This article was written exclusively for Investing.com

- Lumber rises to a new record high

- Copper probes beyond $3 per pound

- Inflationary pressures already brewing in the commodities market

Interest rates worldwide are at the lowest levels in history. Central banks and governments have been stimulating the global economy with unprecedented liquidity and establishing programs to stabilize economic conditions during the worldwide pandemic.

Deficits are rising as borrowing to fund the stimulus hits record levels. The US government borrowed $530 billion from June through September 2008 during the global financial crisis.

In May 2020, the US Treasury borrowed $3 trillion. And more borrowing is on the horizon.

The tidal wave of liquidity pouring into the global financial system comes at a price. It weighs on the value of fiat currencies that derive their worth from the full faith and credit of the governments that issue the legal tender. As the purchasing power of currencies declines, inflationary pressures are beginning to appear. Last week, the Fed Chairman told markets that the central bank is willing to allow inflation to rise above its 2% target rate.

Lumber and copper are two critical industrial commodities, and the price action in wood and the red metal is telling us that inflation may not only be on the horizon, but that it has already arrived.

Since reaching lows in late March and April, lumber and copper futures prices have exploded to the upside. Lumber has traded to a series of all-time peaks in August, and copper probed above the $3 per pound level for the first time since mid-2018.

Lumber rises to a new record high

Lumber futures are not liquid. I have been trading commodities for four decades and have held long and short positions in most commodities futures markets in the UK, Europe, and around the globe. However, I have never ventured into the lumber futures arena because of its lack of volume and open interest.

Illiquid markets can gap to the up- and down-side. They can be roach motels when the price moves against a trader, meaning that one can get into a risk position, but exiting can be another, more painful story.

While I do not trade lumber, I watch the price of the industrial product like a hawk. Lumber prices provide insight into the state of the US and global economies. Lumber is highly sensitive to interest rates. New home building or infrastructure projects increase the demand for wood. Economic contraction or risk-off periods often send the price significantly lower.

After trading to an all-time high of $659 per 1,000 board feet in May 2018, the price of lumber tanked and fell to a low of $251.50 in late March and early April 2020 on the back of risk-off conditions created by the global pandemic.

Source: CQG

The weekly chart, above, shows that the price of random length lumber futures rose to a high of $916.30 per 1,000 board feet last week. Over just five months, the price of the agricultural commodity moved over 3.6 times higher.

Lumber’s ascent comes as the demand for wood rose because of low interest rates that support new homebuilding. Moreover, social distancing guidelines created a surge in home improvement projects requiring lumber.

Simultaneously, the pandemic caused mill closures and a slowdown in production. Rising demand and falling supplies fostered powerful bullish fundamentals for the lumber market. The price jump of $257, taking it above the previous record high, has inflationary ramifications for the economy.

Meanwhile, a falling US dollar and unprecedented levels of stimulus are pushing the prices of other industrial commodities higher. Crude oil has been moving to the upside since reaching a bottom in late April. Copper, the base metal that is a barometer for the global economy and inflationary pressures, reached an over two-year high in August.

Copper probes beyond $3 per pound

Doctor Copper earned its nickname because of its ability to diagnose economic conditions worldwide. China is the world’s leading consumer of the red metal, while Chile is the leading producer. In March, fear and uncertainty over COVID-19 and resultant lockdowns, pushed copper to its lowest price since June 2016 at $2.0595.

The almost four-year low created a bottom in the base metal that is a building block for infrastructure worldwide.

Source: CQG

The weekly chart of COMEX copper futures shows that the price turned higher in March. In August, copper rose above the $3 per pound level for the first time since June 2018.

The four-year low led to a two-year high in the nonferrous metal. Copper moved over 47% higher from the March low to the August peak.

Lower output from Chilean and other mines and increased demand from China pushed the price of copper higher. Falling inventories over the past months have supported the price of copper.

