary dividend and announce a ‘special’ dividend. With no amortisation of the new debt facility and in the absence of additional investment plans or M&A, we believe that Smith News has the capacity to declare another ‘special’ dividend in FY26 or embark on a potential share buyback programme. Furthermore, we estimate that Smiths News could declare total dividends of over 27p/share in the three years to FY27 as the growth initiatives gather momentum, implying that there are now upside risks to net cash generation. Given this more optimistic outlook, we have reduced the rate of decline in revenue in our discounted cash flow (DCF) valuation, which results in an uplift from 90p/share to 93p/share.

Potential to pay c 27p of dividends over the next three years

We believe that Smiths News has a range of options open to it with regards to its surplus capital, which could include investment in growth, M&A, share buybacks or ‘special’ dividends. In FY24, Smiths News raised its total ordinary dividend to 5.15p, at a cost of £12.8m, and announced a 2.0p/share (c £5.0m) ‘special’ dividend, citing that average net debt was trending down. Adding back the £15.7m creditor payment that fell into the last week of FY24, we estimate that Smiths News has generated in excess of £20m pa of free cash flow over the last four years. Therefore, we believe that average net debt will fall, or net cash will rise, by c £7m pa in the absence of unannounced M&A or additional capex programmes. We have, therefore, made the assumption that Smiths News will declare another £5m ‘special’ dividend in FY26.

That said, by FY27 we estimate that the company would still be in net cash and believe that we may have materially underestimated its dividend-paying potential. If we assume Smiths News generates c £7m pa of additional free cash flow by FY27 (ie £21m), minus the £5m ‘special’ we have already forecast in FY26, there is the potential for c £16m, or c 6.5p/share, to be paid out to shareholders in ‘special’ dividends.

To put this another way, by FY27, we forecast that Smiths News could declare ordinary dividends of 15.45p, plus a 5p ‘special’ totalling 20.45p, and potentially generate enough ‘surplus’ cash to pay a further c 6.5p ‘special’ dividend, giving a total of 26.95p, effectively 26.95p x 240m shares comes to c£65m which is c £21m p.a.

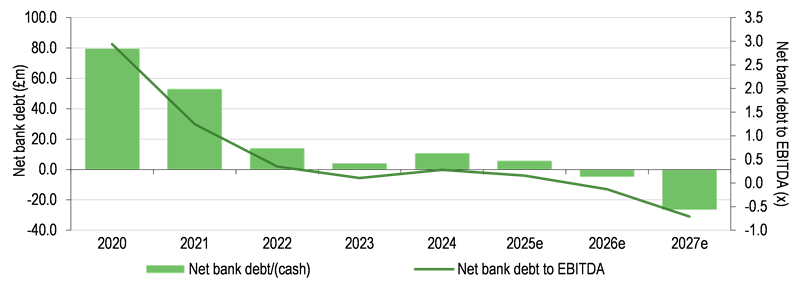

Exhibit 1: Net bank debt reduction and debt ratio

Source: Smith News, Edison Investment Research

Earlier this year, Smiths News renegotiated its financing arrangements in a favourable way to both the company and shareholders, which also included the removal of the £10m pa dividend distribution limit, which paved the way for the FY24 2p ‘special’ dividend. The new facilities included a modest increase to £50m (£40m RCF plus a £10m accordion) and a reduction in the margin from 4.0% to 2.45%, implying a material cost saving. In reality, net debt is low and falling but the larger facility caters for the occasional temporary large working capital swings.

