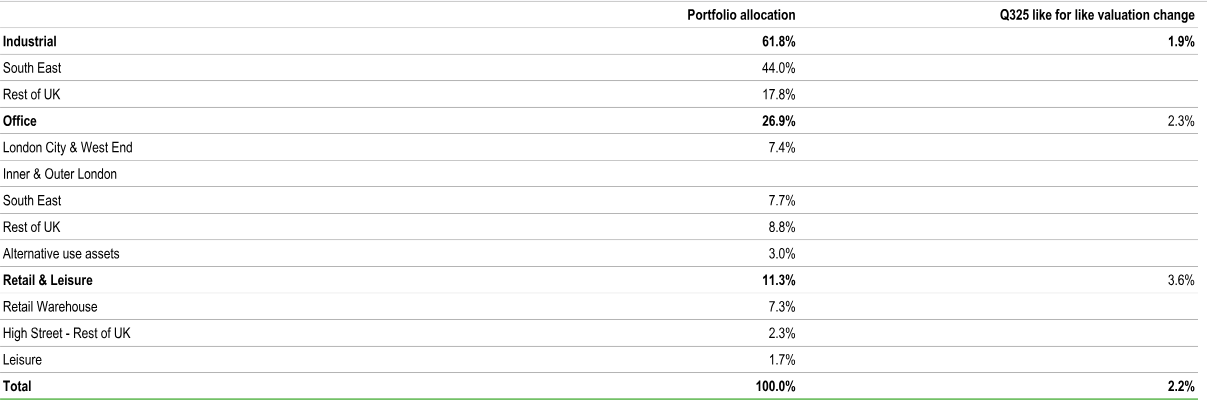

Picton Property Income (LON:PCTN) has completed on the c £13m sale of an office asset designated for alternative use and announced a £10m share buyback programme. The news follows a strong Q325 performance, with asset management initiatives driving income and capital gains, further highlighting the company’s track record of adding value to its portfolio, even in times of market volatility. Q125 NAV per share increased 2.3% to 98.5p, while the accounting total return was 3.2% (and 5.4% for FY25-to-date). DPS was 111% covered. The portfolio offers significant reversionary potential to further drive income and realise value, while gearing is low (LTV of 25%) and all debt long term and fixed rate.

Further accretive capital deployment

The completed sale of Charlotte Terrace in London W14 follows last April’s sale of Angel Gate in Islington for c £30m. A third disposal (Longcross in Cardiff) is expected to complete before the end of FY25, bringing total gross disposal proceeds to c £51m, 5% ahead of the end-FY24 valuation. These sales are part of Picton’s strategy of repositioning selected office assets for alternative use, creating additional value and reducing sector exposure. They significantly enhance earnings and provide opportunities for accretive capital deployment. The measures taken include full repayment of the outstanding floating rate debt, significant investment into the portfolio and now share repurchases. Reflecting the discount to NAV, the board currently views buybacks as the most attractive use of available capital.

Attractive exposure to market recovery potential

In our December update, we explained why we believe that Picton’s strong long-term record of performance and unconstrained, opportunistic and primarily asset-driven approach to portfolio construction make it an attractive way for investors to access a recovery in the commercial property market. The Q325 update, reviewed below, reinforces this view. Picton’s portfolio has a long-term track record of upper-quartile outperformance versus the MSCI UK Quarterly Property Index since its launch in 2005. The 10-year NAV total return is 9.2% pa. Picton’s portfolio is strongly weighted to the industrial and retail warehouse sectors, both supported by strong fundamentals, yet remains well-positioned to adapt to evolving market conditions.

Valuation: Property outperformance at a discount

FY25e DPS of 3.7p represents an attractive yield of c 6%, with a good level of cover and earnings retention available for reinvestment into the portfolio. This enhances its quality and supports rental growth, capital values and total return.

Additional details on recent company updates

Picton’s Q3 net tangible assets (NTA) growth reflected like-for-like portfolio growth of 2.2% (1.6% excluding capex) across all sectors but especially retail warehouses. This was driven by asset management activity, the ability to capture rental growth and a 0.1% tightening in the equivalent yield. Occupancy was unchanged at 92% but will increase to 95% on a pro forma basis with the disposals of Charlotte Terrace and Longcross.

New lettings added £1.3m to annual passing rent, averaging 6% above the H125 estimated rental value (ERV). Lease renewals were at an average of 44% ahead of previous passing rent and 7% ahead of the H1 ERV. Demonstrating Picton’s active, occupier-focused approach, three active management transactions were completed, upsizing existing occupiers, removing break clauses and restructuring leases to secure £1.5m of income (15% ahead of September 2024 ERV).

The 1.6% like-for-like portfolio value uplift (adjusted for capex) compares favourably with the 1.2% capital return indicated by MSCI monthly data, and points to a continuation of Picton’s strong long-term track record of property outperformance. Capex of £4.3m mainly related to upgrading several office assets that remain core to the portfolio.

The Q325 NAV is above our FY25 forecast, indicating upside potential. We will nonetheless wait to see the full-year results (due in May) and whether the more recent debt market volatility has dented the increasing confidence that has been evident in the commercial property market in recent months.

The company also has announced that Francis Salway will become chair of the board and chair of the nominations committee, succeeding Lena Wilson, whose decision to step down from the board at the end of January 2025 had been previously announced. He has extensive experience in the property sector, including as chief executive of Land Securities (LON:LAND) between 2004 and 2012. He is currently a non-executive director of Watkin Jones, the UK’s leading residential-for-rent developer, and a non-executive director of Cadogan Group, which owns and manages the Cadogan Estate in Chelsea.

