- Airbnb is set to unveil its Q4 2023 financial results, following a strong performance in the previous quarter that saw an 18% growth in revenues, reaching nearly $3.4 billion.

- Anticipation surrounds Airbnb's Q4 report, with expectations of $2.16 billion in revenue and $0.7 EPS, signaling a potential 14% increase in revenue compared to the same period last year.

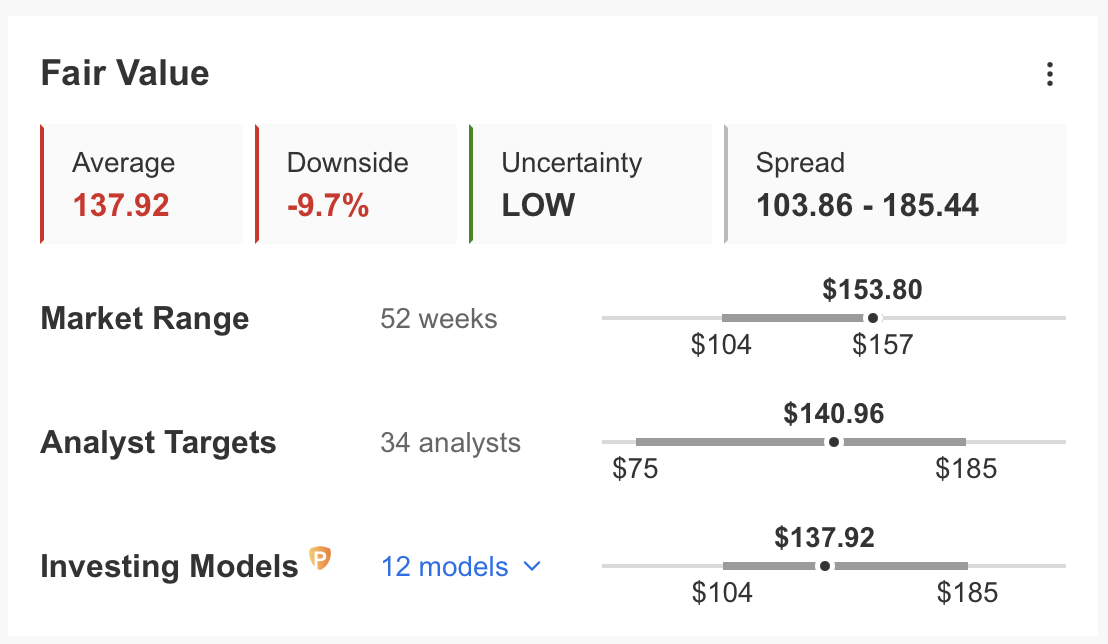

- Despite a robust financial health score of 4 points, the InvestingPro fair value analysis suggests a possible correction of close to 10%.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Airbnb will release its Q4 2023 financial results after the market closes today.