‘Early morning’ market offers organic revenue growth

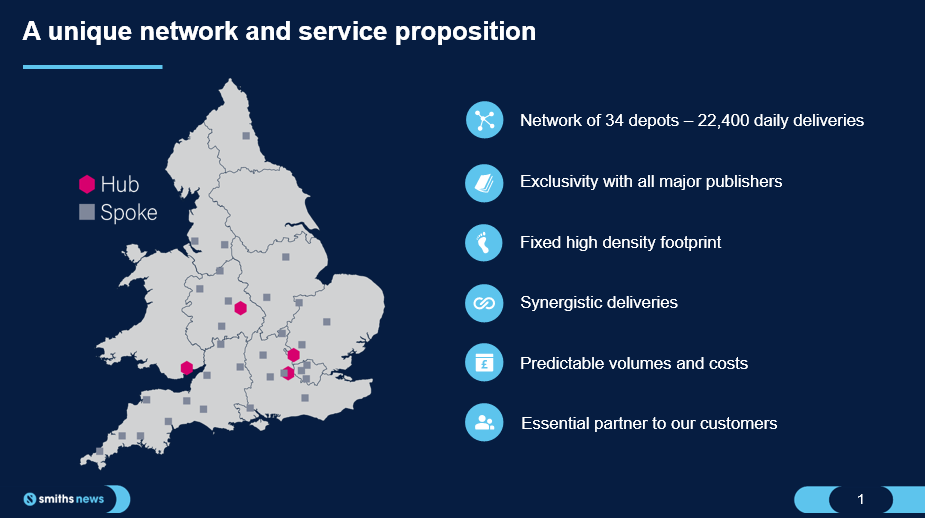

Towards the end of 2022, Smiths News outlined an ambition to better utilise its distribution network to generate new profit streams to offset the anticipated annual decline in newspaper and magazine distribution volumes and revenue. Smith News now operates from 34 depots in the UK. The depots are idle for long periods each day, and its vans visit each of the company’s 22,400 customers every day.

Exhibit 2: Smiths News’ distribution network

Source: Smiths News

Smiths News successfully trialled a cardboard and plastic recycling collection service in Birmingham, which included the collection of unwanted cardboard and plastics at the same time as dropping off the day’s newspaper and magazine delivery. Smiths News rolled out the service to an increasing number of traditional media customers and adjacent businesses, and now has c 5,000 subscribers, with about a third of these being non-news and magazine clients.

Source: Smiths News, CIL Management Consultants, Edison Investment Research

In the year just reported, Smiths News generated c £2.0m in operating profit from recycling and final mile activities which utilise existing warehouse and transport capacity. We believe that the c 5,000 current subscribers represents market penetration of c 5.5%, based on an estimated number of c 90,000 outlets in the postcodes that they deliver to, from almost a standing start. We believe this impressive performance has been possible because there are a number of clear advantages for the retailer:

- waste can be collected more often than with other contractors,

- reduced disruption,

- cost savings, and

- more freed up space for selling/stock purposes.

The speed at which this market share has been captured suggests to us that the proposition is compelling and is likely to be accepted increasingly by more of Smiths News’ existing customer base, but also by other adjacent non-media outlets, such as betting shops, chemists, bakeries and fast-food outlets.

Furthermore, not only is the market large, it is thought to be growing at 3–5% pa, driven by legislation diverting waste from landfill.

Waste recycling is thought to be less than 18% of the total non-news/magazine ‘early morning’ market, suggesting other low-risk opportunities exist. Smiths has trialled other categories, including the distribution of greetings cards in point-of-sale stands, DVDs and books to major retailers and some supermarkets, where the product is delivered to Smiths in bulk and it breaks the supply down, picks, packs and handles returns, playing to the company’s core strengths. There are potentially other products and/or customers where this kind of service may offer value to clients, and income and a profit contribution to Smiths News.

If we assume that revenue and profit fall in line with the ‘traditional’ rate of 3–5% pa, then Smiths will need to generate net cost savings, and/or new profits streams, of c £1.5m pa. Historically, the company has targeted savings of c £5m pa and over the last four years, operating profits have been broadly flat (see Exhibit 4 below). It seems to us that it is more likely than not that Smiths can at least generate an additional £1.5m pa from these two profit contributors and that the risks to profit growth are now to the upside, rather than the downside, which has been the market fear for so long.

