- The BoE seems more reticent than other central banks to endorse rate cuts

- Expect the Bank to drop its tightening bias

- Markets seem more sensitive to dovish nuances of late

- Policy needs to stay “sufficiently restrictive for sufficiently long.”

- It’s likely to stay restrictive for “an extended period of time.”

- “Further tightening” is required if evidence of “more persistent inflationary pressures.”

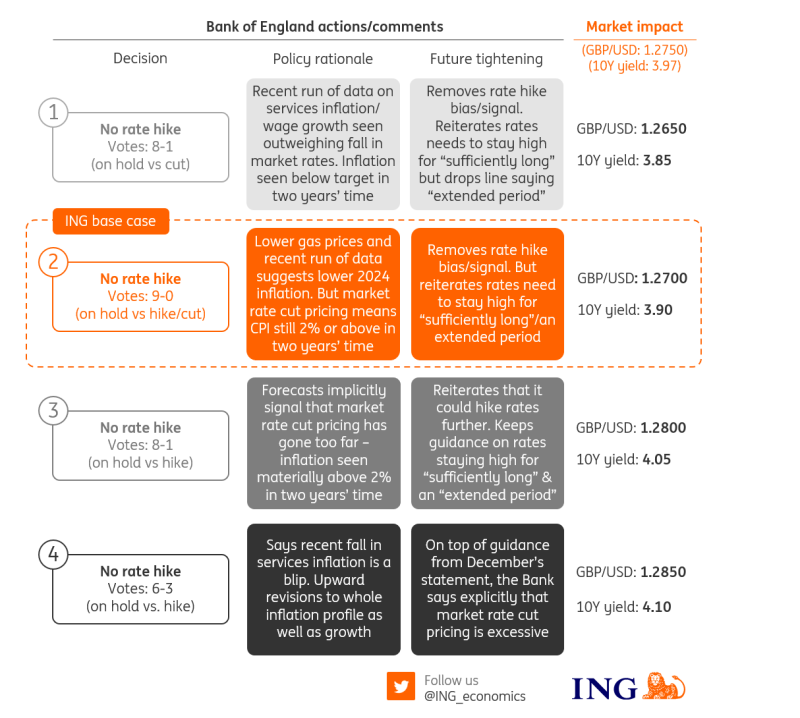

Four scenarios for the Bank of England meeting

The BoE seems more reticent than other central banks to endorse rate cuts

Both the Federal Reserve and European Central Bank have hinted, with varying degrees of caveats, that rate cuts are on the cards this year. So far, the Bank of England hasn’t followed suit. It was careful not to say anything at the December meeting that could be misconstrued as an endorsement of market pricing on cuts. And there has essentially been radio silence from committee members since then.

We suspect the Bank will still want to tread carefully as it gears up for the first meeting of 2024. But the reality is that defending a “higher for longer” stance on interest rates is getting harder as the inflation backdrop shows signs of improving. Remember that the BoE has pinned the chances of rate cuts on three variables. One is the strength of the jobs market, but data here is suffering from well-known reliability problems. So, in practice, it comes down to services inflation and private-sector wage growth. Both are tracking well below the November BoE projections.

Services CPI is currently 6.4%, and despite that coming as an upside surprise to consensus when it was released, it’s still half a percentage point below the BoE’s projection. Private wage growth is 6.5%, but remember this is a three-month average and the latest two ‘single month’ readings are around 6%. When we get the data in a couple of weeks, this variable is likely to have ended the year a full percentage point below the BoE’s most recent forecast (7.2%).

Add in the fact that natural gas prices are noticeably lower across the futures curve, and we should see sizeable downward revisions to the Bank’s inflation forecasts for this year. But what happens to the forecasts beyond 2024 is less clear-cut.