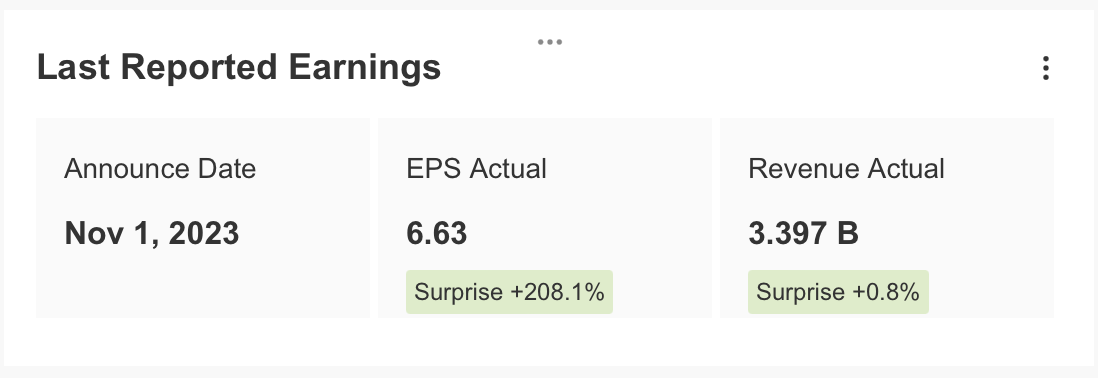

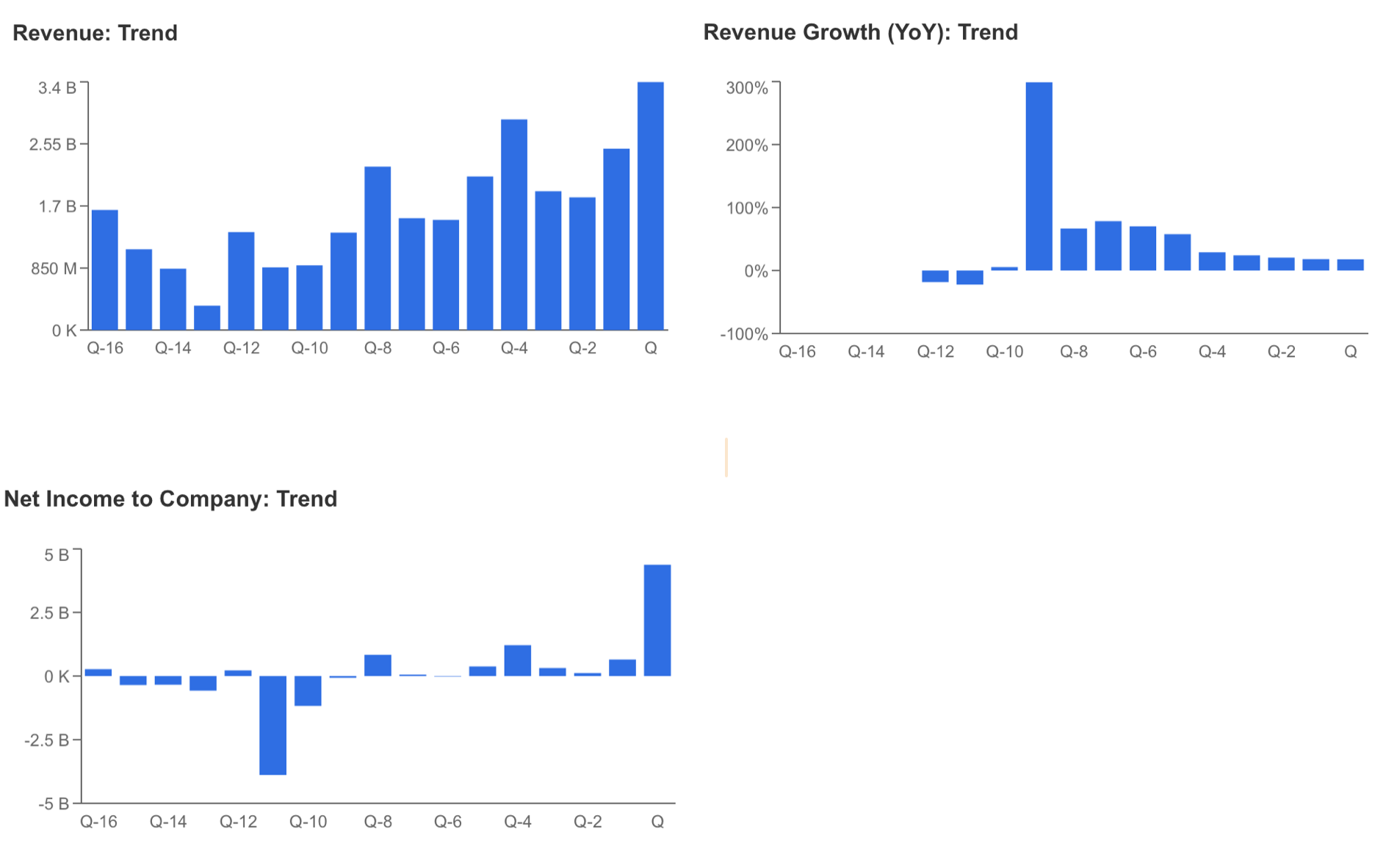

In the previous quarter, the accommodation provider reported revenues of nearly $3.4 billion, reflecting an 18% growth compared to the same period last year.

