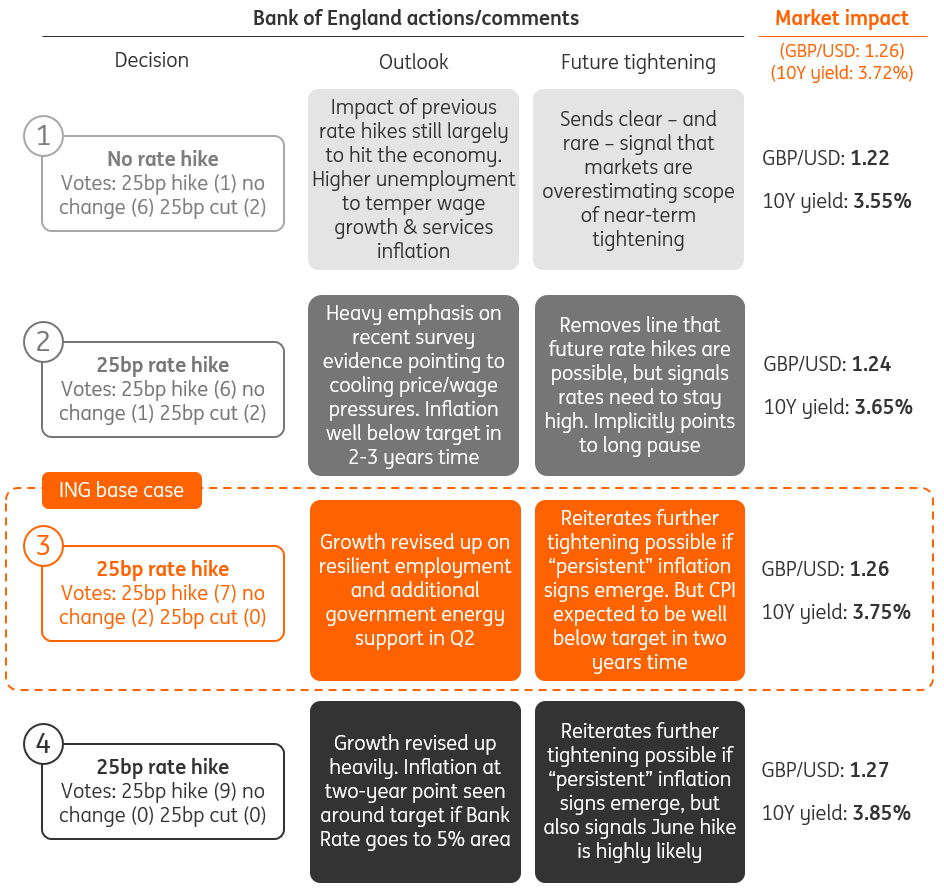

Hawkish inflation and wage data last month point to another 25 basis-point rate Bank of England rate hike on Thursday. But the Bank's recent emphasis on the lagged impact of past tightening suggests the bar for subsequent moves remains high. Unless there's some really unwelcome economic news over the next few weeks, we expect a pause in June.

Four scenarios for the Bank of England's May meeting

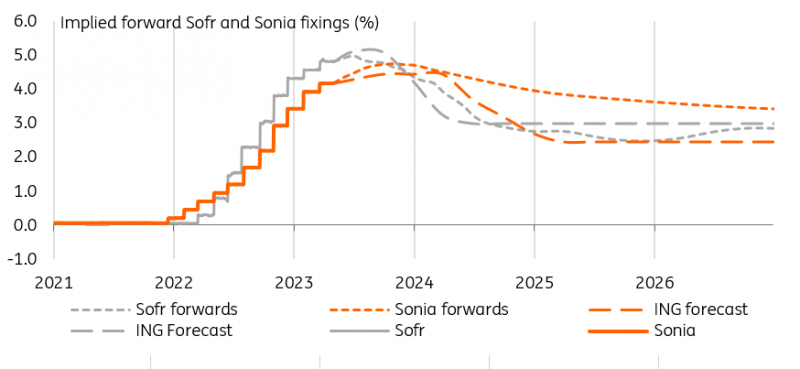

Markets expect the Bank of England to diverge from other central banks

Financial markets are increasingly looking for the Bank of England to diverge from the likes of the Federal Reserve and, to a lesser extent, the European Central Bank over the coming months. Where markets are increasingly aligned with our view of a Fed pause and rate cuts by the end of the year, investors think the Bank of England still has almost three additional rate hikes in its tank this year.

Some of this divergence can be traced back to recent wage and inflation data, both of which came in higher than expected. Indeed this was the catalyst for us to pencil in another rate hike this month, having previously expected no change.

But will the BoE really look that different to the Fed, at least in the short term? There are two reasons to think not.

