Fisher Investments UK Debunks Another Fan-Favourite Myth: Markets Abide By Seasonal Adages

A common market myth we see some market commentators champion is that certain times of year are better for investing than others. These popular seasonal adages have some staying power because select examples imply they worked. However, Fisher Investments UK’s review of market history shows seasonality isn’t predictive.

Fisher Investments UK’s review of financial literature shows several, repeat seasonal claims appear annually throughout the year. First, chronologically, comes so goes January, so goes the year. The thinking here: January’s returns (either the first few trading sessions’ or the full month’s – we have seen various interpretations) will determine the rest of the year’s. In the spring, we regularly see articles advising investors to sell in May and go away – i.e., exiting stocks in late spring and staying out for the summer. Traditionally, this adage referred only to the summer, as brokers in the UK would be on holiday between May and Britain’s St. Leger Stakes horse race in September – and that resulted in less liquidity, lower returns and higher volatility. Relatedly, commentators also warn against owning stocks in September, as it is the only month that US stocks, which Fisher Investments UK cites for their long history, average negative monthly returns.[i] Lastly, commentators laud the Santa Claus rally – whether the week before Christmas Day or the week after 25 December plus the first two trading days in January – as a time that is allegedly a boon for stocks.

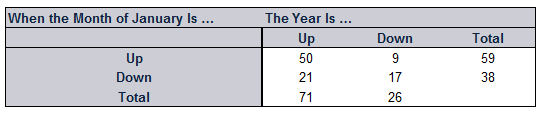

These are the big four seasonal adages Fisher Investments UK regularly sees in the financial press. However, our review of these adages and market performance shows they don’t add up. To use the longest data set available, we are featuring America’s S&P 500 Index in US dollars, with reliable returns dating back to 1925. On the so-called January effect, Exhibit 1 shows January returns don’t reliably predict the full year’s. Yes, when January is positive, the year is overwhelmingly positive – but in our view, that is simply consistent with our research that stocks are up more often than not.[ii] But of the 38 down Januarys, the year’s returns were negative 17 times and positive 21 times. If the January effect was real, then a down January should translate into a down year the vast majority of the time – but that simply isn’t the case.

Exhibit 1: January Returns Versus the Full Year

Source: Global Financial Data, as of 9/5/2023. S&P 500 Total Return Index, annual and January data, 31/12/1925 – 31/12/2022. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

How about sell in May and go away? Today, Fisher Investments UK’s commonly sees proponents cite the timeframe of 30 April – 31 October as the period to avoid markets, since this stretch is the S&P 500’s weakest rolling six-month period of the calendar. Yet this period’s returns don’t significantly underperform the other six months. Since 1925, returns from 30 April through 31 October were down only 27 times versus being up 70, with an average return of 4.2%.[i] If investors unquestioningly followed this adage and exited markets for the summer, they would have missed positive returns 72.2% of the time – costly for those with long-term market-like investment goals.[ii] This holds in Europe, too. Since the first euro-denominated returns start in 1999, the MSCI Economic and Monetary Union (EMU) Index has been up in 62.5% of the 30 April – 31 October periods.[iii] This is only slightly lower than the 66.7% for the other six months.[iv]

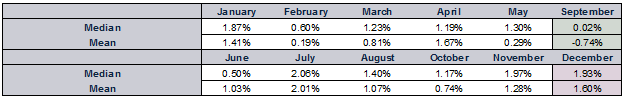

On September’s supposed woes, consider Exhibit 2, which shows average and median monthly returns (a median is the figure with an equal number of observations above and below) since 1925. Average September returns (shaded green) are slightly negative, and the median return is barely positive. But Fisher Investments UK’s research suggests a handful of outliers have skewed September’s average returns – e.g., September 1931’s -29.6% plunge, the worst month in the S&P 500’s history, occurring amidst America’s Great Depression.[v] Whilst outliers tend to dominate headlines, consider: since 1925, September has been positive 52.0% of the time.[vi] Exhibit 2 also dispels the Santa Claus rally (December returns shaded purple). If the Santa Claus rally was real, we would expect to see December rank as the year’s top-performer. It isn’t.

Exhibit 2: S&P 500 Index Monthly Returns

Source: Global Financial Data and FactSet, as of 8/5/2023. S&P 500 Total Return Index, monthly data, 31/12/1925 – 30/4/2023. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

In Fisher Investments UK’s view, these historical data show correlation isn’t causation. When seasonal adages work, we think it is coincidence. They may occur frequently enough to give the myths staying power, but we don’t think acting on these adages is a sensible investment decision. We also think it is myopic to focus on short-term stretches, whether it is a couple weeks or a couple months. Looking more broadly, over longer timeframes markets are more often positive than not. Recall Exhibit 1: since 1925, the S&P 500 Index has delivered a positive return in 71 of 97 years – 73.2%.[i] So whilst it can be difficult to remain calm amidst short-term volatility, Fisher Investments UK thinks it is important for investors to not react to seasonal adages – lest they risk missing stocks’ longer-term positive returns.

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square (NYSE:SQ), Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Ibid. Frequency of positive S&P 500 annual total returns, 31/12/1925 – 31/12/2022. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[i] Ibid. S&P 500 average total return, 30 April to 31 October, 1926 – 2022. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[ii] Ibid. S&P 500 Total Return Index frequency of positive returns from 30 April to 31 October, 1926 – 2022. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[iii] Source: FactSet, as of 15/5/2023. MSCI EMU Index (with net dividends) frequency of positivity. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[iv] Ibid.

[v] Global Financial Data Inc., as of 10/5/2023. S&P 500 total return, 31/8/1931 – 30/9/1931. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[vi] Ibid. Frequency of positive S&P 500 total returns in the month of September, 31/12/1925 – 31/12/2022. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[i] Source: Global Financial Data, Inc. as of 10/5/2023. S&P 500 September average total return, 1926 – 2022. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[ii] Ibid. Frequency of positive S&P 500 annual total returns, 31/12/1925 – 31/12/2022. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.