- Stocks like BBBY have no fundamentals to support their massive share price jump

- With monetary conditions becoming tighter and no stimulus money, there just isn’t enough liquidity around

- There are strong reasons to believe that the recent rally in meme stocks will be short-lived

As the broader market shows signs of bottoming out after this year’s first-semester rout, meme stocks also seem to be coming back in vogue.

Bed Bath & Beyond Inc (NASDAQ:BBBY), one of the most talked-about meme stocks in forums like WallStreetBets, is up more than 400% during the past month. As I write this article, the stock is jumping around 55% for the day.

Similarly, AMC Entertainment Holdings Inc (NYSE:AMC), the movie-theater firm, jumped around 60% during the past 30 days.

The meme stock phenomenon started during the pandemic when a group of small investors gathered on Reddit’s WallStreetBets forum to bid up share prices of vulnerable, highly-shorted companies, such as GameStop (NYSE:GME). The move was labeled a short squeeze. It occurs when a stock that institutional investors had bet against pivots extraordinarily higher, forcing short sellers to buy back to cover their losses.

Tight Monetary Conditions

Despite this month’s robust rebound in these names, there are strong reasons to believe this rally will be short-lived and retail investors should stay away. So, if you’re entering this trade now, hoping to make quick bucks, I strongly recommend you to think twice. And if you’ve already invested, this is an excellent time to sell and pocket some profits.

First, the Federal Reserve remains in the midst of its most aggressive monetary tightening cycle in decades. That means there is little cheap money available this time, and thus less liquidity for rallies like the one we saw last year.

Moreover, some of the recent rallies in speculative investments have already fizzled. American depositary receipts of AMTD Digital Inc (NYSE:HKD), a little-known Asian fintech company that became a sensation among individual investors, finished Friday at roughly $192 after soaring to a peak of $1,679 less than two weeks earlier.

Another sign that the current rally in meme stocks is shallow is that the shares of Robinhood Markets Inc (NASDAQ:HOOD), where many of these investors trade, are down about 80% during the past year, signaling that savvy investors don’t see the return of retail activity which could support meme stocks anytime soon.

Broader markets, despite recent gains, are still down for the year. The average retail investor is sitting on a paper loss of 21% in their brokerage accounts this year, according to Vanda Research estimates as of Thursday, as cited by the Wall Street Journal.

And finally, stocks like BBBY have no fundamental reasons to rise as they are. In fact, they are among the worst stocks to bet on in the current market.

The struggling retailer is quickly burning cash, and it’s so desperate to raise funds that it’s now looking to tap into private lenders. The company had about $108 million in cash and equivalents at the end of May, down from $1.1 billion a year earlier.

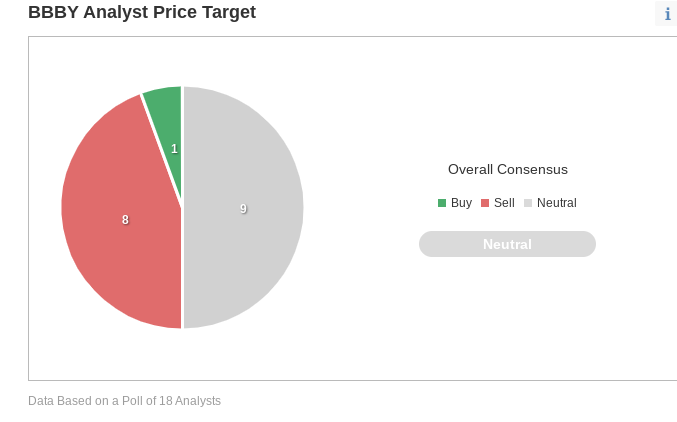

That’s why virtually no analyst polled by Investing.com recommends owning the stock.

Source: Investing.com

Loop Capital, while reiterating its sell rating and $1 price target on BBBY, said in a recent note that new financing would be expensive and might not change much for the company.

Bottom Line

The meme stock phenomenon appears to be here to stay, thanks to the influence of social media.

However, if you understand this game and want to be successful in the long run, you should always avoid being the last one holding a worthless asset.

Disclaimer: The author doesn’t own shares of the companies mentioned in this article.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.