GBP and USD swap spreads show diverging rate paths

Firstly, this divergence narrative is somewhat at odds with the Bank’s recent messaging. Since February, the Bank has been warning that past rate hikes are still largely to feed through to the economy. Further tightening, it said, was contingent on signs of "more persistent" inflationary pressures. The Bank felt it was too early to declare victory in March, and we suspect the same is true this month after last month's hawkish data. Nevertheless, the bar has been implicitly set reasonably high for the Bank to keep taking rates much higher.

Secondly, the recent data wasn’t quite as disastrous for the BoE as it looked at first glance. Wage growth has been volatile, and the most recent month’s outperformance followed two months where regular pay increased at a much slower pace than we’d seen throughout 2022. If we average out this volatility and look at pay growth over the past three months, compared to three months prior, growth is still clearly slower than it was.

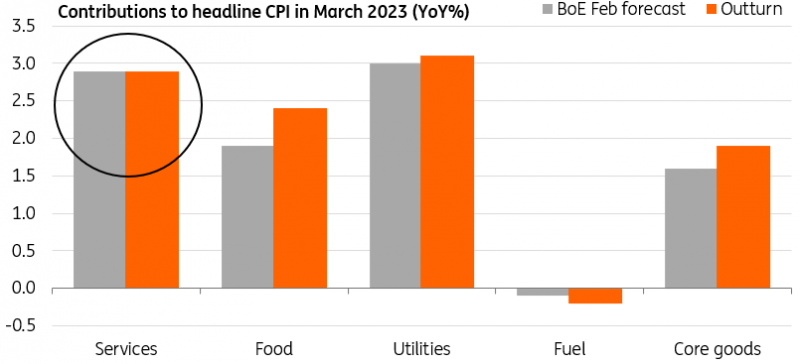

On inflation, it’s true that headline CPI is almost a full percentage point higher than the Bank of England predicted in February. But as the chart below shows, that’s solely down to more aggressive food price rises, as well as some surprising stickiness in core goods inflation. Neither trend is likely to be long-lasting, and services inflation, which tends to be much less volatile and more 'persistent', has come in bang on where the BoE had predicted. We think it's pretty close to a peak.

The BoE's own "Decision Maker Panel" survey of CFOs has also been repeatedly pointing to lower price and wage pressure, as well as reduced recruitment difficulties, over the past few months. Policymakers have traditionally put a lot of weight on this data.

Services inflation as the Bank of England expected in its last forecasts

Bottom line: we expect a 25bp hike this month, but it’s likely to be the last.

We doubt the Bank will want to shut down its options on Thursday – another unhelpful set of data over coming weeks would pile on the pressure for them to do more in June. Expect the Bank to retain its data-dependent guidance that implies further tightening is possible, though the clear dovish risk is that the Bank “does a Fed” and waters down this guidance further, perhaps removing the bit about further tightening.

Either way, the new forecasts are likely to contain clear hints that the tightening cycle is reaching its limits. Keep an eye on the Bank's inflation forecast for two years' time. That's the time horizon where BoE policy makes most of a difference and back in February, that forecast was seen well below target (albeit partly due to energy). Expect the same story in the new forecasts due on Thursday, regardless of whether the Bank bases its model on market pricing for interest rates or a scenario where the Bank Rate stays on hold. The chart below shows it's unusual for this forecast to be so far below target.

The BoE's February forecast for inflation in two years' time is much lower than previous projections

We should expect upward revisions to growth forecasts and downward revisions to the unemployment rate, partly on the back of the decision to scrap the planned increase in energy prices in the second quarter. But this is unlikely to materially alter than Bank’s thinking on inflation.

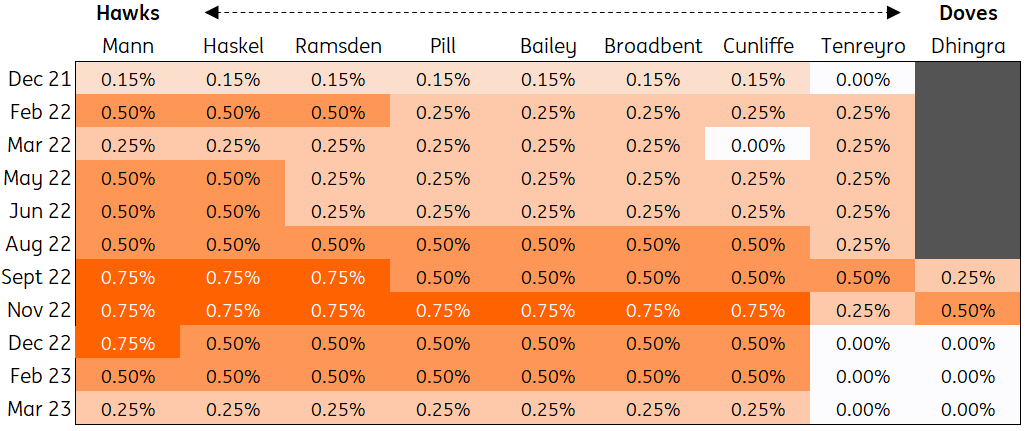

The final wild card comes from the vote split. Last time we saw seven members vote for a 25bp hike and two for no change. There’s certainly a tail risk, based on recent comments, that one or both of the doves (Tenreyro and Dhingra) vote for a rate cut at this meeting. That could set up a rare, but not unprecedented, three-way split. Still, it’s clear that the “core” five or six committee members tend to move together, and that means that whatever the decision, the vote is unlikely to be exceptionally close.