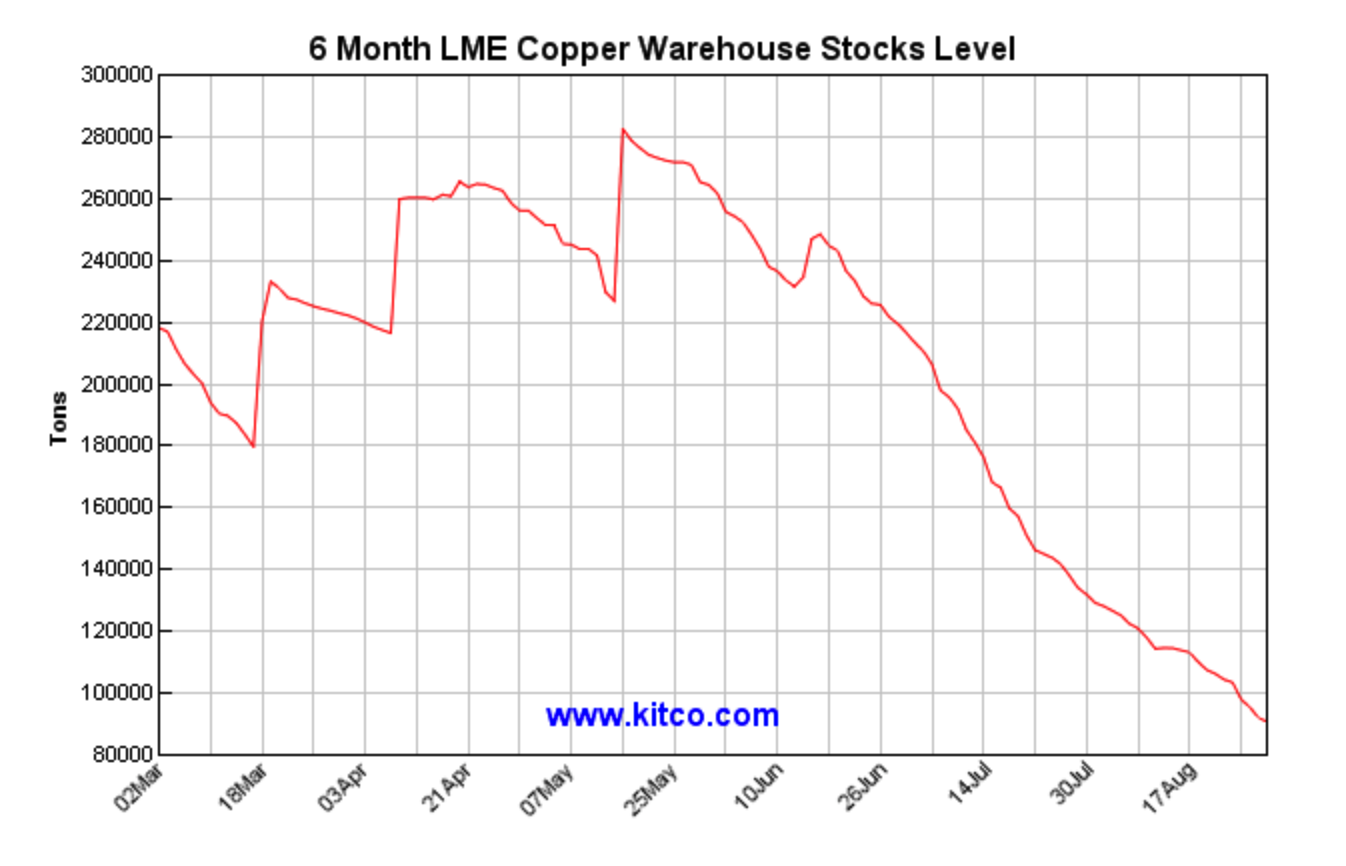

Source: LME/Kitco

As the chart shows, stockpiles of copper in London Metals Exchange warehouses dropped from over 280,000 metric tons in May to below 91,000 tons last week. Declining copper inventories have been supportive of the price as they are a sign that demand is rising while supplies are dwindling. Copper was trading at just above the $3 per pound level on the nearby COMEX futures contract at the end of last week, just below the recent high.

Inflationary pressures already brewing in the commodities market

Copper and lumber are two industrial commodities signaling that inflationary pressures are not just on the horizon, but have already arrived. The price action in gold, crude oil, silver, and many other commodities validates the action in the copper and wood markets.

Gold rose to an all-time peak in August. Since March, the volatile silver market more than doubled in price, and crude oil has done the same since April.

Meanwhile, the stock market experienced a V-shaped recovery that has taken most of the leading indices to record levels. Inflationary pressures on the back of unprecedented stimulus and a falling dollar will significantly impact markets across all asset classes over the coming months and years.

The US Federal Reserve remains committed to an accommodative approach to monetary policy. Low interest rates are fuel for the bull market in raw materials.

Copper and lumber are the barometers already telling us that the purchasing power of currencies is declining—and that, of course is the definition of inflation.