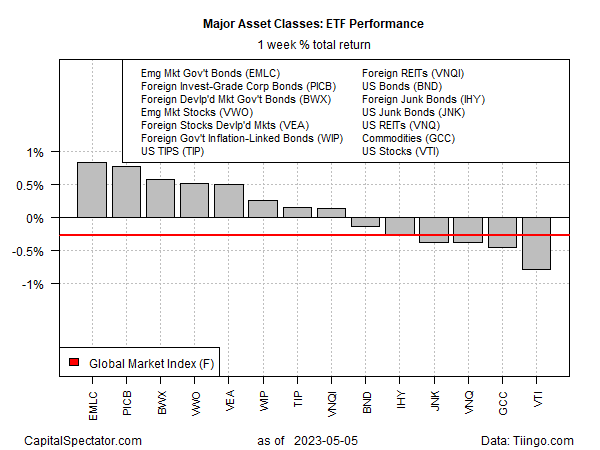

Fixed-income markets ex-US led performances during a mixed week for the major asset classes through the close of trading on Friday, May 5, based on a set of ETFs.

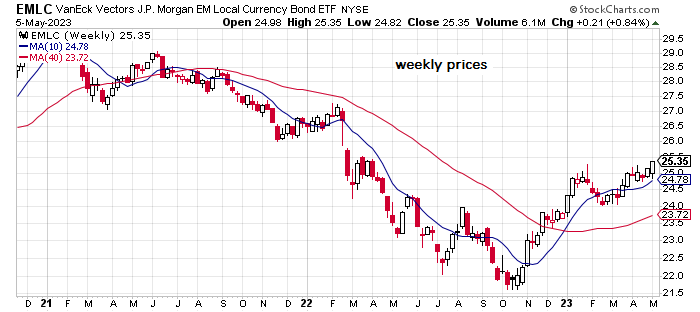

The strongest performer: VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC) rose 0.8% last week, lifting the fund to its highest weekly close in more than a year. The ETF’s ongoing strength since rebounding off its bottom in October translates to one of the highest momentum scores for global markets, based on a proprietary ranking system at The ETF Portfolio Strategist, a sister publication of CapitalSpectator.com.

Foreign bonds ex-US had a good week generally, delivering the top-three performances for the major asset classes last week.

US assets, by contrast, were in the loser’s column via bonds, property shares, and stocks. American shares posted the biggest decline last week via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), which edged down 0.8%.

The Global Market Index (GMI.F) also lost ground last week, slipping 0.3%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

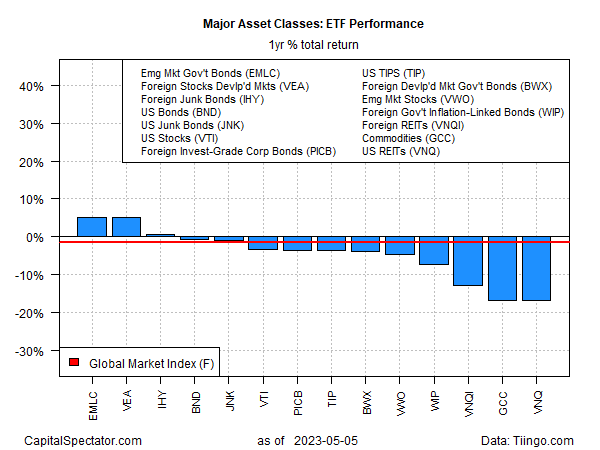

For the one-year window, emerging-markets bonds took the lead. EMLC closed on Friday with a 5.1% gain vs. the year-ago level (after factoring in distributions). The increase is slightly ahead of the one-year gain for developed-markets stocks ex-US (VEA).

Most of the major asset classes, however, continue to nurse losses for the one-year window. Commodities (GCC) and Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) are essentially tied for the deepest one-year loss at nearly -17%.

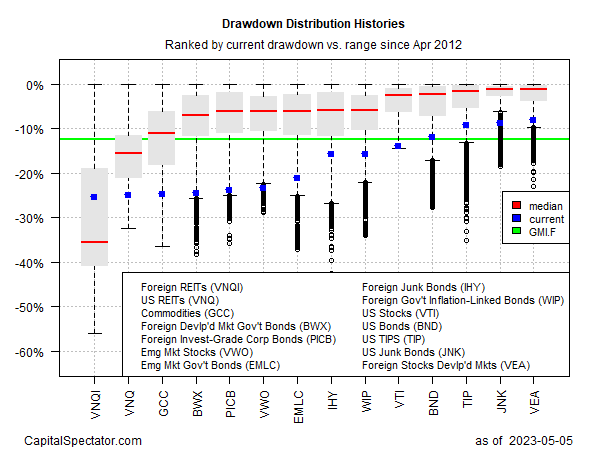

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdown at the end of last week: stocks in developed markets ex-US (Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA)) with a comparatively mild -8.1% peak-to-trough decline.