Following the Q3 results that surpassed revenue expectations, the company also disclosed a net profit of $4.37 billion.

This marks a significant 260% increase compared to the same period the previous year, with a noteworthy portion of the net income growth—$2.7 billion—attributed to a one-time tax advantage

Source: InvestingPro

Consequently, Airbnb achieved earnings per share of $6.63 in Q3, surpassing InvestingPro expectations by an impressive 208%.

Source: InvestingPro

In this article, we will take a deep dive into the San Francisco, California-based giant's fundamentals to better understand were the company stands going into earnings.

Fundamental View: Macro, Geopolitical Issues to Adversely Affect Travel Demand?

With the data indicating that bookings increased in November and December, there is the thought that there may be geopolitical problems and macroeconomic data that may negatively affect travel demand in the market for the current period.

In this uncertain environment, the company's last quarter report is eagerly awaited.

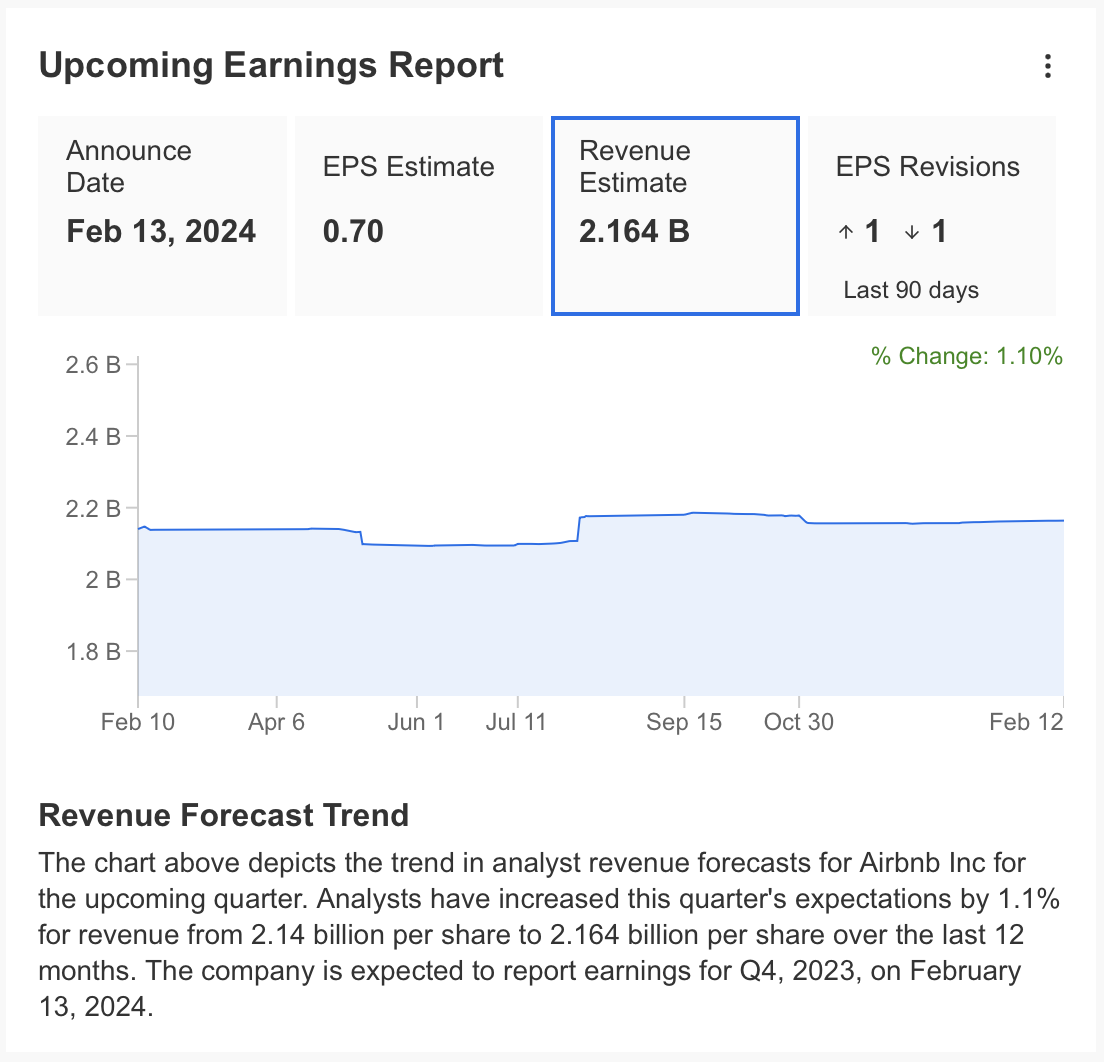

When we take a look at the Q4 expectations via InvestingPro, we see that there is an expectation of $2.16 billion in revenue and $0.7 EPS.

This will mean a 14% increase in revenue compared to the same period last year and will show that the loss of momentum in revenue growth continues.

EPS is expected to increase by 46% compared to $0.48 in the last quarter of last year.

Source: InvestingPro

Airbnb strives to adopt an approach that reduces the cost of accommodation for travelers.

Although the current pricing policy leads to a loss of momentum in revenue growth, it seems to have a positive impact on the company's net income.

Although there are fluctuations in quarterly periods, it has started to generate stable net income since the second half of 2022.

