Gold is not a risk asset, it is an insurance policy, and the gold mining industry will one day leverage that characteristic

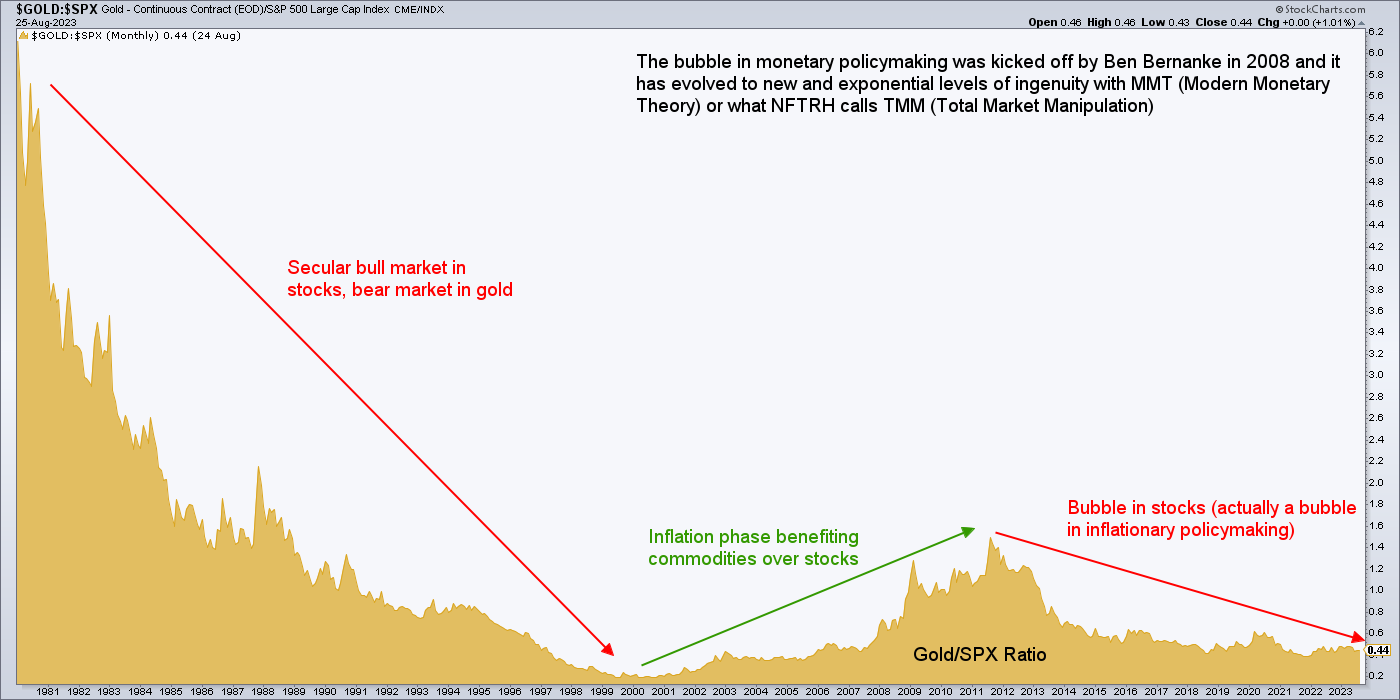

Just as a standard financial insurance policy is meant to only pay out when bad things happen, gold will only pay out when bad financial things happen. Sure, its assigned price can rise with other asset markets, but its price related to risk assets will underperform when said risk assets are in a bull phase or an unbroken bubble.

As you can see, the bubble in policy-making, and thus, risk assets, is unbroken. Insurance has not been needed, yet. Why would anyone want to speculate on gold when its relative performance is so poor?

The answer is, they wouldn’t. Or more accurately, shouldn’t. Unfortunately, many people view gold as a play in the same casino that houses stock speculation. That is where so much frustration about perpetually under-performing gold stocks comes in. Well, their fate is tethered to an insurance asset or, by definition in an asset bubble, an under-performing asset.

Worse still, gold miners (HUI Gold Bugs Index) have under-performed their own underperforming product. That is because gold stocks leverage their product’s standing within the macro. That standing has been in Palookaville more often than not since the 1970s. Leverage does work both ways, however, and when the bubbles currently trouncing gold today burst, well, let’s just say we will behold that leverage working in reverse, to the upside. But it’s a long process, undoing bubbles and changing the macro.

There has been one righteously bullish period for gold stocks over the last many decades dating back to the 1970s. That period was a brief time during and just after the deflation scare that began in 2000. Thereafter, beginning in 2003 the declining HUI/Gold ratio indicated gold stocks were in a bubble, which dragged on until the crash of 2008 and secondarily, the top in the precious metals complex in 2011.

Today there is certainly no bubble in gold stocks. However, analysts using the HUI/Gold ratio to claim that gold stocks are undervalued are only viewing one piece of the picture. Gold stocks are actually valued where they should be valued in a bubble environment. When the bubble bursts for real (as opposed to the temporary situations in 2000, 2008, and 2020, to which policymakers rode to the rescue) the gold stock sector will rise from what will actually be indicated to be depressed valuations as gold out-performs stocks and commodities.

One indication that the age of bubble-making (including the years 2000, 2008 & 2020 noted above) may be ending is the 30-year Treasury yield Continuum that I relentlessly club people over the head with. If nothing else it is symbolic of policymakers’ previous license to inflate the system at every crisis point. This license was granted by the decades-long downtrend in long-term Treasury yields, which was disinflationary market signaling.

