This article was written exclusively for Investing.com

- The asset class continues to grow

- Polkadot is number six on the list

- Cardano is fourth

- The trends are higher

- Crypto mania comes in waves

There are many choices and alternatives in the digital currency asset class. Most of the attention focuses on Bitcoin and Ethereum, the two leading cryptocurrencies that reflect over 75% of the asset classes’ total market cap.

However, there are over 8,480 other tokens that make up the entire market. Since digital currencies remain a burgeoning asset class, many of the newer arrivals will fail. Selecting the few long-term survivors can be a challenge.

Only recently has the total market cap risen above the one trillion level. As of Feb. 15, it stood at around $1.466 trillion. Cryptocurrencies are still small compared to other markets. Apple (NASDAQ:AAPL) has a market cap of nearly $2.233 trillion, far higher than the value of all digital currencies.

In markets, the strongest assets tend to do best over time, while the weakest often fall by the wayside. Polkadot and Cardano are two top-ten cryptos by market cap. Their positioning tells us they are likely to survive over the coming years.

The asset class continues to grow

In 2017, when Bitcoin rose to over $20,000 per token for the first time, the market cap of the entire digital currency asset class moved above the $800 billion level. A little over three years later, with Bitcoin trading way over double that level, the asset class’s value has grown to nearly $1.5 trillion. Bitcoin alone accounts for nearly $903 billion.

Meanwhile, the massive volatility of Bitcoin and the other cryptos means that the market cap and individual values are a moving target. The number of tokens continues to grow each day and was at 8,484 on Tuesday, Feb. 16.

Bitcoin and Ethereum have the lion’s share of the market cap. The other 8,438 coins have the potential to challenge the leaders.

Polkadot and Cardano are two cryptos with market caps above $25 billion and are in the top 6 digital currencies. Bitcoin, the barometer for the asset class, reached a new high, surpassing $52,000 on Feb. 17, though it's currently trading below that round number.

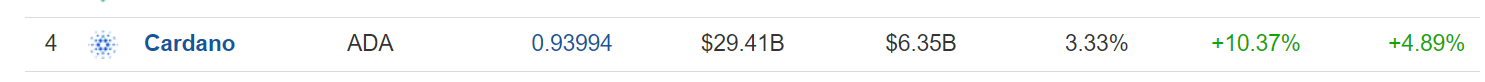

Cardano is number four on the list

Cardano is currently the fourth-leading cryptocurrency by market cap. Cardano’s symbol is ADA.

At $0.9399 per token currently, Cardano had a market cap of $296.41 billion.

Source: Investing.com

Cardano is a cryptocurrency network and open source project that runs a public blockchain platform for smart contracts. The Cardano Foundation in Zug, Switzerland, developed the project.

Cardano is a non-profit platform that allows for multiple digital currencies. The website states:

“Cardano restores trust to the global system- creating through science, a more secure, transparent, and sustainable foundation for individuals to transact and exchange, systems to govern, and enterprises to grow.”

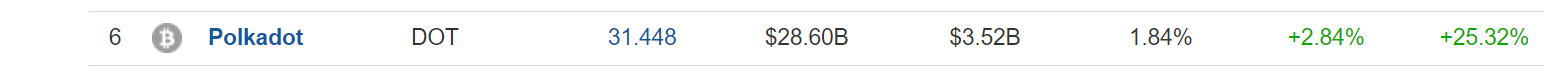

Polkadot is sixth

Polkadot's symbol is DOT. At $31.45 per token it is the sixth leading cryptocurrency has a market cap of $28.60 billion.

Source: Investing.com

Polkadot is a heterogeneous multi-chain interchange and translation architecture that enables customized side-chains to connect with public blockchains. The Ethereum co-founder Gavin Wood created the protocol.

Polkadot builds on previous blockchain networks, offering several fundamental advantages, including scalability, specialization, a stand-alone, work-together environment, self-governance, and upgrading ease.

The trends are higher

Position in the hierarchy of the volatile cryptocurrency marketplace is a moving target. Polkadot and Cardano have been climbing on the digital currency hit parade.

By the time you read this piece, the rankings may have already changed. Meanwhile, the Polkadot and Cardano price trends are higher along with the rest of the asset class.

Source, both charts: Coinmarketcap

The chart highlights that Polkadot has traded from a low of $2.932233 to a high of just over $30 on Feb. 16.

Cardano traded at a low of below 2 cents in October 2017 and was at over 83 cents per token on Feb. 17.

Cardano reached a record high of $1.172654 in early 2018. After trading below 10 cents in late 2020, Cardano took off on the upside with the rest of the digital currency asset class.

The impressive climb put the crypto’s market cap fifth behind Polkadot, and above XRP in mid-February 2021. Since then, Cardano's standing has shifted.

Crypto mania comes in waves

There are so many digital currencies to choose from these days. While Bitcoin and Ethereum are the asset class leaders, and the ones garnering most of the headlines, the most attractive candidates for appreciation are likely the cryptos that are off the market’s daily radar.

One day we may all need to own digital currencies for practical reasons, so for that reason I follow three rules when considering investing in one.

First, I only risk capital I am willing to lose. With over 8,480 tokens in circulation, many are likely to fail and disappear.

The second rule is that I tend to favor those that have gained a critical mass when it comes to market cap. Therefore, the leading cryptos with over a $1 billion market cap have the best chances of success. As of Feb. 16, sixty of the 8,484 digital currencies qualify.

Finally, the bullish price action in the asset class tends to come in waves. The first wave ended in late 2017 and early 2018 when Bitcoin and many other tokens rose to initial highs.

After three years of price consolidation, the second wave has taken Bitcoin to substantially over double its 2017 high and the entire asset classes’ market cap to nearly the $1.5 trillion level.

I hate buying rallies. In October 2020, Square (NYSE:SQ), a technology payment company founded by Twitter's (NYSE:TWTR) Jack Dorsey, announced it invested $50 million in Bitcoin. At the $11,000 per token level, Dorsey’s purchases turned out to be a bargain as SQ more than quadrupled its investment over the past four months.

The latest push higher for Bitcoin and the asset class came on the heels of Elon Musk’s announcement that Tesla (NASDAQ:TSLA) bought $1.5 billion in BTC and will accept the leading token as payment for the carmaker’s products in the future. While the news is bullish, digital currencies are markets. All markets tend to rise to levels far higher than anyone believes possible during bullish trends.

When gravity hits, they often fall to illogical levels on the downside. We are now in the midst of a substantial bullish and parabolic period in the asset class. While the trend is always your best friend in markets, and it remains higher, the risk of a severe correction rises with the tokens’ prices.

Now could be an excellent time to put the tokens with the best odds of succeeding on your radar. When gravity hits the markets, buying at lower prices could improve the odds of long-term success.