Market Overview

The risk improvement spluttered somewhat yesterday, but there are signs that the market is beginning to take a view that the Coronavirus is past its worst. With the number of new cases at its lowest daily rise since the end of January, there is a sense of optimism that whatever methods that China has employed to get a handle on the situation, they may be working (even if they may appear somewhat severe). However, with the economic fallout yet to be determined on how manufacturing and supply lines have been hampered and growth negatively impacted, the optimism is slightly cautious still.Fed chair Powell notes the FOMC is “closely monitoring” the situation but the economic impact on the US seems to be rather slight at this stage. Interestingly also today, the Reserve Bank of New Zealand held monetary policy steady (no change at 1.00% expected), but also removed its easing bias as it only expected a short term impact of Coronavirus before growth picks up in the second half of the year. The switch out of safety means that Bond yields continue to rise. The US 10 year yield is another +2bps this morning, whilst gold and the yen are slipping.On the risk side, there is a continued sign of Chinese yuan recovery, the Aussie is also gaining ground, whilst the oil price is also showing signs of recovery. However, in equities, which has been a real place to see the risk rally, there is something of a move with the handbrake on, as Wall Street limped into the close last night. There is not the outright bullish response yet and futures are just slightly higher today. Cautious optimism seems to be the strategy.Wall Street closed mixed last night with the S&P 500 +0.2% at 3358, but with US futures another +0.2% higher today, there has been some decent support on Asian markets (Nikkei +0.7%, Shanghai Composite +0.9%). In Europe this translates to mild gains in early moves, with FTSE futures +0.2% and DAX futures also +0.2%.There is a further recovery in risk appetite across forex majors. The RBNZ decision has certainly helped NZD to outperform today which is over 1% higher against the dollar, whilst AUD and GBP also continue their recent rebounds. JPY is the underperformer increasingly.In commodities, the drift lower on gold is into a second day, whilst the recovery is once more having a go this morning on oil which is around +1.5% higher.It is a quiet day for the economic calendar today. The only real data point of the European morning is the Eurozone Industrial Production at 1000GMT which is expected to continue to deteriorate with a -1.6% decline in the month of December (after growing by +0.2% in November), which would mean a year on year decline of -2.3% (-1.5% in November). With little of note in the US session, the EIA Crude Oil Inventories at 15:30 GMT are expected to show stocks building by +2.9m barrels (+3.3m barrels last week).It is day 2 for Fed chair Powell Congressional testimonies this time to the Senate Banking Committee at 1500GMT. The written testimony is the same as yesterday, but the questions he fields will clearly be different and may pull some surprises out of the chair. There is another Fed speaker today with Patrick Harker (board member voter, who leans slightly hawkish) is speaking at 1330GMT.