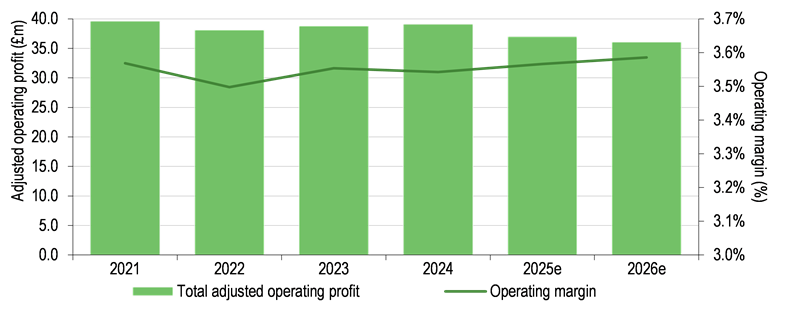

Exhibit 4: Adjusted operating profit and margin

Source: Smiths News and Edison Investment Research

We estimate that in FY25 Smiths News will generate an adjusted operating profit of £37.0m, down from £39.1m in FY24 due to the lack of ‘one-off’ income from sticker collections (FY24: £1.6m), a 53rd trading week in FY24 (FY24: £0.9m) that does not repeat in FY25, and reduced further by c £0.6m for the increase in employers’ National Insurance contributions. Offsetting this, we believe that Smiths will generate an additional £1m from growth activities, netting off to the £37.0m.

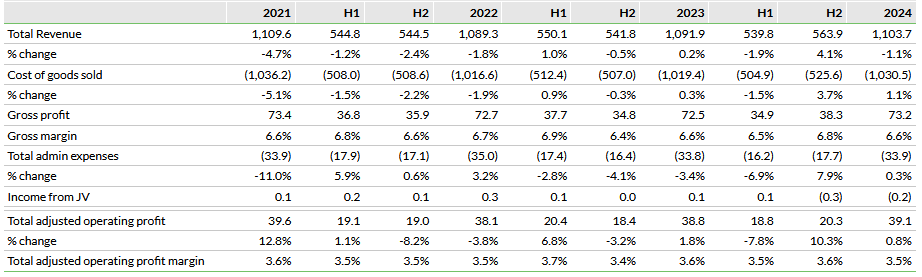

FY24 outperforms market expectations

Smiths News’ FY24 results were ahead of market expectations, with adjusted operating profit coming in at £39.1m, £0.3m ahead of last year and £0.9m ahead of market consensus. Key elements of the better result were the 53rd week of trading, the contribution from sales of the men’s UEFA European Championship sticker collections and a £2.0m (FY23: £0.7m) contribution from organic, low-risk growth initiatives. Cost savings of £5.6m offset inflationary pressures across the business.

Average net debt continued to fall, from £25.0m to £11.7m, and, along with the refinancing completed in May, led to lower interest costs in the year. The refinancing also removed the £10m pa dividend cap, which has allowed Smiths News to implement its recently revised capital allocation policy. To this end, Smiths News has proposed a total ordinary dividend for the year of 5.15p/share (cost £12.8m), plus a 2.0p/share ‘special’ dividend (cost £5.0m), bringing the total dividend payable for the year to 7.15p/share.

Exhibit 5: FY24 results summary (£m)

Source: Smith News, Edison Investment Research

Overall revenue was £1,103.7m, up 1.1% y-o-y, but excluding 1.9% that related to the 53rd week implies a decline of 0.8%, which is below the long-run average decline of 3–5% pa. Excluding the additional week, Newspaper revenue was up 1%, driven by new contracts and cover price rises, offset by volume decline. In magazines, revenue fell 3.2% on a similar basis, again outperforming the 10-year average decline of 6% pa.

