In Fisher Investments UK’s reviews of financial commentary, we often see arguments that equities’ fortunes are tied to interest rates. The thinking amongst many commentators we follow: rising interest rates hurt equities whilst falling rates benefit them. We see a big problem with this view, though: the data don’t support it. Although rate changes (and the chatter surrounding them) can swing sentiment in the short term, we don’t think they drive equities’ longer-term returns.

According to the thinking underpinning the headlines Fisher Investments UK reads, interest rates influence equities because share prices reflect the present value of future earnings. Calculating what those future earnings are worth today uses interest rates – representing the time value of money (the benefit of having a pound now versus later).[i] According to the maths, the lower the interest rate, the higher the present value of future earnings, and vice versa. If the theory holds, higher rates would weigh heavily on equities – particularly the shares of fast-growing firms, most of whose earnings are perceived to be generated in the future.

But our review shows reality doesn’t always follow theory. Consider the last two years as developed world interest rates spiked.[ii] Now, we think the anticipation of higher rates weighed on global equities in 2022’s first half – alongside other issues, including war and inflation (economy-wide price increases), which roiled sentiment and drove a downturn. Yet equities began to recover later in 2022 and rose to new highs by 2023’s end.[iii] Rising rates didn’t prevent equities rallying after the initial hit to sentiment wore off, in Fisher Investments UK’s review, as the deep economic contraction commentators we follow said would ensue failed to materialise – and markets moved on.

For example, German 10-year Bund yields leapt from -0.18% at 2022’s start to a 2.98% early-October 2023 peak before retreating to 2.00% by year-end.[iv] Other eurozone nations’ bond yields we observed moved similarly in direction and magnitude.[v] Yet eurozone equities troughed in late-September 2022 and were up 36.3% to a new high in December 2023.[vi] Fisher Investments UK’s reviews of UK and US markets found similar trajectories. Despite 10-year Gilt yields’ surge from 0.97% to as high as 4.74% in August 2023, UK equities’ low was well before that in October 2022 – and they hit a record high at 2023’s end for a 19.0% gain.[vii] US 10-year Treasury yields rose from 1.51% to their recent October 2023 4.99% peak, but the S&P 500 troughed a year earlier and had risen 36.5% to a record on 2023’s penultimate day.[viii] America’s Nasdaq 100 – replete with fast-growing firms alleged to founder badly as rates rise – did better, climbing 59.8% in its October 2022 – December 2023 peak-to-trough ascent.[ix]

Now, there was a lot of volatility in between these highs and lows, and rates and equities did move in opposite directions on several occasions. Some of their inflexion points also coincided. We don’t dismiss that, and we do think it is fair to argue that interest rate wiggles affected investor sentiment toward equities in 2022 and 2023. But a sentiment-fuelled phenomenon, which Fisher Investments UK thinks the last two years was, is different from a lasting, fundamental relationship.

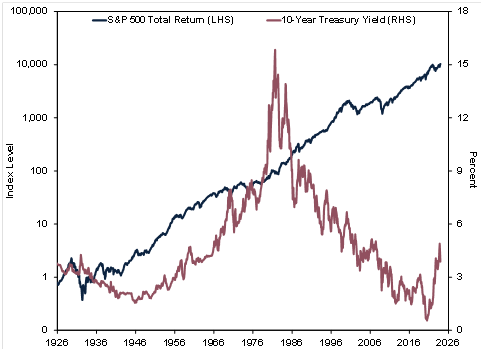

To see this, we think it helps to look at the long term. Using US data for their nearly century-long history, Exhibit 1 shows S&P 500 returns (blue line) aren’t connected closely with the 10-year Treasury yield (maroon). Sometimes equities fall when bond yields rise – as was the case in 1931 – 1932 during the Great Depression. Other times, equities rise whilst yields trend downward, like during the 1990s. There are also periods when both fall at the same time (see 2000 – 2003) and rise in tandem (e.g., in 2021). Based on our study, there is no strong relationship.

Exhibit 1: Equities Have Risen Long Term Whether Rates Trended Up or Down

Source: FactSet, as of 11/1/2024. S&P 500 total return and 10-year US Treasury yield, December 1925 – December 2023. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns. Left-hand side axis in base-10 logarithmic scale, which shows percent-based moves in equal increments graphically.

To us, this isn’t a mystery – equities and bonds have different drivers. For equities, Fisher Investments UK’s reviews of equities show rates matter far less than corporate earnings’ prospects 3 to 30 months out relative to expectations. Rate moves are one (and, in our view, marginal) influence over publicly traded firms’ profitability. We think they affect rate-sensitive sectors like Real Estate, Financials and Utilities – but those segments don’t comprise the whole market.[x] Meanwhile, we find bonds are driven mostly by inflation and inflation expectations. Our analysis indicates bonds, like equities, move on supply and demand, and demand derives heavily from inflation’s path – the yield investors demand lending to issuers ties to how much purchasing power they would expect to lose over the bond’s life.

For investors, we think chatter over rates as an equity market driver overstates their influence. The reality is that equities don’t hinge on rate moves, based on Fisher Investments UK’s reviews of markets.

______________________________________

[i] “Discounted Cash Flow (DCF) Explained With Formula and Examples,” Jason Fernando, Investopedia, 6/11/2023.

[ii] Source: FactSet, as of 11/1/2024. Statement based on American, British, Dutch, French, Italian and Spanish 10-year government bond yields.

[iii] Source: FactSet, as of 11/1/2024. Statement based on MSCI World Index returns with net dividends, 31/12/2021 – 31/12/2023. Presented in pounds.

[iv] Source: FactSet, as of 11/1/2024. 10-year German Bund yield, 31/12/2021 – 31/12/2023.

[v] See note ii.

[vi] Source: FactSet, as of 11/1/2024. MSCI EMU Index return with net dividends, 31/12/2021 – 31/12/2023. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[vii] Source: FactSet, as of 11/1/2024. 10-year UK Gilt yield and MSCI UK Investable Market Index return with gross dividends, 31/12/2021 – 31/12/2023. Presented in pounds.

[viii] Source: FactSet, as of 11/1/2024. 10-year US Treasury yield and S&P 500 Index total return, 31/12/2021 – 31/12/2023. Presented in dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[ix] Source: FactSet, as of 11/1/2024. Nasdaq 100 Index total return, 31/12/2021 – 31/12/2023. Presented in dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[x] Source: FactSet, as of 11/1/2024. Statement based on MSCI World Index sector weights.

Disclaimer:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square (NYSE:SQ), Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.