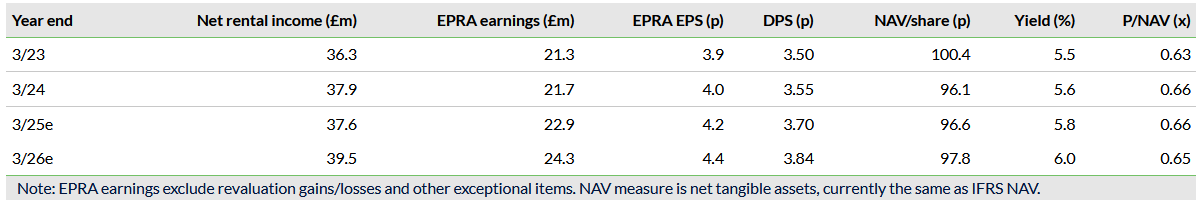

Exhibit 1: NAV Total Return

Source: Picton Property Income data, Edison Investment Research

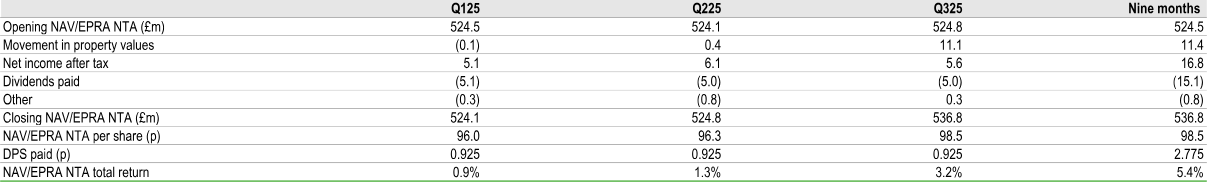

Exhibit 2: Q325 Portfolio Summary

Source: Picton Property Income

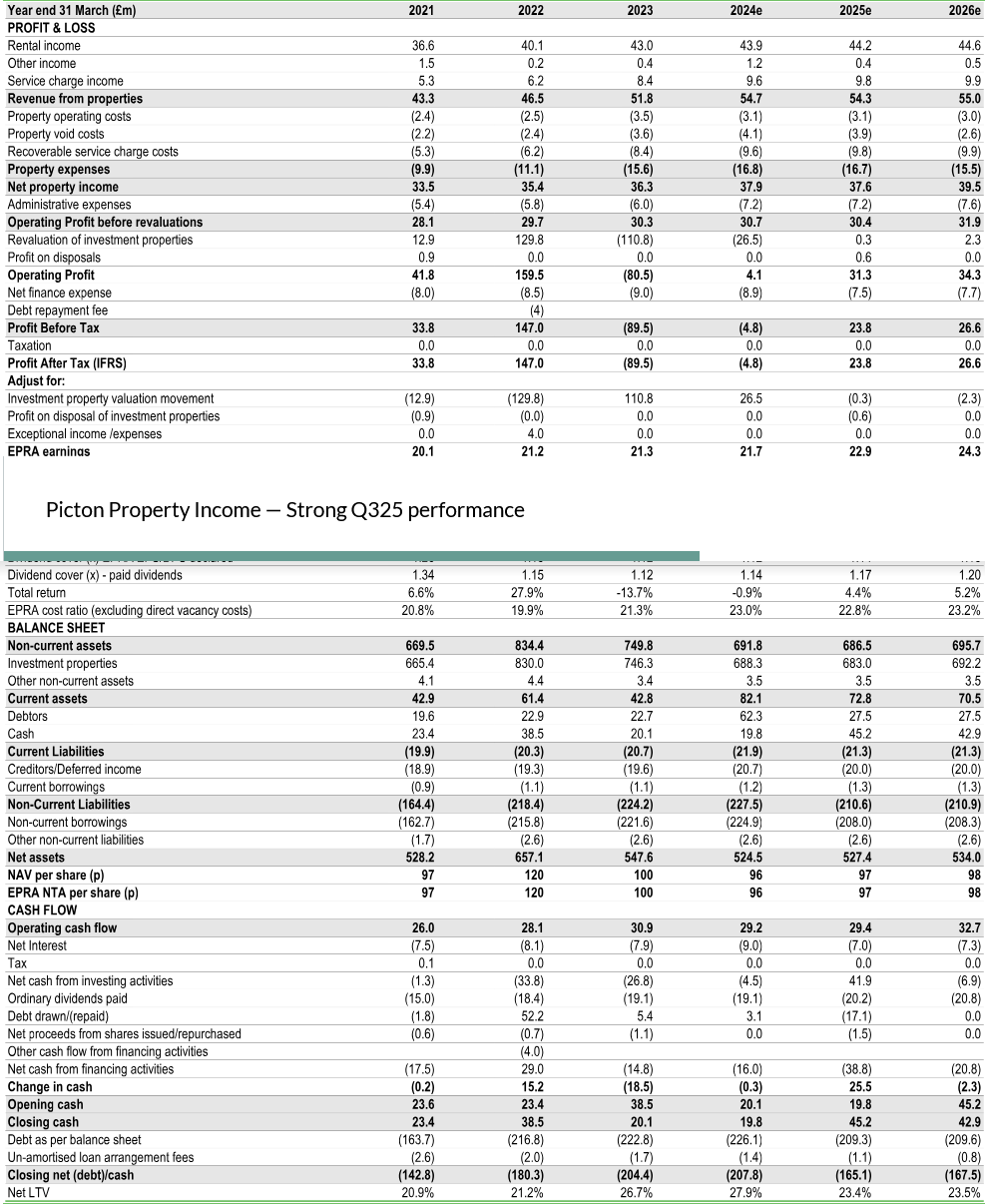

Exhibit 3: Financial Summary

Source: Picton Property Income historical data, Edison Investment Research forecasts

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.