Source: InvestingPro

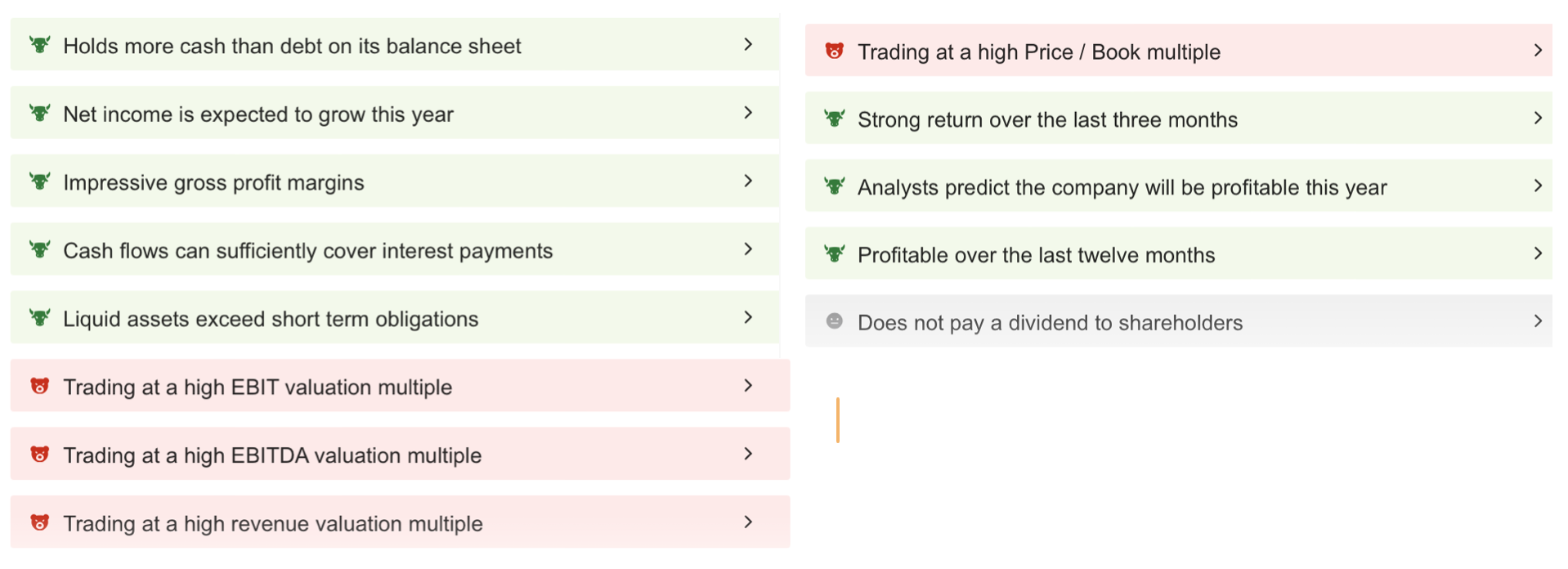

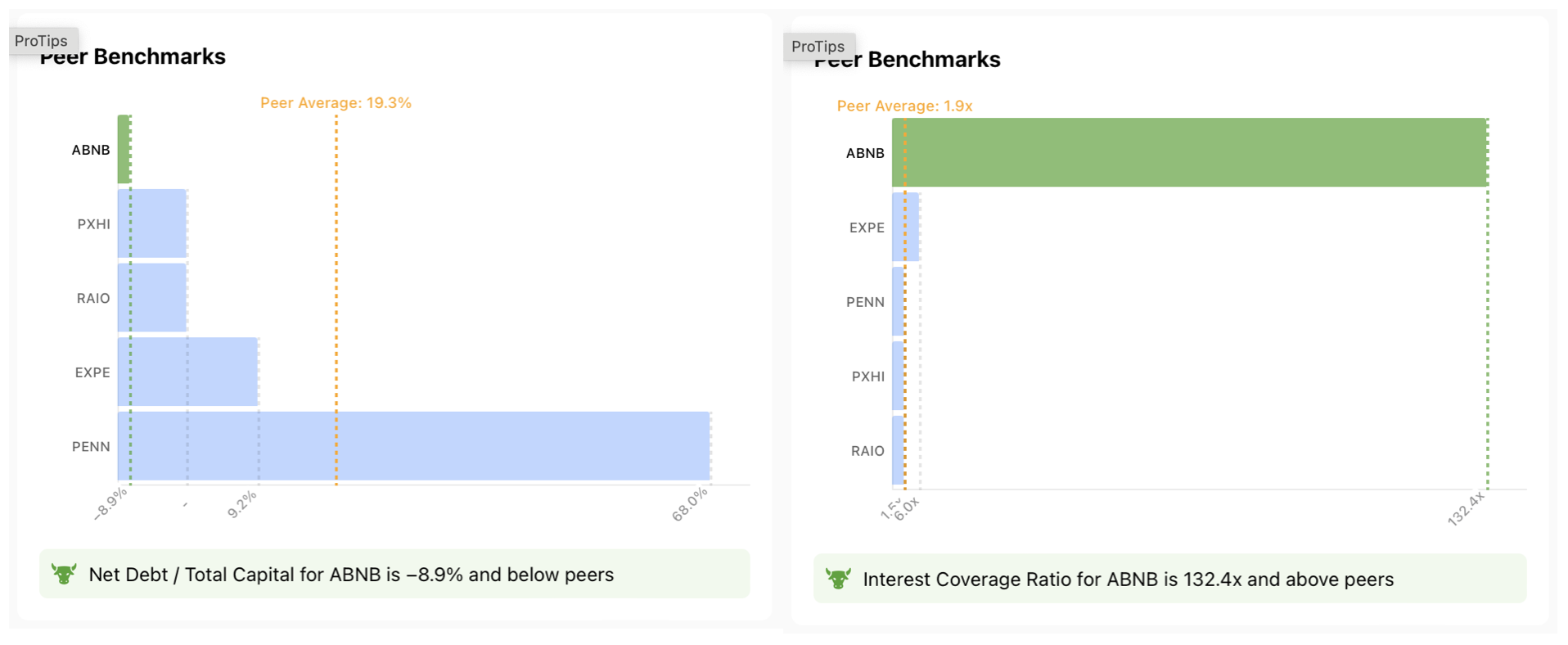

With the ProTips report prepared for Airbnb via InvestingPro, we can make an important inference about the company's financial health by looking at its strengths and weaknesses.