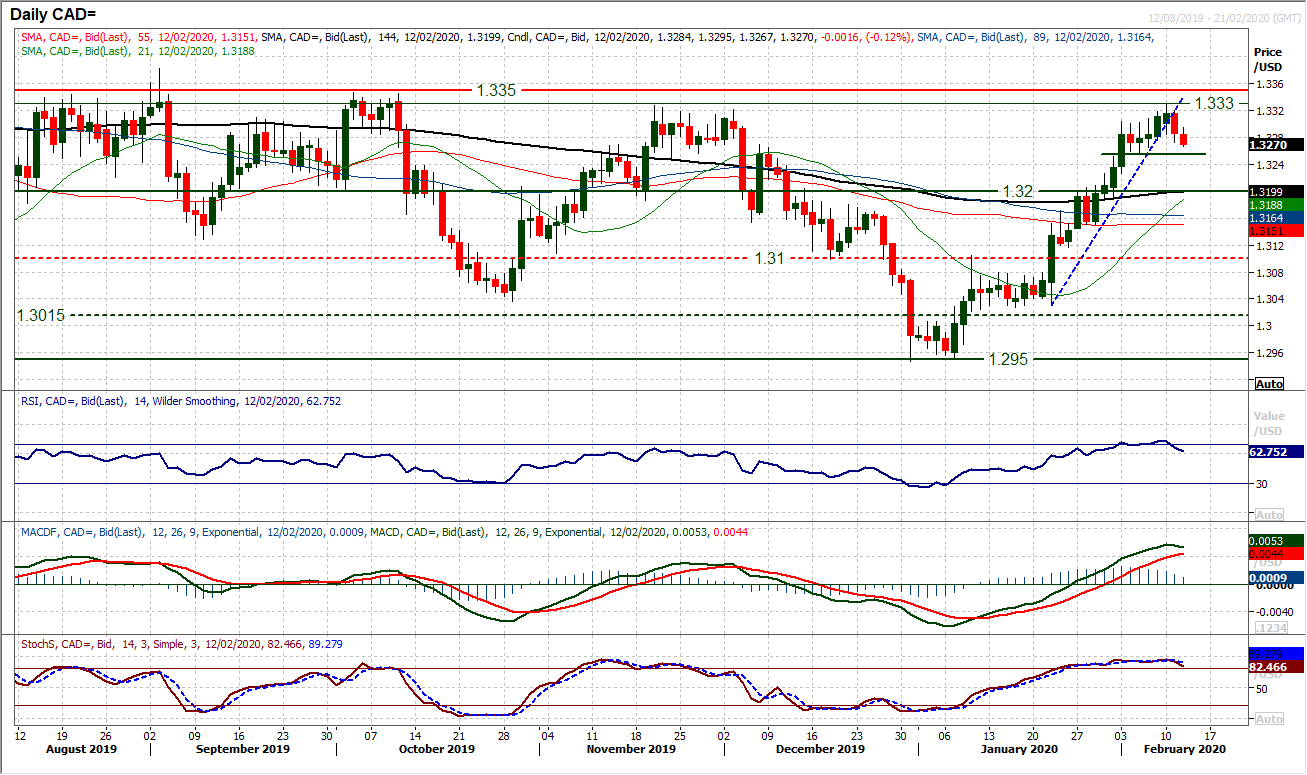

Chart of the Day – USD/CAD

Risk appetite is improving and with the oil price picking up, this should help the Canadian dollar. The signs of renewed correction on USD/CAD are growing. Last week we discussed the potential of the market finding resistance in the key band between 1.3300/1.3350 and yesterday’s bearish candle opens the prospect of the market starting to correct again. A broken three week uptrend comes with the RSI crossing decisively back below 70. This is the first time the RSI has done this since January 2019, and in each of the six occasions since the beginning of 2017 when the RSI has crossed back under 70, the market has engaged a decisive correction. MACD lines are slowing their advance and Stochastics are also rolling over now (not yet a confirmed bear cross). The hourly chart suggests the support at 1.3260 will be key to generating downside momentum initially and a breach would open 1.3100/1.3200 which both seem to be mid-range pivots. Yesterday’s bear candle has now left resistance at 1.3330 under 1.3350 which is key. This reversal needs confirmation still, but the signs are growing.

