- GBP/USD is approaching a key support level ahead of the Fed and BoE meetings.

- The BoE is very unlikely to consider rate cuts before the Fed and the ECB.

- Meanwhile, Fed's hawkish stance could keep the downtrend intact for the pound sterling.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Starting in June, new banknotes featuring the new Monarch Charles III will be introduced in the UK alongside the existing ones.

This change might be important for everyday English people who use pounds on a daily basis, but the Bank of England and the Fed's upcoming decisions would be crucial for the country as a whole.

The UK banking authorities might choose to continue with a hawkish monetary policy, sending the pound sterling higher.

Therefore, the Bank of England and Federal Reserve's respective meetings this week could heavily influence the GBP/USD trend for the year ahead.

BoE Governor Hints at Higher for Longer Interest Rates

In his February speech, Bank of England Governor Andrew Bailey suggested the likelihood of keeping interest rates high for a longer duration.

This indicates that the European Central Bank and the Federal Reserve might do so first, prompting the Bank of England to follow suit.

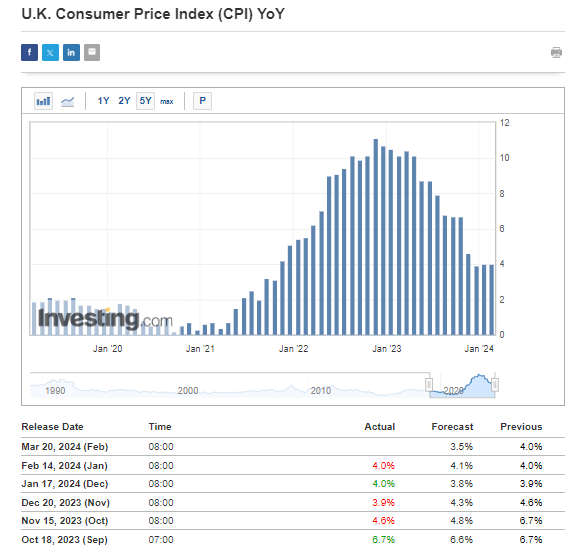

On the macroeconomic front, inflation has noticeably decreased in recent months but still hovers above the 4% threshold.

On Wednesday, we expect new data to come out before the Bank of England's meeting on Thursday.

If the data shows inflation higher than expected, it could lead to a more aggressive approach from the Bank of England. Any decision to change interest rates would be a surprise.

What will be interesting to see is how each member of the board votes.

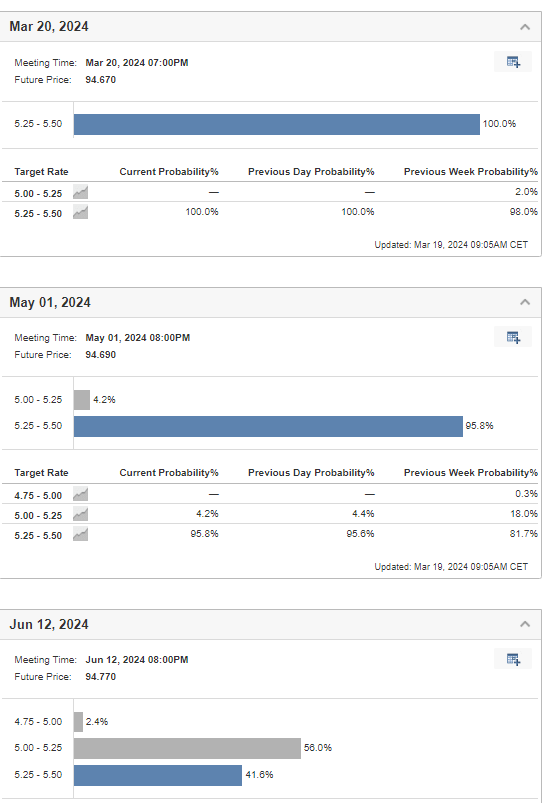

Similarly, the Federal Reserve is also unlikely to make any changes at its upcoming meeting on Wednesday. Recent data hasn't provided enough clarity for the Fed to decide on future actions.

The announcement will likely be neutral, emphasizing the need to monitor further data from the US economy.

Given the lesser chances of recession, the Federal Reserve isn't under pressure to make any sudden moves.

Currently, the market predicts the first rate cut will take place in June, with a probability slightly above 50%.

GBP/USD Technical View: Stronger US Dollar Sparks Correction

In recent days, we've seen the US dollar getting stronger, and this is affecting the GBP/USD currency pair.

As a result, we're witnessing a significant correction, with the pair breaking through its initial target level of $1.27 per pound. This paves the way for further declines.

If the Fed adopts a more hawkish stance at Wednesday's meeting, sellers could push the price down towards the support level of around 1.25.

The following day, we'll get the Bank of England's decision and its statement, which will likely dictate the direction of prices in the coming weeks, depending on what's communicated.

In the medium and long term, if the UK maintains higher interest rates than the US, it should increase demand for GBP/USD.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year Invest ingPro subscriptions.

Do you only use the Investing app? This offer is also for you! InvestingPro for the app now also 10% off with INWESTUJPRO1. Enter discount code TU.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.