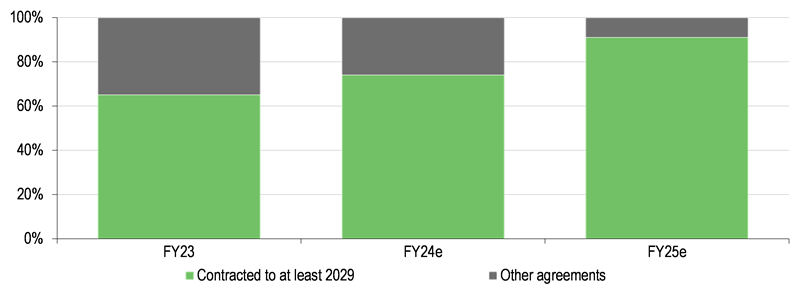

Following the signing of numerous publisher agreements in recent periods, Smiths News now has c 91% of revenues contracted until 2029 and can look forward to relative stability in the core business. This high level of contracted revenue should free up management time to focus on the development of revenue from the nascent growth initiatives.

Exhibit 6: Contracted revenues in FY23, FY24e and FY25e

Source: Smiths News

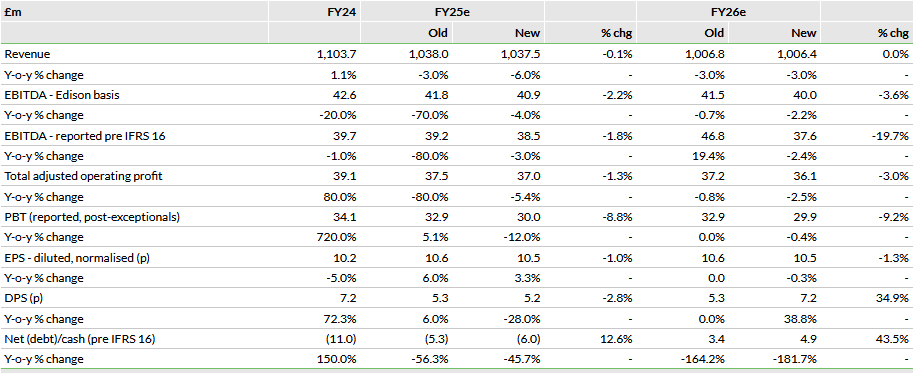

Forecasts reflect higher NI costs and dividends

There are two principal adjustments to our FY25 and FY26 forecasts. Firstly, the increase in employer National Insurance contributions is expected to raise costs and lower adjusted operating profit by c £0.5m and c £1.2m in the two periods. Secondly, net debt is expected to increase, both as a result of the cost increase, and due to the c £5m cost in FY25 of the ‘special’ dividend announced with the FY24 results. This also implies higher interest costs.

That said, we still anticipate that Smiths News will end FY26 with net cash, hence our revised expectation of a second ‘special’ dividend in the absence of investment elsewhere. Finally, we have introduced FY27e estimates for the first time.

Exhibit 7: Forecast revisions

Source: Smiths News data, Edison Investment Research

Valuation edged up to 93p, with upside potential

Our DCF valuation is largely unchanged except for one small detail. Previously, we had assumed that long-term revenue would decline at 5% pa from year four in our model into perpetuity. Given the success of the non-core revenue initiatives so far, we have reduced this to a decline of 4% pa, which has the effect of raising the valuation modestly, from 90p, to 93p, representing c 50% upside. As time goes on and non-core revenue streams become more established, there is upside risk here, and lower declines, or even long-term growth, may be possible, which would have a profound impact on the valuation.

Smiths News trades on a P/E of 5.6x in FY25e, with a yield of 8.4% and the prospect of further special dividends to bolster the yield as debt falls. In our experience, when ‘safe’ dividend yields exceed P/E ratios in absolute terms, it indicates a value opportunity.

Exhibit 8: Financial summary

Source: Smiths News accounts, Edison Investment Research