Timing a market entry is never easy; whether catching the lows for a buy or highs for a sell.

Often, one could be late to the party, going long when there’s more downside to explore or shorting when the peak hasn’t been reached.

Thus, the question with arabica coffee: After this week’s seven-year highs, is it still a buy?

Like any market with the dual perspective of fundamentals and technicals, arabica has strong stories to tell on both ends.

And overwhelmingly, the narrative is positive—meaning this rally likely has legs, with potentially a lot more to gain for anyone staking a buy at this point.

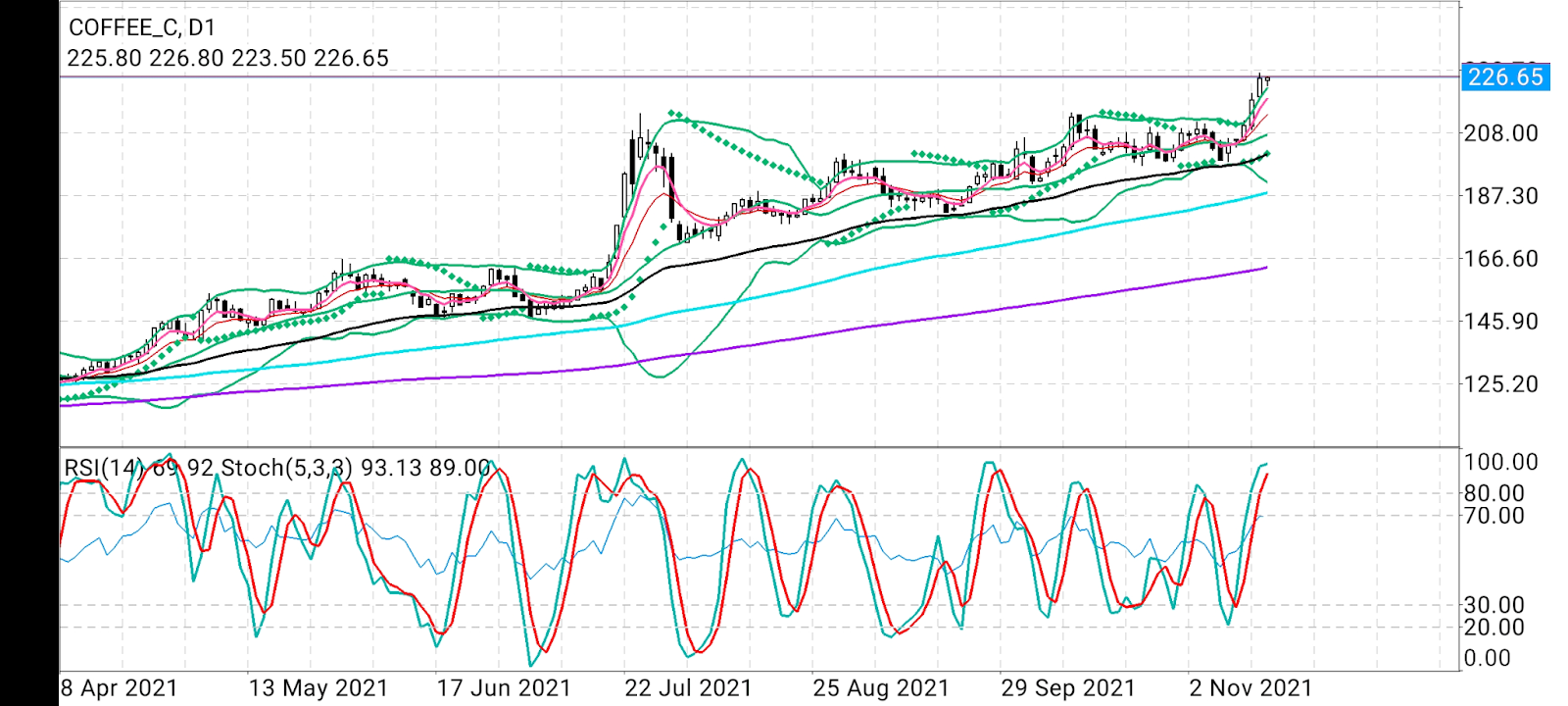

All charts courtesy of skcharting.com

First, The Fundamentals

As media reports suggest, Brazil (the top arabica producer) and Vietnam (the Number One grower of robusta, the other major coffee variant) have multiple supply issues currently.

Truckers strikes and other shipping snarls, poor weather and soaring fertilizer costs as well as the return of COVID have combined to delay the delivery of coffee beans from the two centers to consumers around the world.

“The trucks have gone on strike in Brazil, compounding logistical problems for exports from that country,” Jack Scoville, chief crop analyst at Chicago’s Price Futures Group, said in an analysis shared with Investing.com.