Source: InvestingPro

The fact that the amount of cash on the company's balance sheet exceeds its debt can be interpreted as a strong indicator of its financial health.

Airbnb has a much better Net Debt to Total capital ratio than peer companies, which provides advantages such as the company's ability to resist recessionary periods and its high ability to seize growth opportunities.

On the other hand, the company's cash flow is sufficient to cover interest expenses. Airbnb is currently in a very advantageous position compared to its competitors with an interest coverage ratio of 132.4X.

Source: InvestingPro

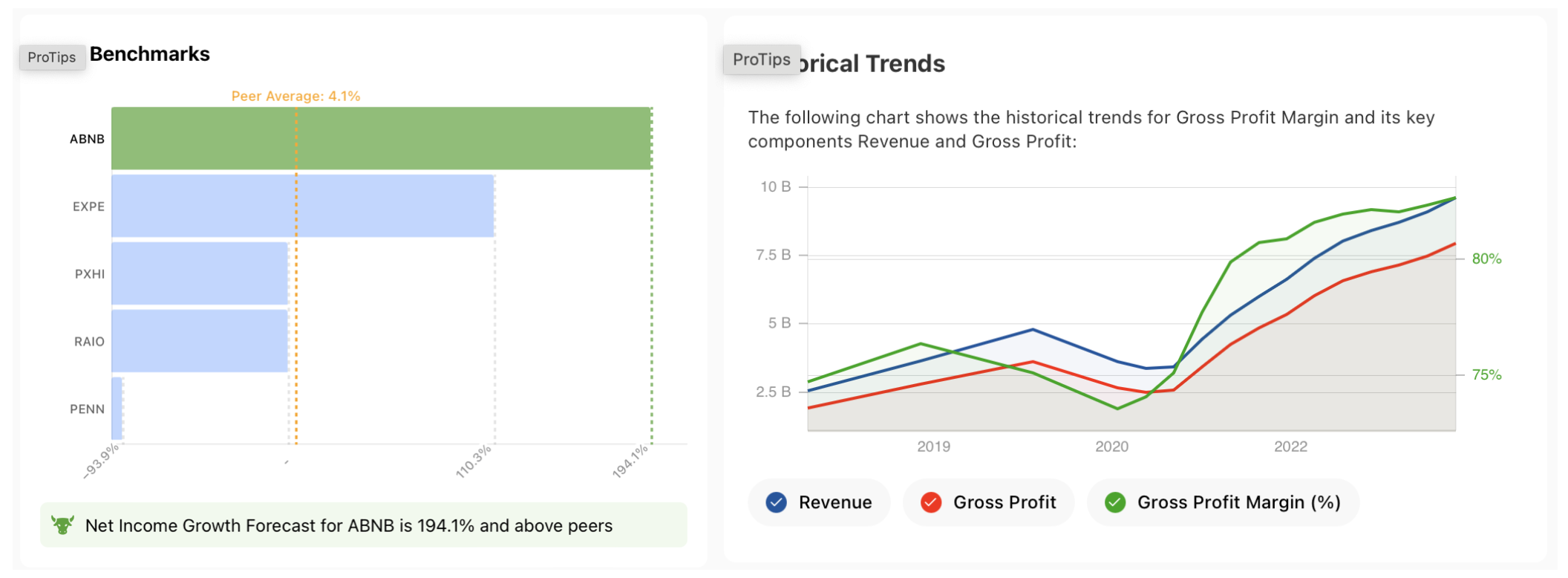

In terms of profitability, the company is expected to significantly increase its net profit in 2023, while the expectation of an annual net profit increase of 194% compared to the peer average of 4.1% is a rate that will attract investors.

In addition, the company's gross profit margin is also at high levels. With an average gross margin of 82.7%, Airbnb reflects that its operations are efficient, it retains pricing power, and has the potential to further increase its net profit.