Today the yield could be rising for reasons spanning from bond selling by sovereign nations to a “bond vigilante” style reaction against US deficit spending, also known as fiscal, as opposed to the Fed’s monetary inflation. My email pal and former associate Mike Churchill actually illustrated this dynamic well in his recent note to clients:

The bottom line is that the Continuum indicates that something changed. The odds are that what has changed is a deep impairment of the age of inflationary bubble-making on demand by monetary policymakers. As for the government’s absurd deficit spending, I suppose it will end when its futility (increasing trillions in debt leverage) can no longer be hidden. Make no mistake, the inflation, such as it is infecting the economy, is now coming from the government, not the Fed. I do not believe the government’s fiscal efforts can effectively go it alone, with the Fed working monetary policy in the other, disinflationary direction. But in our financial Wonderland, who’s to say what reality will actually play out, and when?

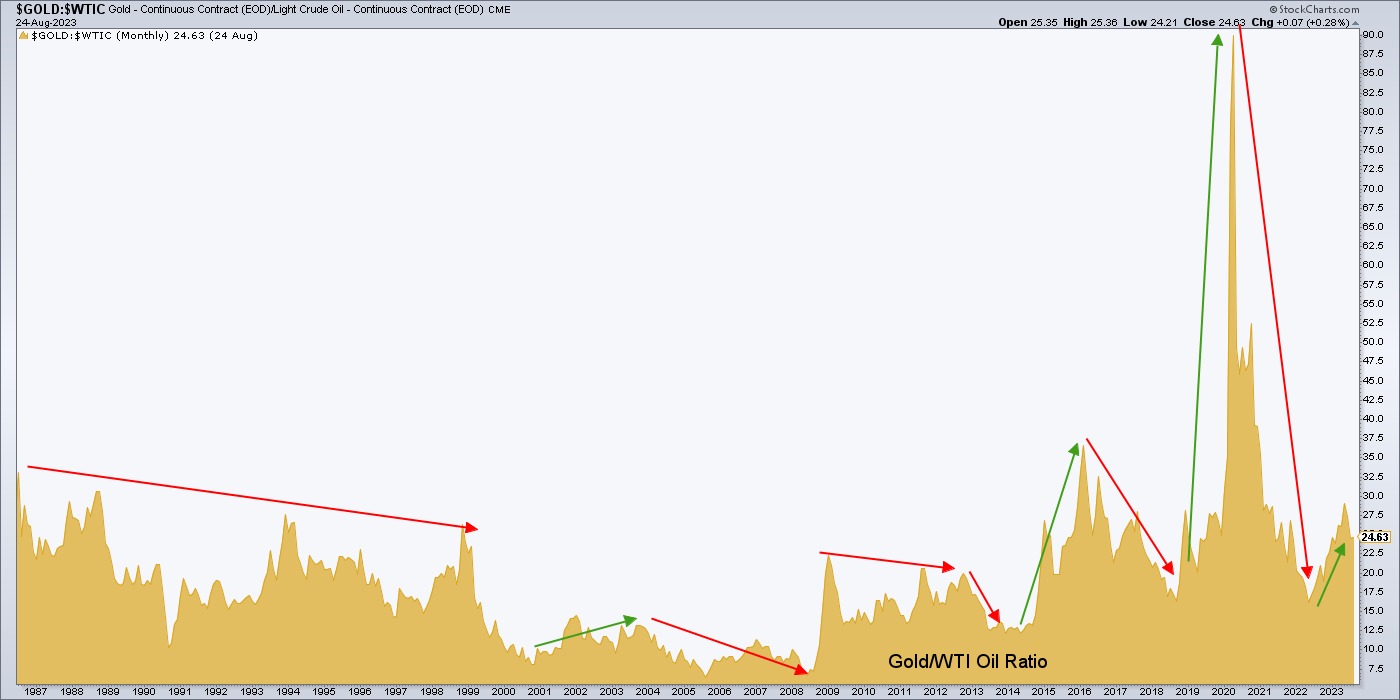

Eventually, gold’s future post-bubble-out performance to the stock market will act as a psychological, or what I call a macro fundamental for gold mining, as investors flee the bubble in search of gold’s stability on a relative basis. When gold outperforms commodities, especially mining materials and energy commodities, that will act as what I call a sector fundamental, directly benefiting the bottom line performance of the gold mining industry as a whole.

Here is the long and jagged history of gold vs. primary mining cost input, crude oil. The red arrows have been times of fundamental stress for gold mining. For example, the red arrow that extended from 2004 to 2008 is a perfect companion to the view of that same bubble phase in gold stocks as noted in the second chart above. HUI merrily rose into 2008 despite terrible sector fundamentals.

All in all, there have been times of benefit in Gold/Oil and times of impairment. Essentially a sideways picture with massive volatility. But when commodities like oil and major stock markets start to under-perform the monetary insurance known as gold, we may finally have a secular bull market in gold stocks. Sure, that is crazy talk today because it is being uttered within the confines of a bubble in risk assets. But one day…

Most profound, in my opinion, is that the very thing that most people claim to be the ally of gold mining, inflation, is the very thing that has kept the sector’s fundamentals under wraps since 2003. When this is finally proven true to the herds, gold stocks may long since be out of the barn (bubble) and into a new era of beneficial fundamentals.

The macro moves slowly, and I’d like to be around when it finally proves a major change is at hand. Due to the changes visually expressed by indicators like the Continuum, I think I may actually be around to benefit from something that has not occurred in decades. Meanwhile, patience and ongoing perspective are things. They should be valued much like gold itself will one day be valued.