How individual MPC members voted at recent meetings

Gilts: It's all about the BoE outlook

Gilt valuations barely budged when S&P raised the UK’s rating outlook or when the Debt Management Office (DMO) announced a symbolic reduction in its FY2023-24 issuance remit of £3bn. What drives gilt valuations, by and large, is a repricing of BoE policy. Some degree of divergence with other developed rate markets makes sense. For instance, the US is the epicentre of the tightening in lending conditions, and the Fed has admitted to being sensitive to it. In that respect, that a gap opens between US and European rates, say up to the 5Y point, makes sense. It is harder to justify longer-dated forwards, say the 5Y rate in 5 years' time, to widen as well.

In practice, the two curve segments cannot entirely decorrelate, so GBP 5Y5Y rates trading at a pick up to their USD counterparts may continue for some time until the market gains conviction that the BoE will follow the Fed in its cutting cycle. What’s important to note for this meeting is that the rise in GBP rates occurred without much encouragement from the Bank of England and with economic data not diverging much from its forecast, as you can see in our base case, above. This means that the BoE remaining non-committal on its next policy steps should not cause an immediate retracement of the recent jump in sterling rates and of the recent widening relative to the dollar.

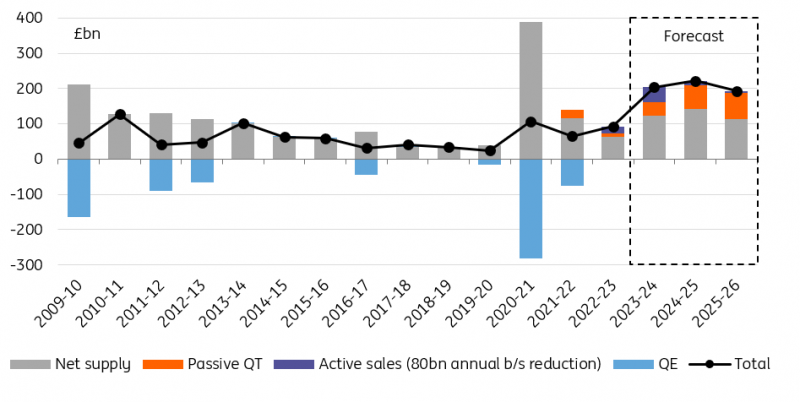

Another challenge for gilts and sterling rates is the sharp increase in government issuance this fiscal year compared to the last. This is a well-known issue, and markets have overcome its broader macro implications (such as twin deficits, difficulty in getting foreign investor demand, weak currency, inflation challenges and so on). But even looking at the more narrow issue of supply and demand imbalances, we think this will remain an ongoing challenge for gilts. At a minimum, we would expect this to push gilt yields up to the Sonia swap rate (5Y currently trades 30bp through, 2Y almost 50bp), but it will also show the convergence downward of sterling rates compared to their dollar counterparts.

Continued draw on private investors is a challenge for gilt investors

FX: GBP is happy to trade on the sidelines

Sterling has been out of the market’s focus over recent months. Three-month realised volatility in EUR/GBP has dropped below 6% for the first time in a year – perhaps welcome news for a UK government which would like sterling out of the limelight. We note with interest, too, that sterling’s correlation with global equity markets has fallen drastically over the last twelve months. This suggests that GBP could be seen as a non-correlated risk or some kind of ‘safe haven’. We do struggle with that nomenclature, however, given the UK’s large twin deficits.

Regarding the event risk of the Bank of England meeting, the key issue will be whether there is a sharp correction in the pricing of further BoE tightening later this year. On balance, we doubt the pushback will be there (yet), suggesting that sterling does not have to fall too far, if at all. With downside risks to the dollar still present, it looks like GBP/USD can hold above these 1.25 levels and perhaps push onto the 1.2650/2750 area. Given what should be a building dollar bear trend this year, we suspect any intra-day sell-off on any remarks being read as a ‘pause’ would be limited to the 1.2350/2450 area. Our baseline assumes GBP/USD ends the year near 1.28/30, and EUR/GBP gravitates back to the 0.89 area as the ECB out-hikes the BoE.

The article was first published on think.ing.com.