The company's current ratio of 1.8X, with liquid assets exceeding short-term liabilities, is also an important sign that liquidity is being used efficiently.

In addition, ABNB stock continues to perform strongly, with a return of nearly 30% in the last 3 months, well above the peer average of 1.5%.

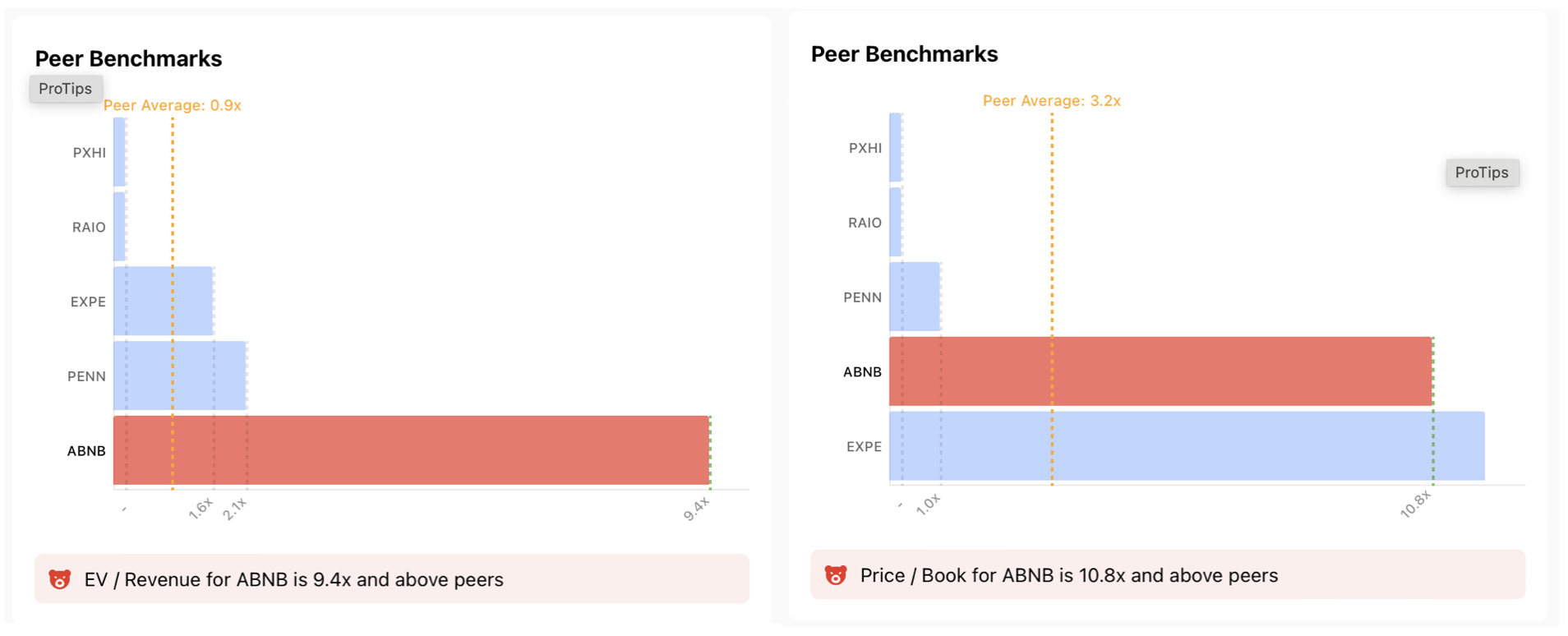

If we examine the factors that may be negative for the company's stock; we can mention that there is a risk of a correction due to the continued overvaluation of the share price.

Although this situation is not always negative, there may be a risk factor such as accelerating sales in case of a deterioration in the financial situation, which is currently considered quite healthy.

Source: InvestingPro

Currently, Airbnb's enterprise value-to-revenue ratio of 9.4X is above the average of 0.9X.

