- Bitcoin has dipped below a critical support level of $53,000 amid a market pullback.

- The recent failed assassination attempt on Donald Trump has increased his election chances, potentially boosting Bitcoin sentiment.

- Could this be the right time to start buying before the crypto starts to move higher again?

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

The cryptocurrency market ran out of steam in recent weeks after valuations appeared stretched, and that has been evident with the price declines seen in Bitcoin. The crypto has dipped below a key support level of $53,000.

However, a potential silver lining has emerged for Bitcoin bulls. The recent failed assassination attempt on Donald Trump has boosted his chances of winning the election, and a Trump victory is seen as positive for Bitcoin.

End of Bitcoin's Correction in Sight?

Over the past weekend, dramatic events during Donald Trump's meeting with voters in Pennsylvania rippled through financial markets, including the digital currency sector.

The failed assassination attempt on the Republican candidate, which could theoretically boost his chances of victory, brought a wave of optimism among investors. This sentiment positively impacted cryptocurrencies, as evidenced by the gains in Bitcoin and Ethereum.

Since the beginning of June, Bitcoin has faced significant headwinds. These include the liquidation of assets from the collapsed Mt. Gox exchange, a broader sell-off by digital miners, and the German government. Despite these pressures, Bitcoin's price found support just above the demand zone around $53,000 per coin, halting the downward trend.

From a technical perspective, this stabilization indicates that the supply side has eased, suggesting that Bitcoin may be nearing the end of its correction phase. Investors are watching closely to see if this marks the beginning of a more sustained recovery.

Buyers have pushed above $60,000, and now they will will face resistance at the local supply zone of around $63,000 per coin. If the bulls break through this level, the uptrend could resume, targeting the recent historical highs.

TON Challenges Ethereum

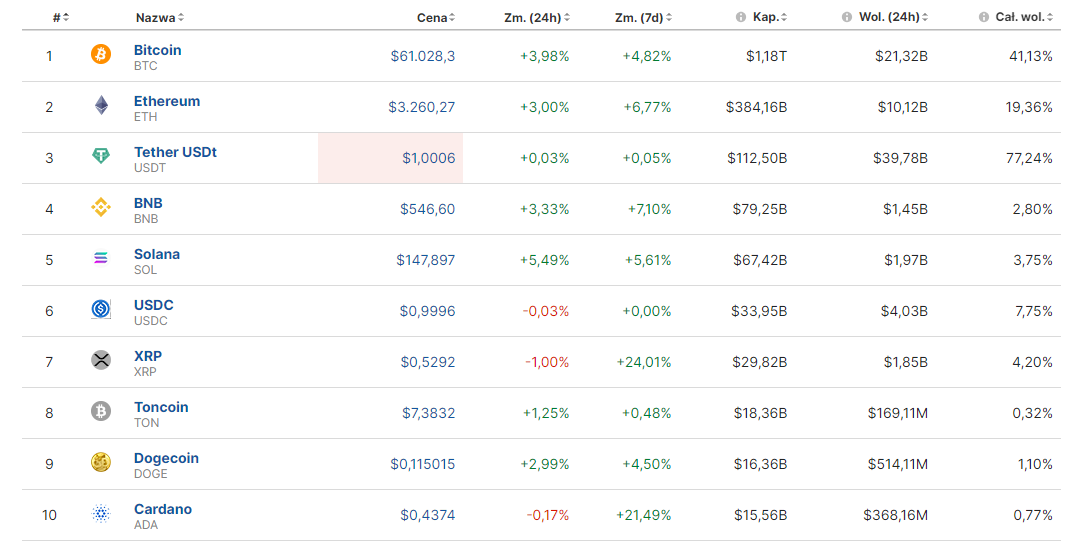

There's a new entry in the top 10 cryptocurrencies. TON/USD, with a market capitalization of $18.38 billion, has surged to the 8th spot. This rise is fueled by its close ties to the popular messaging app Telegram, where TON has the potential to become the dominant payment method.

TON (The Open Network (LON:NETW)), a cryptocurrency created in 2018, has gained significant popularity this year through its integration with the Telegram platform, where it originated. The entry of major investor Panther Capital has also fueled its growth. TON's potential lies primarily in Telegram's vast user base, which boasts 900 million active users.

The project, managed by the TON Foundation, a group of non-commercial supporters, offers several advantages. The micropayment system allows users to pay for various applications or games available on Telegram. Additionally, users can create their own applications through smart blockchain contracts.

TON is increasingly challenging Ethereum, as both cryptocurrencies utilize the Proof of Stake protocol. TON's annual transactions have already surpassed Ethereum’s, with 568,300 compared to Ethereum's 351,400. Given Telegram's extensive user base, this gap is likely to grow. However, TON faces challenges, such as incompatibility with the EVM development environment and limited market expansion in the US and China due to local competition.

Currently, TON's value continues its upward trend. A break past the local supply zone at $7.70 per coin could lead to new highs.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.