The recent decline in the US Dollar Index against other major currencies has made many market participants wonder: is now a good time to invest in European stocks?

The greenback lost around 5% of its value against the euro and about 6% versus the pound in July. While broader US indices are likely to keep offering plenty of robust stocks, long-term investors may consider diversifying with shares of established companies listed in the UK and continental Europe.

Below are two exchange-traded funds to consider:

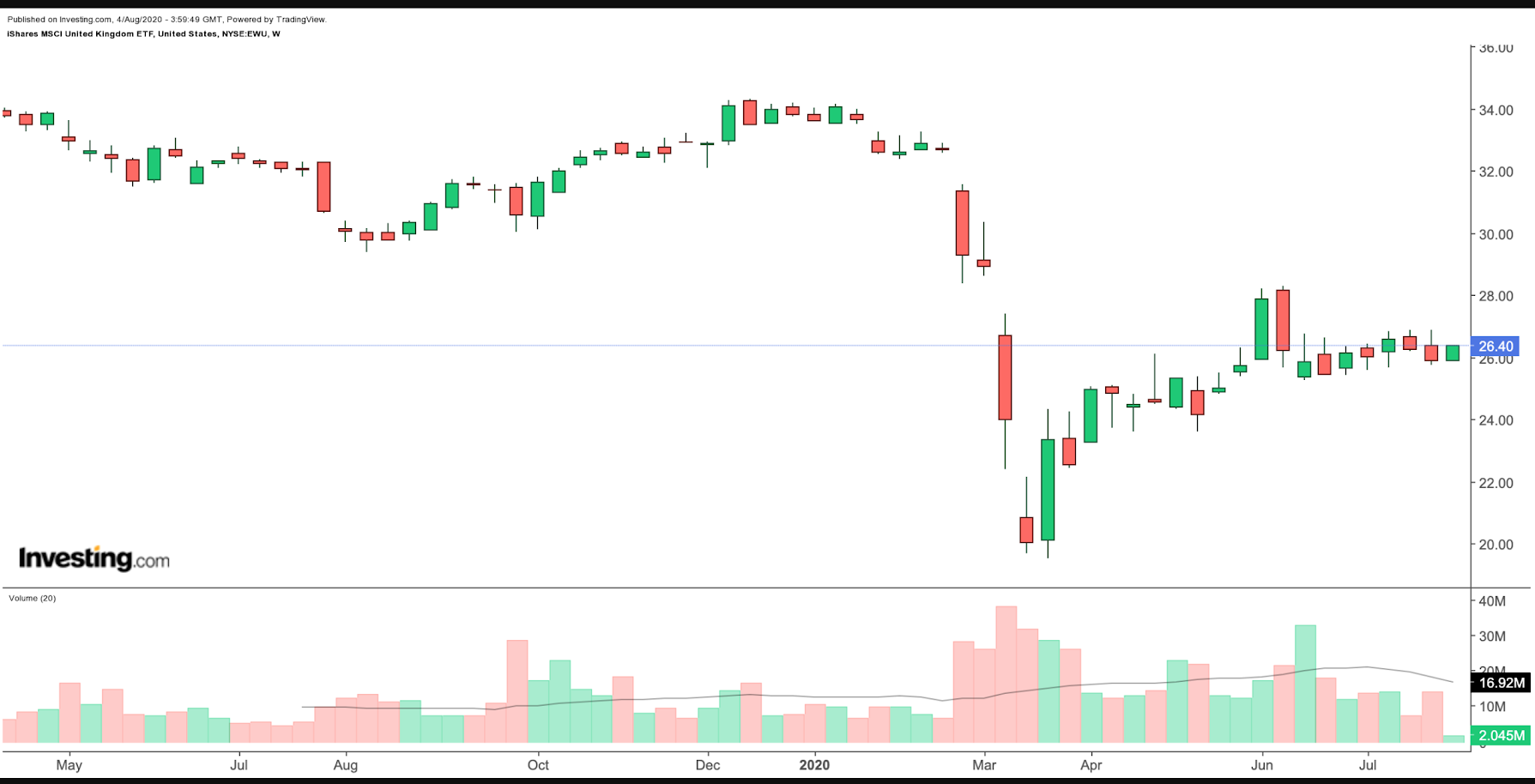

1. iShares MSCI United Kingdom ETF

- Current Price: $26.40

- 52-Week Range: $19.51 - 34.31

- Dividend Yield: 3.88%

- Dividend Distribution Frequency: Semi-annually

- Expense Ratio: 0.50 % per year, or $50 on a $10,000 investment

The iShares MSCI United Kingdom ETF (NYSE:EWU), which currently has 88 holdings, tracks the MSCI United Kingdom index.

First, we'll provide some background on the UK equity markets. London is a center of international financial markets with the London Stock Exchange (LSE) being the primary equity exchange in the UK and the largest one in Europe.

Financial Times and the London Stock Exchange jointly own the FTSE Group, an independent organization that has several indexes of shares covering not only the UK but also other global markets.

The most famous index in the UK, the FTSE 100, was launched in 1984 and primarily consists of multinational conglomerates, with which many global investors would be familiar.

The FTSE 250 index was launched in 1992 and comprises the 101st to the 350th largest companies listed on the LSE. Since stocks listed on the FTSE 250 usually have a domestic focus, they are more directly affected by shorter-term developments in the UK economy.

Although most of the companies in EWU are members of the FTSE 100 index, several come from the FTSE 250. The most important sectors (by weighting) include Consumer Staples (19.91%), Financials (16.90%), Healthcare (14.34%), Industrials (10.66%) and Materials (10.47%). These five sectors comprise around 72% of the fund.

