Homeownership is the quintessential American dream, but it’s become increasingly elusive for many households. A multitude of factors, including soaring home prices, elevated interest rates and persistent inflation, has created the perfect storm, making homeownership a distant reality for more U.S. residents.

It’s impossible to overexaggerate the benefits to owning one’s home. In 2022, primary residences accounted for more than a quarter of all assets held by U.S. households, underscoring just how important homeownership is in building long-term wealth.

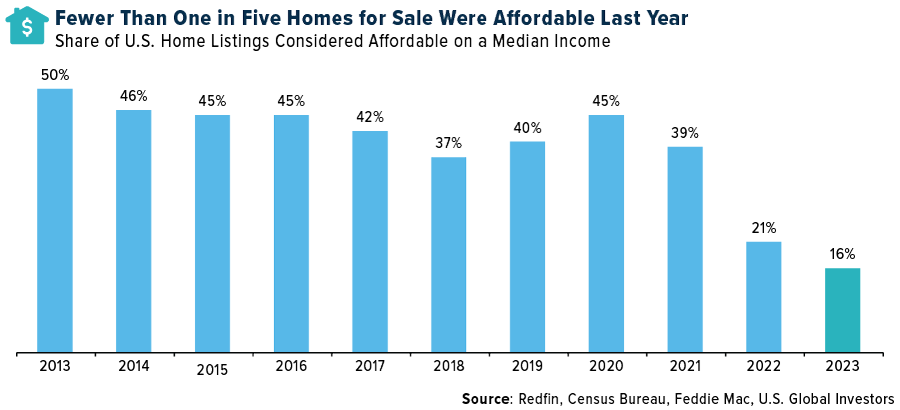

But according to analysis conducted by Redfin (NASDAQ:RDFN), a mere 16% of homes for sale in 2023 were considered affordable for the typical U.S. household, the lowest share on record. This stark figure represents a decline from 21% in 2022 and a significant drop from over 40% before the pandemic-fueled homebuying frenzy.

While the vast majority of renters (81%) aspire to own a home in the future, a staggering 61% are plagued by concerns that they may never realize this dream, according to a new survey conducted this month by the Harris Poll. This sentiment is particularly pronounced among renters, with 57% expressing the belief that the American Dream of homeownership is effectively “dead,” compared to 43% of those who already own a home.

High Mortgage Rates Exacerbating the Supply Crunch

The affordability crisis can be attributed to a multitude of factors, chief among them being the persistent rise in mortgage rates. Despite recent declines from their October peak, rates remain significantly higher than they were in 2022, resulting in a typical homebuyer’s monthly payment being approximately $250 more than a year ago, Redfin estimates.

Moreover, elevated mortgage rates have inadvertently exacerbated the supply crunch, as many homeowners are opting to stay put rather than risk losing their ultra-low rates. This reluctance to sell has bolstered prices as buyers now compete for a limited pool of available properties.

While some relief may be on the horizon, the path ahead remains uncertain. The Federal Reserve’s recent decision to hold off on rate changes, coupled with the potential for future cuts, has introduced a degree of volatility into the market.

A Rate Cut in June?

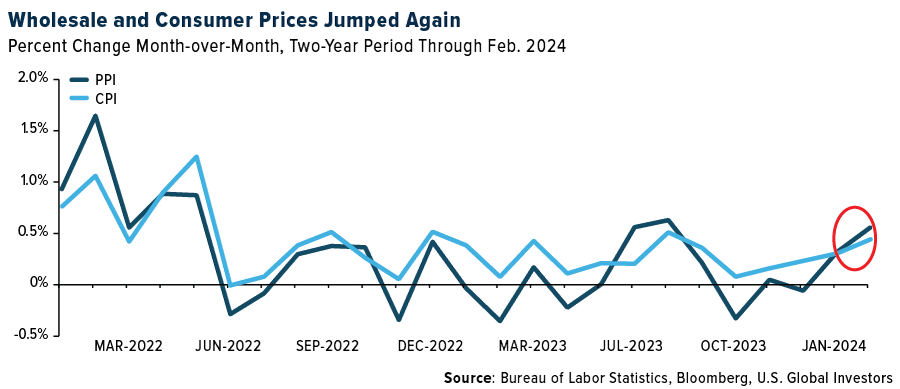

Compounding the challenge is the unexpected surge in wholesale prices in the U.S., as evidenced by the producer price index (PPI). Prices for manufacturers rose 0.6% month-over-month in February, ahead of expectations, while the consumer price index (CPI) also ticked up from January. This poses fresh obstacles for economic and monetary policy, potentially delaying anticipated rate cuts as the central bank prioritizes curbing inflation over stimulating growth.

Some international financial firms, including UBS and RBC, still anticipate the Fed to start cutting rates as early as its June meeting, with the Bank of Canada, European Central Bank (ECB) and Bank of England potentially following suit in subsequent months.

But don’t expect rates to drop to near-zero anytime soon. Former Fed Chair and current Treasury Secretary Janet Yellen has cautioned that it’s “unlikely” that market interest rates will revert to pre-pandemic levels, aligning with projections from the White House and private sector forecasts.

Gold’s Record-Breaking Rally

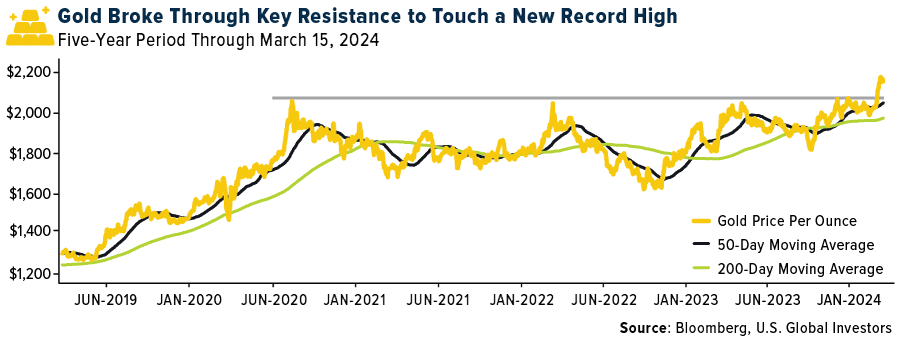

Against this backdrop, gold has performed very well, touching a new record high of $2,195 per ounce. Fueled by growing investor confidence in a potential rate cut and a weakening U.S. dollar, the yellow metal has surpassed key resistance levels, exhibiting bullish momentum.

As I’ve written many times, global central bank demand for gold has shown no signs of abating, while a potential rebound in demand from gold-related exchange-traded funds (ETFs) could provide additional support for the precious metal.

While the U.S. stock market’s solid performance and interest rates above 5% may raise questions about the allure of non-interest-bearing gold, the potential for a reversion in these assets could partially explain the metal’s record and near-record-high prices. Historically, wars have been catalysts for gold price appreciation, and the current geopolitical landscape appears to be no exception.

As investors grapple with the challenges of the current economic landscape, the precious metal’s resilience and potential for further gains may offer a glimmer of hope.

***

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.