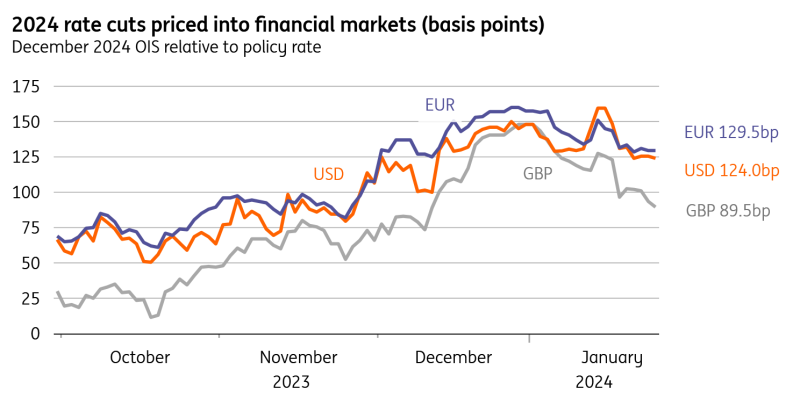

Financial markets expect roughly four UK rate cuts this year

Expect the Bank to drop its tightening bias

Financial markets expect the Bank Rate to be one percentage point lower in two or three years' time than was the case in November. That will have important ramifications for the Bank’s two-year inflation forecast, which is seen as a barometer of whether markets have got it right on the level of rate cuts priced. Previously, the Bank’s model-based estimate put headline inflation at 1.9% in two years’ time, or 2.2%, once an ‘upside skew’ is applied. We wouldn’t be surprised if this ‘mean’ forecast (incorporating an upside skew) is still a little above 2% in the new set of forecasts. And if that’s the case, it can be read as the BoE subtly pushing back against the quantity of rate cuts markets are pricing in.

If that happens, we suspect markets will largely shrug it off. The bigger question is whether the Bank makes any changes to its statement – and its forward guidance currently reads like this:

We think the baseline assumption going into this meeting is that the last of those sentences gets dropped and that the three hawks who'd been voting for a rate hike in December finally throw in the towel, given the recent run of inflation data.

A hawkish surprise is, therefore, a statement that looks much the same as December’s, with at least one or two committee members voting for a further rate hike. A dovish surprise would see the Bank remove or water down the sentence on how long policy needs to stay restrictive. There’s also a tail-risk that Swati Dhingra, known to be the most dovish committee member, votes for a rate cut, though our base case is a unanimous decision to keep rates unchanged (6-3 previously).

Markets seem more sensitive to dovish nuances of late

The market discount for BoE rate cuts has moderated. At the end of last year, a first cut by May was still fully discounted, and overall more than six cuts were fully priced in for 2024. This has come back towards slightly more than 50% implied probability of a May cut and four cuts overall being priced in. These are not unplausible scenarios but are obviously dependent on data and, for instance, the government's tax plans.

But looking at markets more globally, they appear more sensitive to softer data and any dovish nuances provided in communications. As such, we do see a possibility for front-end rates to tick slightly lower if the MPC, for instance, removes its hike bias - in its commentary as well as the voting split.

Further out the curve 10Y gilt yields have risen back towards 4% from around 3.5% at year-end. But yields appear capped at 4%, facing resistance to move higher. If we take a simple modelling approach, augmenting a short-term money-market-based estimate of the 10Y gilt with yields of its US and German bond peers, we conclude that gilts see slightly too high yields already. Keep in mind that the BoE meeting is flanked by the Fed meeting, jobs data in the US, and the CPI release in the eurozone, which should be crucial in driving wider sentiment.

When it comes to FX markets, sterling has been the best-performing G10 currency against the dollar this year. Its implied yield of 5.2% means that it is the only G10 currency up against the dollar on a total return basis this year. As above and given that the market is minded to look for the more dovish interpretation of central bank communication in what should be a year of disinflation, the idea of the BoE playing dovish catch-up with the Fed and the ECB could be a mild sterling negative.

That probably means that EUR/GBP will struggle to maintain any break below strong support at 0.8500 in the near term, and the BoE event risk means EUR/GBP could start to trade back over 0.8600. However, our end-quarter target of 0.8800 looks too aggressive now. Scope for tax cuts in early March, sticky services inflation and composite PMI readings comfortably above 50 in the UK could well mean that EUR/GBP traces out a 0.85-0.87 range through the first half of this year. For GBP/USD, the FX options market currently prices a very modest 42 USD pips of day event risk around the Wednesday FOMC/Thursday BoE meeting. Our baseline scenario assumes GBP/USD could trade back down to/under 1.2700 on Thursday, especially should the FOMC meeting have disappointed those looking for a March rate cut from the Fed.