The top ten holdings make up 45% of total net assets, which is around $2.1 billion. EWU's top five companies are AstraZeneca (NYSE:AZN), GlaxoSmithKline (NYSE:GSK), HSBC Holdings (NYSE:HSBC), Diageo (NYSE:DEO) and British American Tobacco (LON:BATS) (NYSE:NYSE:BTI).

Year-to-date, the fund is down about 24%. However, in March, it hit a 52-week low of $19.51, so $1,000 invested in EWU then would now be worth over $1,300.

Although the UK left the European Union on January 31, 2020, the Brexit transition period only ends on Dec. 31, 2020. During this transition period, the UK and the EU are working out a deal on trade, so investors can expect UK-based share choppiness as the end of the year approaches.

2. SPDR EURO STOXX 50 ETF

- Current Price: $37.32

- 52-Week Range: $24.29 - 41.27

- Fund Dividend Yield: 1.65%

- Dividend Distribution Frequency: Quarterly

- Gross Expense Ratio: 0.29% per year, or $29 on a $10,000 investment

The SPDR® EURO STOXX 50 ETF (NYSE:FEZ) which has 50 holdings, follows the Euro Stoxx 50 Index. The most important sectors (by weighting) are Financials (14.08%), Information Technology (13.76%), Consumer Discretionary (13.66%), Industrials (12.42%) and Materials (10.81%). These five sectors comprise 65% of the fund.

The total net assets stand at around $1.7 billion and the top ten holdings make up 42% of the fund. FEZ's top five companies are SAP (NYSE:SAP), ASML Holding (NASDAQ:ASML), Linde (NYSE:LIN), Sanofi (NASDAQ:SNY), and LVMH (PA:LVMH) Moet Hennessy Louis Vuitton (OTC:LVMUY).

Finally, in terms of geographical breakdown, EU members France, Germany, and the Netherlands have the highest contribution, totaling close to 80%.

So far in the year, the fund is down close to 9%. However, it's up over 50% from its lows of March. In recent weeks, economic data out of Europe hasn't been much to write home about. However, the European Central Bank has announced a large stimulus package that will likely support the economy as well as share prices of solid European businesses.

The Bottom Line

ETFs make it easy to invest in European markets without having to select companies individually. Both EWU and FEZ have relatively low expense ratios and are backed by robust economies. As such, long-term investors may want to keep European funds on their radar.