The decision, the rate cut and the forward guidance

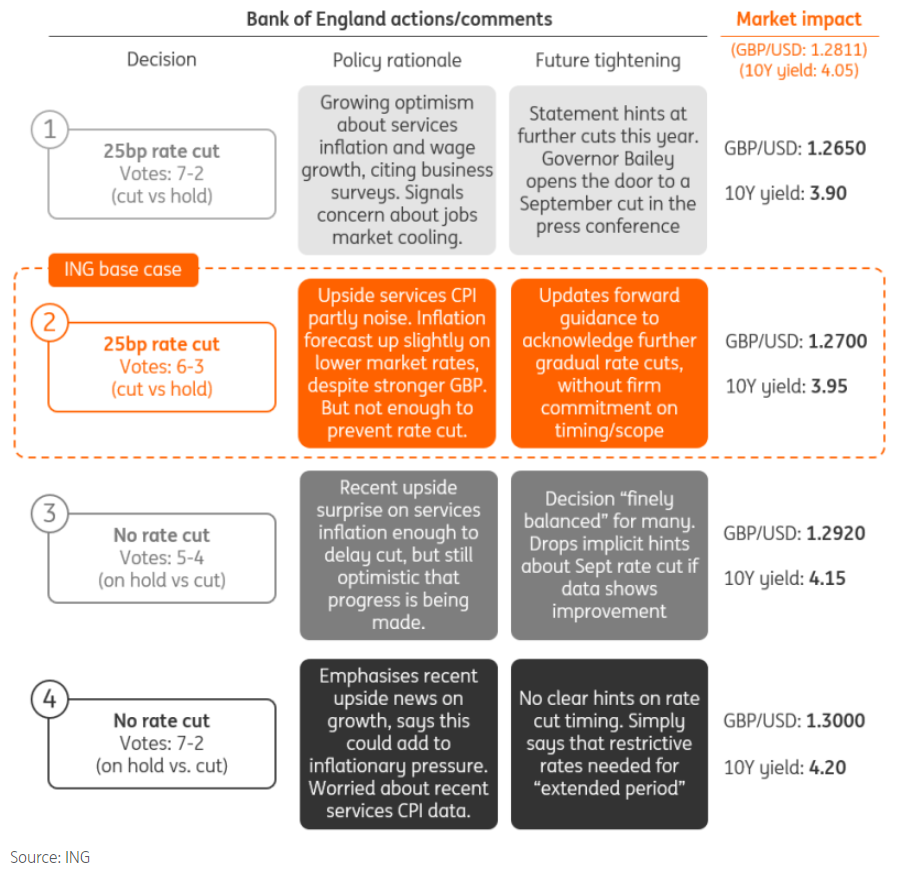

Financial markets reckon Thursday’s Bank of England meeting is a 50:50 call between the first 25bp rate cut and another ‘on hold’ decision. We’re leaning towards a cut, though we agree nothing is for certain.

We know that this week’s decision will hinge on a handful of committee members who felt the June decision was “finely balanced”. We’ve heard very little from officials since the general election was called in June, and that means it’s tricky to gauge how they are interpreting the recent upside news on services inflation. This metric has come in well above the BoE’s most recent forecasts, but a lot of this looks like noise.

We explained in our separate Bank of England preview why we think policymakers will choose to look through these recent surprises. And don’t forget that at his last press conference back in May, Governor Andrew Bailey raised the possibility of cutting rates faster than markets expected back then. That was a rare statement of intent from the governor and suggests he is keen to get on with the job of cutting rates.

Aside from the rate cut itself, there are two key questions for markets: what’s the vote split, and what signal does the Bank choose to send about the future?

On the former, we expect a 6-3 vote in favour of a rate cut this Thursday. Two members voted for a cut in June, and it looks like at least two, perhaps three of the external members are highly reluctant to cut just yet. That leaves four or five in the middle, and history suggests they tend to move as a group. In other words, don’t look at June’s 7-2 decision to keep rates on hold and think that means we couldn’t get a majority in favour of a cut this week. And if we don’t get that cut, the same argument can be applied to September’s meeting.

On forward guidance, remember that the Bank of England is typically much more reluctant to comment on future policy than the likes of the European Central Bank or Federal Reserve. Even if it does cut rates as we expect this week, expect a fairly vague statement about future rate cuts without any commitment to timing or scope. The dovish risk scenario here is that Governor Bailey makes similar comments in his press conference to the ones he made in May, which might hint more directly at what comes next.

The impact on market rates

Sterling markets seem relatively unsure about the BoE path forward compared to market pricing in the US and eurozone, and thus this meeting could move rates quite a bit. Given that the pricing by markets for total BoE cuts in 2024 is still less than for the Fed and ECB, the case for lower yields is strong if the BoE cuts this week. The 10Y Gilt yield has not broken through the 4.0% handle since March, but a cut this week would give enough conviction to break through and head lower.

The impact on the pound

On a trade-weighted basis, sterling had earlier this month rallied to levels last seen on the day of the Brexit vote in June 2016. We felt the move had largely been driven by softer US rates and French political problems rather than a wholesale repricing of the UK’s role in Europe. The forthcoming BoE meeting and our call for the start of the easing cycle should therefore present a headwind to the resurgent pound.

This year, 10bp movements in the 10-year Gilt / US Treasury spread have been worth roughly one cent for GBP/USD. Thursday’s event risk therefore presents a clear downside threat to GBP/USD and our dovish views on the BoE cycle mean that we struggle to see GBP/USD above 1.30 later this year.