The FTSE 100 led the gains in early trading in Europe as results from BP (LON:BP) lifted the heavyweight by 1.6%, while heavier weight Shell (LON:RDSa) followed suit. Profits at BP rose to $12.8bn, the highest in eight years on higher oil prices and cost cutting efforts. It marks a sharp turnaround from the loss reported in 2020 due to oil demand destruction due to coronavirus restrictions. Fourth quarter earnings were above forecast. It comes as the Treasury has reportedly pushed for six new North Sea oil & gas fields to get the go-ahead...the energy price crunch has persuaded at least some of those in power that pursuing net zero at all costs is a burden on ordinary people that wasn’t thought through. After initial gains, shares in BP pared gains as investors digested the results and comments from CEO Looney more fully, pulling the FTSE back from its high. On a related note, SSE (LON:SSE) rose over 1% as rising power prices encouraged it to lift its outlook.

Ocado (LON:OCDO) dragged on the index though as shares plunged eight percent on lowered guidance and a 12% drop in core earnings. EBITDA declined from £73m to £61m last year. The blame lies on continued investment in its platforms but investors who’ve been in for the long haul are clearly losing patience. Overall, Ocado delivered a loss before tax of almost £177m... when do the profits come? And if not now, will they ever?

Nevertheless, the FTSE 100 has emerged from the recent turbulence in global stock markets to hit its highest since the pandemic. The lack of exposure to speculative tech names like Ocado has been a positive for the UK market as the great unwind from this bloated corner of the market takes place in the US. The FTSE 100 has outperformed in 2022, rising over 3% whilst the DAX (–3.5%), Dow Jones (-3.5%) and S&P 500 (–6%) have all fallen. The Nasdaq Composite is down over 10% still. We’d talked up the FTSE being the place to be for the rotation from growth to value – question is whether we see a double top around this 7,600 area or if there are legs to drive on to 7,700 to fully recover the pandemic losses.

Across the Stoxx 600, chemicals, basic resources, autos, utilities and food & beverage all rose about 1% in early trade. Broad-brush gains, risk reasonably well bid although we are seeing the dollar come back…chiefly it seems on EUR bears gripping hold of the EURUSD cross. The US 10-year yield is nudging closer to 2%. Lagarde spoke yesterday, less hawkish. Also worth pointing out that Knott – among the most hawkish – only called for one hike by the end of the year…market pricing in more. Germany’s 10yr bund yield jumped top its highest since January 2019 at 0.252% this morning before sliding sharply back to where it started. Bund-BTPs spreads continue to widen.

SoftBank’s sale of chip business Arm to Nvidia has collapsed. Regulators everywhere expressed concern...now do we see a bumper London listing for the UK company? Eyes down for any reaction in chipmakers today in the US.

Just Eat Takeaway (LON:JETJ) shares are lower to the tune of 2% as it announces plans to delist from the Nasdaq. Another that will eventually ditch Amsterdam for a single London listing? It wasn’t that long ago that it was ejected from the FTSE for being too Dutch.

Stocks fell on Wall Street on Monday. Meta (FB) declined another 5% as its post-earnings slump continued to do damage. Peloton (NASDAQ:PTON) surged 21% on rumours that Amazon (NASDAQ:AMZN) and Nike (NYSE:NKE) could be lining up to buy the company. The Nasdaq finished down 0.58%, the S&P 500 down 0.37%. Choppy session, the Dow finished flat and Asian shares were mixed.

Cathie Wood is launching a new ETF made up of private companies and illiquid stocks...perfect. Make mark to market great again. Pesky things like public markets and liquidity be damned! ARK filed for a new fund that will focus on “illiquid securities and securities in which no secondary market is readily available, including those of private companies.”

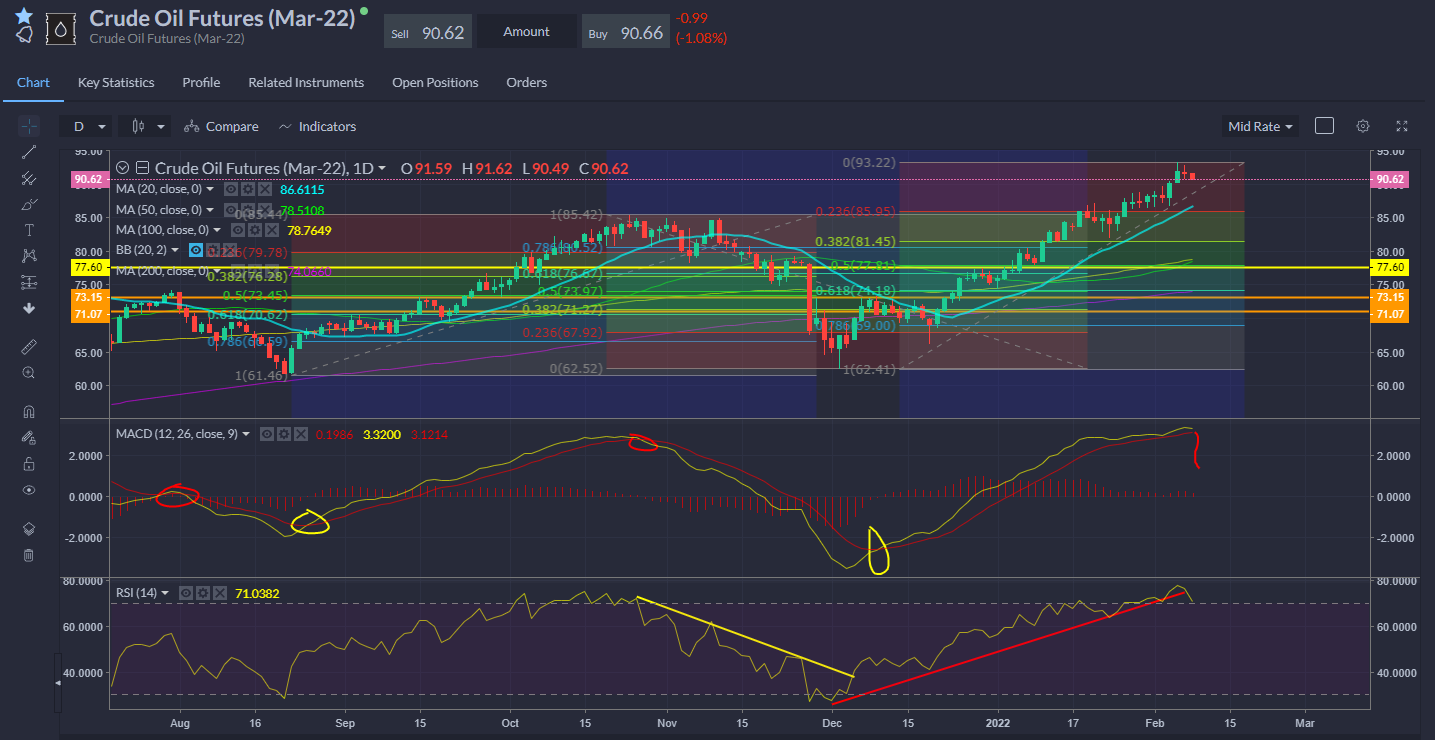

Oil prices showing signs of fatigue but we still need a clear signal this is a near-term top. France says Russia is moving to de-escalate the crisis brewing on its Ukraine border. Break on the RSI trend line is one, but we are looking to the MACD to cross.