Similarly, the P/B ratio of 10.8X compared to the average of 3.2X reflects that the company's stock is overvalued.

In addition, the fact that the company does not pay dividends can be seen as a negative factor, especially for long-term investment plans.

Source: InvestingPro

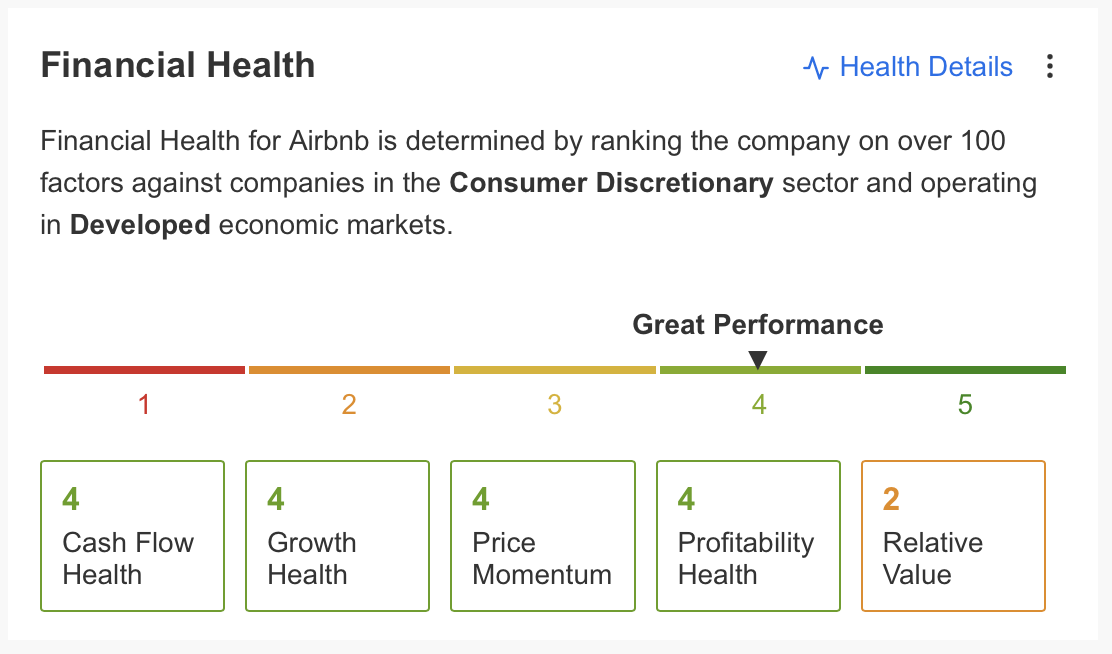

In summary, the financial health chart from InvestingPro rates the company out of 5 in various criteria such as cash flow, growth, price momentum, and profitability.

The company received a solid score of 4 points, indicating a robust financial health.

Source: InvestingPro

The fair value analysis, based on 12 financial models, shows that ABNB's share may see a correction of close to 10% in the coming months and may fall as low as $138.

The consensus forecast of 34 analysts is that the stock could fall as low as 140 dollars. However, the ratios to be updated according to the earnings report to be announced today may also lead to a change in the fair value estimate.

Therefore, using InvestingPro regularly will help you stay alert to changes in the market and current reports.

Airbnb Technical View

This week, the share price surged 4% ahead of the earnings report and started to test its peak in July last year. Closing the week above $155 on average has become important for the upward swing to continue throughout 2023.

A positive earnings report could be the catalyst for ABNB's share to gain momentum. In this case, we can see that the stock may continue towards the Fibonacci target zone in the range of $ 165 - 180 during the year.

On the other hand, if ABNB, which reflects overbought conditions, fails to exceed the $ 155 resistance, this may be seen as an excuse for traders and it may be usual for the stock to retreat towards the lower band of the channel to the range of $ 135 - $ 140.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,427.8% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code UKTopDiscount at checkout for a 10% discount on yearly and bi-yearly InvestingPro plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.