Added Scoville:

“The lack of coffee available to deliver against robusta contracts remains a factor and is becoming more important for New York. Containers are not available in Vietnam to ship coffee. COVID has also returned to Vietnam in a big way and could be a factor in interrupting shipments. Production in Vietnam is now estimated at 29 million tons, from 31 million previously.”

He said Brazil had less coffee this year due to a freeze earlier in the year and dry weather at flowering time a year ago.

As a result, arabica is up 77% on the year, rallying virtually non-stop from $1.59 per lb at the end of June to $2.22 now. Robusta is up some 65% for 2021, rising from $1.34 at end-March to $2.27.

The rally means higher operational costs for some of the world’s top coffee chains—Starbucks (NASDAQ:SBUX), Costa Coffee which is owned by Coke (NYSE:KO), Restaurant Brands International (NYSE:QSR) owned Tim Hortons, and Peet's Coffee & Tea (AS:JDEP)—which rely on premium beans to turn out their products. These big coffee franchises have so far resisted passing on the higher expenditure to their customers.

Even so, the surge in coffee futures could lead to higher costs for patrons at neighborhood cafes and grocery stores, fueling more food inflation, with US consumer prices already expanding at their fastest annualized rate in 30 years. Robusta coffee, particularly, is used widely in instant beverages such as Nestle's (OTC:NSRGY) Nescafe.

Prices are likely to stay high as elevated shipping costs eat into profits for producers, exporters, importers, roasters and retailers, said Christian Wolthers, the president of Wolthers Douque, a Florida importer whose family has been in the Brazilian coffee business for decades.

“The global coffee markets remain in deficit and whenever prices drop we see industry buying ahead of further tightening,” Kona Haque, who leads research at commodity trader ED&F Man in London, was quoted telling Bloomberg.

This week’s rally which sent arabica to 2014 peaks of $2.2590 per lb came amid falling certified stockpiles and a stronger Brazilian currency that eroded incentives to sell commodities priced in dollars.

In addition, according to Bloomberg, early projections for Brazil’s 2022 crop indicated yields will trail the nation’s last high-yielding cycle in 2020-21, adding that this will limit the rebuilding of stockpiles needed to weather the typical dip in the following harvest’s output.

Brazil’s 2021 arabica output plunged after drought and frost damaged trees, and rains will remain crucial for any 2022 recovery. Second-ranked arabica supplier Colombia is struggling with excessive rains that cut yields and heightened the risk of plant disease. The two account for almost three-quarters of world arabica output.

Soaring fertilizer prices have also added to farmers’ woes while elevated freight costs and a lack of container ships hinder exports. That has stalled shipments of millions of bags of coffee out of Brazil. Vietnam, the top robusta supplier also has seen freight rate climb even higher.

Fertilizer costs are rising in Brazil amid global export restrictions and robust demand, according to Bloomberg Intelligence. Countries where currencies have depreciated against the dollar are feeling the impact even more, including Costa Rica, long a favorite of American coffee connoisseurs. That’s pushed buyers to seek alternatives and Africa has made up for some of that.

Now, For The Technicals

Technical chart signals suggest that if arabica breaches $2.25, it could surge to the next level of $3 per lb, according to Hernando de la Roche, senior vice president for StoneX Financial Inc. in Miami who was quoted by Bloomberg earlier this week. He added that there has also been buying tied to expiring options, which spurred short covering.

Sunil Kumar Dixit, who regularly plots commodity technical charts for Investing.com, says arabica has “plenty of rally room” and advocates a step-by-step target building for bulls, “instead of a lofty $3 pie-in-the-sky.”

“I have seen institutions using loudspeakers on a market breakout with little regard to consolidations,” said Dixit.

“Most breakouts are immediately followed by deeper corrections. Markets tend to prove the majority wrong by catching them on the wrong foot and the same could happen with the long-running coffee rally.”

That said, the chief technical strategist at skcharting.com remains highly optimistic about arabica in the near to mid-term.

“With the bullish momentum in place now, I still expect a modest relaxation and softening of the rally, which may correct prices to retest the breakout area of $2.15-$2.10 at some point of time. Thus, I would say it's not too late to enter this market.”

He said arabica’s breakout above the $2.10-$2.15 horizontal and static resistance area continues to scale toward initial targets of $2.32-$2.37.

“The trend on daily and weekly time frames is bullish as long as prices hold above $2.19 and the resistance-turned-support area of $2.15-$2.10.”

“A careful study of long-term price patterns reflects strength in the bullish wave, which ushers in a higher price zone over an extended period of time.”

Over the mid- to long-term, prices may form a base over $2.25-$2.35, he said.

“A long consolidation over the said base is required for launch towards next price zone $2.64-$2.87. I don't see $3 coming soon.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.