- Bitcoin broke the consolidation area to the downside last week.

- This week's rebound has allowed Bitcoin to return to the ascending channel and resume the uptrend.

- Following a breakout from that range, the crypto could eye all-time highs with the next rally.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Bitcoin's price action resembled a rollercoaster ride in July. After repeatedly bouncing off its trading range ceiling, the cryptocurrency tumbled below its support level, briefly dipping to $53,000. However, institutional buying powered by ETFs quickly intervened, propelling Bitcoin back to the $58,000 zone.

Market Dynamics: Mt. Gox and Trump Influence

Despite this recovery, recent developments have created a complex picture. Bitcoin surged to $66,000 this week, driven partly by positive sentiment following the German government finished selling off Bitcoin. However, the Mt. Gox news has dampened this optimism. The ongoing transfer of assets from the Mt. Gox exchange has introduced uncertainty, with some fearing that large-scale sell-offs could depress market prices.

On the other hand, Trump’s influence has significantly impacted Bitcoin. His assassination and the speculation about his potential re-election have stirred market enthusiasm. Trump’s prior endorsement of Bitcoin and his upcoming speech at the Bitcoin Conference have fueled speculation that he might advocate for Bitcoin as a strategic reserve if re-elected.

While Trump’s stance remains unofficial, it is likely to boost market enthusiasm in the short term. Conversely, the Mt. Gox situation has split opinions. Some anticipate that the release of $9 billion in assets could depress the market due to potential sell-offs, while others believe that long-term bullish trends will prevail as Mt. Gox victims may not sell in large volumes immediately.

Looking ahead, potential Fed rate cuts and the possibility of clearer crypto regulations under a elected Trump could further support Bitcoin’s ascent in the coming months.

Critical Trading Levels to Monitor as Bitcoin Eyes New Highs

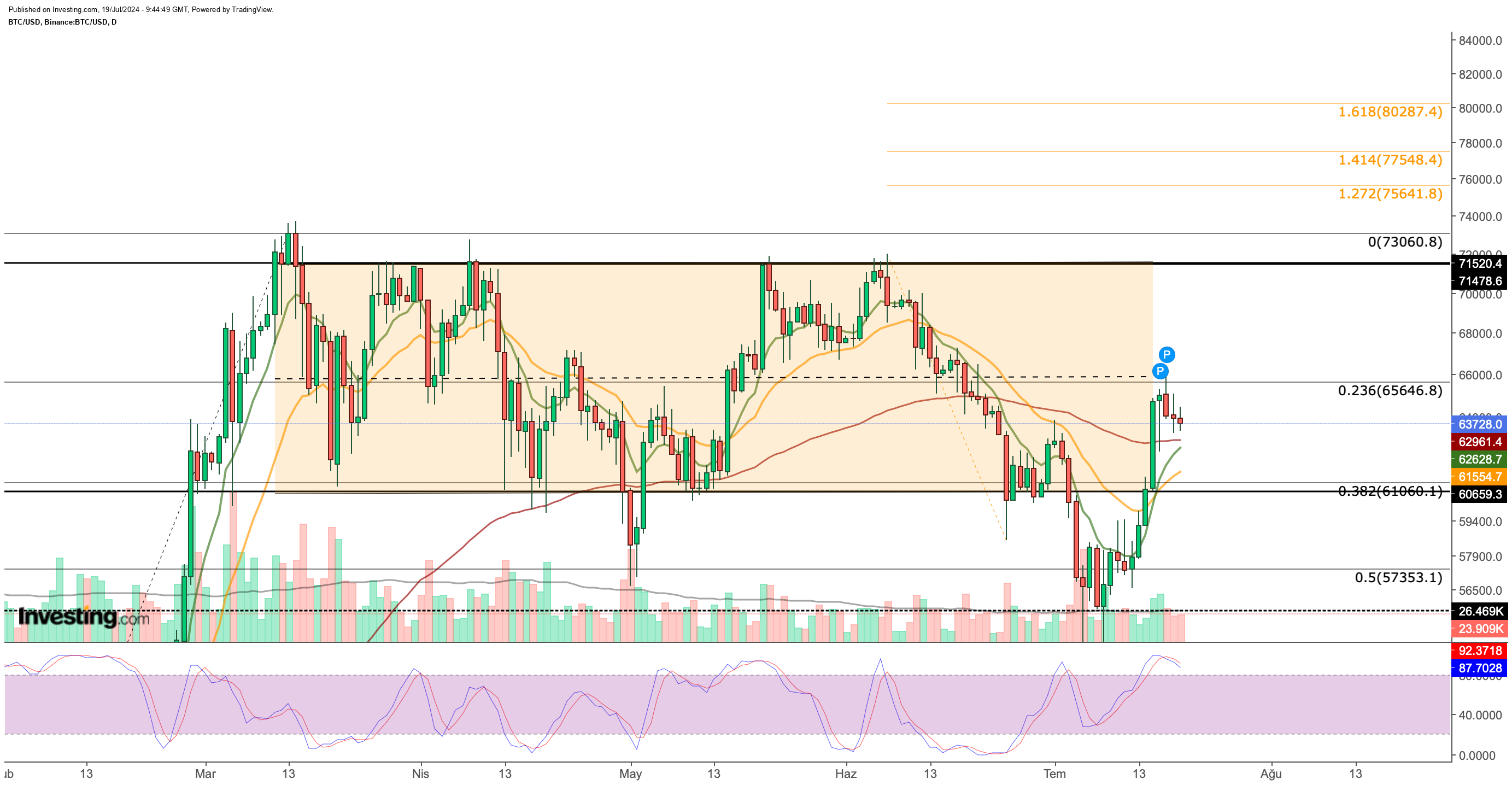

Bitcoin's technical outlook remains bullish, as indicated by the weekly chart. This week’s strong push towards the $60,000 level has reinforced the uptrend. However, to sustain this momentum, Bitcoin needs to hold support around $61,000. This level aligns with the lower boundary of the rising channel and is crucial for maintaining the trend.

If Bitcoin establishes a support level around $66,000, it will trigger a bullish signal from the Stochastic RSI on the weekly chart, setting the stage for a new peak.

Daily Chart Analysis:

On the daily chart, recent bullish momentum faced resistance at the midpoint of the horizontal channel, around $65,600. This level will act as the nearest resistance in the coming days. A break here could push Bitcoin towards the previous peak in the $71,000-$73,000 range. Should the uptrend continue, we might see Bitcoin reach our target zone of $75,000-$80,000.

Additionally, the daily chart shows signs of recovery in the short-term EMA values, which had been declining. Currently, the EMA values, ranging from $61,500 to $63,000, serve as dynamic support. As long as Bitcoin remains above these levels, it is likely to continue its upward trajectory.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.