Against the backdrop of a second Trump mandate in the US, the prospect of more Fed rate cuts, improving prospects in China, and a global economy that refuses to turn lower in spite of all predictions at the start of the year, one thing is certain: Risk-on sentiment has seldom been higher in the stock market.

While that has so far proven highly positive for the bulls, as global markets notched the best week of an already amazing year last week, it also significantly skews the overall risk-reward proposition when holding stocks.

Certainly, that doesn't imply that you should just take your profits and run for the hills - although hoarding some cash might in fact be a good idea at this point (just look at what Buffett has been doing).

However, what it does imply is that having a better understanding of the actual value of the stocks in your portfolio has become more important than ever before.

As savvy investors know, allocating your investments to assets that offer a greater upside and a smaller downside potential will often prove the difference between having a great and an average year when the tides eventually turn.

Moreover, despite the market being at such frothy heights, there are arguably several bargains out there.

But how do you spot these stocks? Well, that’s where InvestingPro’s Fair Value tool will prove a game-changer.

With just one click, you can access over 17 industry-standard metrics for every stock on the market, providing accurate price targets to help guide your next move.

And now, as part of our Black Friday sale, you can tap into this tool at a 55% discount.

But don't just take our word for it - let's have a look at the success stories through real-world examples, which we will discuss in detail below.

1. NatWest Stock: Patience With Fair Value Tool’s Early Buy Signal Pays Off Handsomely

NatWest Group's (LON:NWG) stock took a downturn in early 2023, peaking just below £313 in January before embarking on a steady decline.

Despite this downward trend, an early signal from the fair value tool on March 20, 2023, flagged the stock as potentially undervalued.

Yet, the stock continued to struggle, failing to attract bullish interest until it hit bottom in October 2023 ahead of a strong earnings report on October 27, 2023, when NatWest posted impressive results and a 415.79% jump in the EPS YoY.

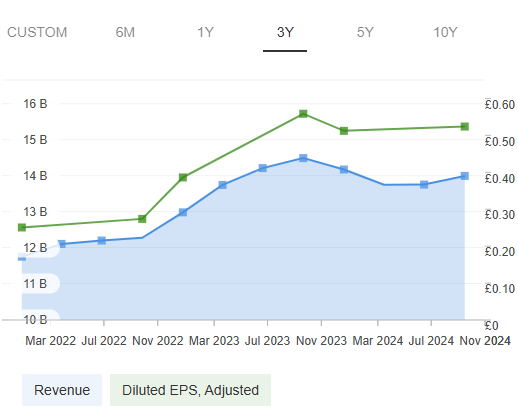

The earnings per share (EPS) surged from £0.29 to £0.56 QoQ, while revenue rose from £13.742 billion to £14.411 billion - the stock began its recovery.

Source: InvestingPro

As bullish interest returned, those who trusted the fair value tool's early signal and held on were rewarded. By November 8, 2024, the stock had delivered a remarkable 47.71% return, just shy of its fair value target by 3.93%.

In the end, patience paid off for those who spotted the signal early, proving the power of tracking financial metrics and staying the course.

2. Ricoh – Fair Value Signals Possible Undervaluation Before Stock’s Parabolic Rise

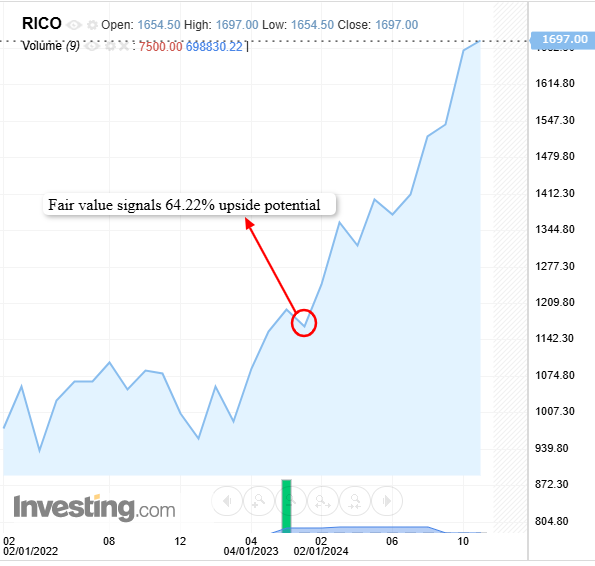

Ricoh's (LON:RICO) stock has soared by 64.28% in just under a year, and its fair value indicator got it right from the start.

Back on December 5, 2023, the tool highlighted Ricoh as a potentially undervalued stock. As if on cue, the company’s stock took off in a parabolic rise, delivering remarkable gains by November 8, 2024.

But what exactly tipped off fair value to this stock’s potential?

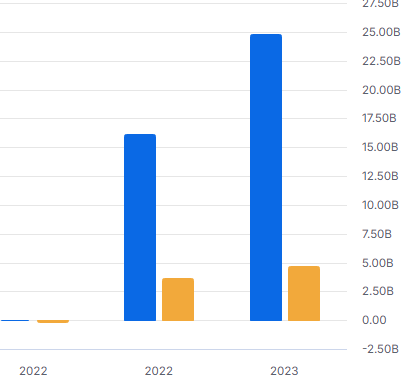

The answer lies in Ricoh’s improved financials. After a tough 2022, marked by sharp declines in both revenue and net income, the company made a remarkable turnaround.

Revenue surged from £16.11 billion in FY 2022 to £24.73 billion in 2023, while net income jumped from £3.59 billion to £4.64 billion during the same period.

This significant rebound made Ricoh’s stock stand out, with fair value signaling a potential mispricing just before the big move.

Bottom Line

In an era where market rallies can make even cautious investors eager to jump in, spotting undervalued gems becomes crucial—and tools like InvestingPro’s Fair Value have proven invaluable.

NatWest and Ricoh stock’s impressive rallies exemplify how smart insights, powered by data, can uncover opportunities that others might miss.

As market optimism grows, now could be the time to add undervalued stocks to your portfolio with confidence.

With InvestingPro’s Fair Value tool, you’ll gain access to deep insights, helping you make informed decisions even when the market seems at its peak.

Don’t miss out on today’s opportunities—equip yourself with InvestingPro and take advantage of our Black Friday offer to stay ahead.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.