By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It was another wild and crazy day in the financial markets as the 1,100-point swing in the Dow caused widespread volatility in currencies. The early NY trading session started with a rapid rise in the U.S. dollar but by the day’s end it gave up all of those gains. This U-turn in the dollar mirrored the reversal in the Dow tick by tick, which ended the day up more than 540 points in positive territory after falling more than 500 points at the open. Investors are now wondering if the “healthy correction” is complete, paving the way for a recovery in currencies and equities.

Before addressing this question, it is important to understand that volatility affects currencies in a number of ways – first and foremost, it creates risk aversion, which leads to liquidation. This directly impacts the currencies of exporters hurt the hardest by slower U.S. or global growth. Second, it encourages profit taking, particularly after the strong moves in January. The process of unwinding these trades results in a need to buy back funding currencies like the U.S. dollar and Japanese yen. These moves can also trigger stops that accelerate the declines. So in the past few days, we’ve seen heightened anxiety, profit taking, liquidation and a general reduction in risk. Even if the correction is over, anyone who may have become complacent during the slow and steady rise in stocks got a brutal wake-up call this week that will make them reluctant to return to the market with the same enthusiasm.

Concern about the negative impact of rising yields is the primary reason why stocks crashed and despite the recovery in equities, 10-year yields rose 9.4bp to 2.8%. So the danger that the U.S. economy faces is still very real as higher rates increase borrowing costs for homeowners, consumers and businesses. Rising yields also make fixed-income investments more attractive and a rotation from stocks to bonds could keep equities under pressure. This means that while the bulls managed to wrest control from the bears on Tuesday, the war has not been won. The dollar still stands to rise further against European and commodity currencies and will remain under pressure versus the Japanese yen. As we said in Monday’s note, USD/JPY needs to close above 110.50 to usher in a new uptrend – otherwise the downtrend remains intact.

The euro may not be the day’s best-performing currency but it is still one of the most resilient. After dropping within 15 pips of 1.23, it gravitated back toward 1.24. The latest economic reports highlight the underlying strength of Germany’s economy – factory orders rose 3.8% against a forecast of 0.7%. EUR/USD’s turnaround was particularly impressive given the yield spread, which moved in the opposite direction, signaling a decline in the currency. Of course, there’s been a material divergence between EUR/USD and the 10-year German Bund – U.S. Treasury yield spread, which can be explained by the selling of U.S. bonds, which may not be expected to change. While the latest recovery in EUR/USD could take it above 1.2450, the rally should fizzle near 1.2550 as we are looking for another wave of selling in equities.

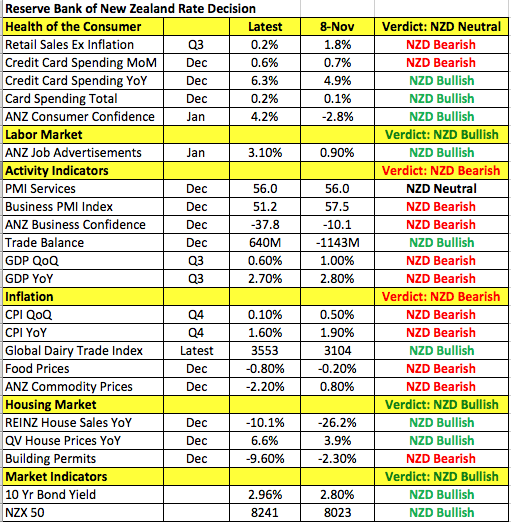

The title of best-performing currency goes to the New Zealand dollar, which refused to fall alongside its peers. Although it would be easy to attribute its strength to the third straight gain in dairy prices, the currency started moving higher in Asia and never saw the same degree of selling as other major currencies. This strength reflects the market’s belief that Grant Spencer, the acting governor won’t say anything market moving before Adrian Orr, the new governor takes over next month. Still, it has been nearly 3 months since the last rate decision and the economy has taken a turn for the worse. Not only is the New Zealand dollar up 5% against the greenback and 2% versus the Australian dollar, data has been softer with retail sales growth slowing materially, manufacturing activity easing, business confidence falling and inflation slowing. There are some bright spots in housing and trade with the trade balance unexpectedly turning to surplus in December on the back of strong exports but that may not be enough to offset the deterioration. Fourth-quarter labor market numbers were due for release Tuesday evening and while all signs point to weaker job growth, the forecasts were low. If the tone of the RBNZ statement remains unchanged and Spencer says nothing new, NZD/USD could extend its gains up to 0.7350. However if he expresses explicit concerns about NZD strength and emphasizes the risks that it poses to the economy, it could be what finally does NZD/USD in and drives the pair below .7250.

The Australian and Canadian dollars ended the day higher against the greenback after recovering earlier losses. The Reserve Bank of Australia met last night and FX traders responded negatively to the rate decision and earlier data. The RBA left interest rates unchanged and emphasized an “unchanged policy.” They see inflation remaining low for some time and rising only gradually due to the strength of A$. Although non-mining investments improved, they felt that household consumption remained a key source of uncertainty. These worries were reinforced by the larger-than-expected decline in retail sales in December and the unexpected trade deficit at the end of last year. Looking ahead, we could see near-term underperformance in the currency, particularly against the Canadian dollar, Japanese yen and Swiss franc. The rally in USD/CAD stalled right underneath the 50-day SMA despite weaker trade and manufacturing data. The IVEY PMI index dropped to 55.2 from 60.4 while the trade deficit widened unexpectedly.

Last but certainly not least, sterling, which had been hit the hardest by the market’s volatility, ended the NY session unchanged against the U.S. dollar and euro. No U.K. economic reports were released but the next 48 hours will be critical for the pound. Prime Minister May’s Brexit “war cabinet” meets Wednesday and Thursday to discuss post Brexit trade. Traders will be on the lookout for any market-moving headlines, particularly over the customs union. With data turning sour, we see more downside risk in GBP/USD ahead of the rate decision with sellers likely to come in between 1.4050 and 1.41.