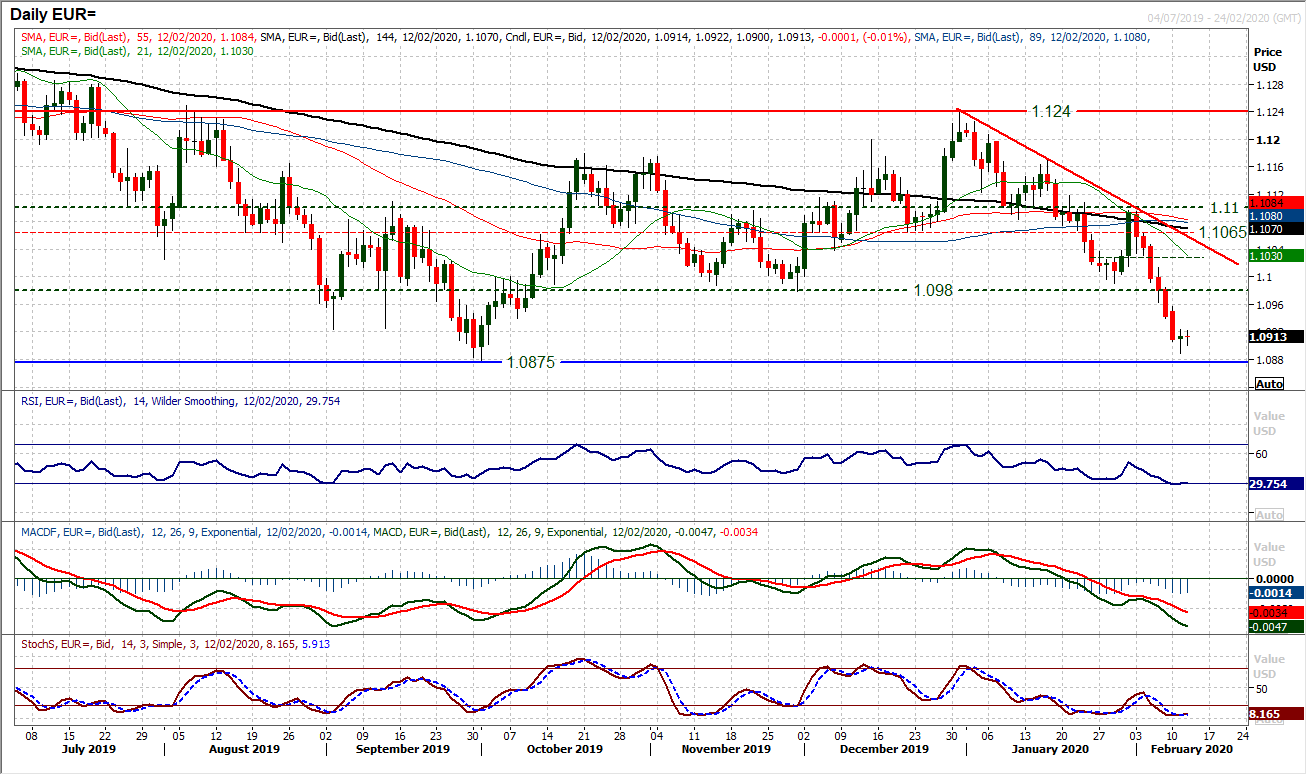

EUR/USD

The euro remains under pressure but for the first time in a while, there is a suggestion that the downside impetus may be beginning to slow. This comes as a crucial long term support at $1.0875 draws perilously close. Yesterday’s intraday rebound off $1.0890 may have left an initial low of a marginally positive candle, but the bulls do not seem ready yet. However, the RSI is moving into extreme territory. It is very rare that the RSI moves below 30 on EUR/USD and when it does, this tends to be a strong contrarian signal. For now though, momentum remains against the euro, as the MACD lines continue to falter and Stochastics remain stuck in bearish configuration. The hourly chart shows how a succession of lower highs and lower lows where old support becomes new resistance continues. So the importance of $1.0940 is growing. This is the first real resistance. To be tested, realistically, there needs to be an improvement in hourly momentum, where RSI needs to consistently pull above 50 and MACD needs to be above neutral. Whilst these conditions are not met, then rallies will continue to falter and $1.0875 will be tested. Below there the market is at multi-year lows and eyes $1.0500/$1.0600.

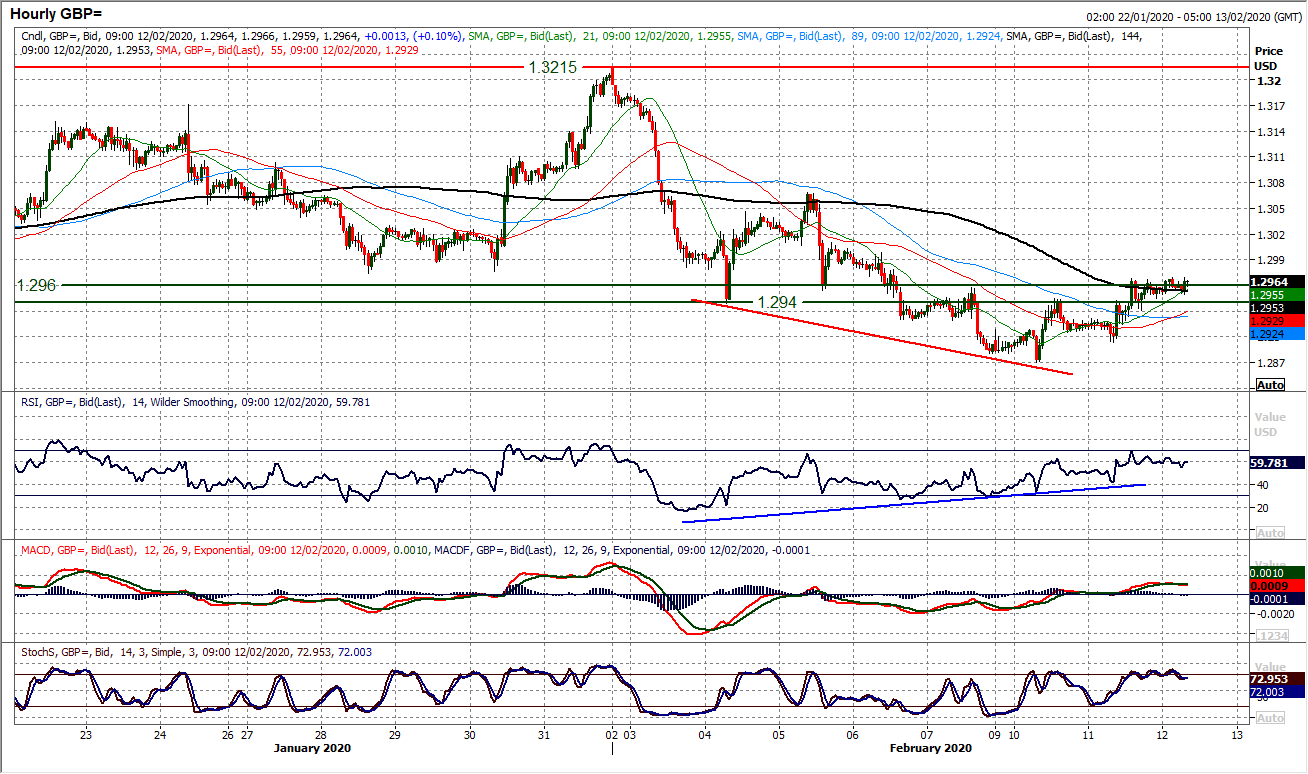

GBP/USD

The prospect of a near term recovery on Cable is growing. A second positive candle has seen the market pick up well this week and the resistance of overhead supply between $1.2940/$1.2960 is being tested. The recovery prospects are reflected best on the hourly chart in the wake of the bullish divergence with improving momentum. A decisive move clear of $1.2960 would also constitute a small basing pattern (arguably an inverted head and shoulders) which would imply +90 pips towards $1.3050. Holding above $1.2940 would certainly now help the recovery effort this morning. The daily chart shows a hint of recovery too, with the RSI picking up from 40 as Stochastics also look to post a recovery bull cross. Support at $1.2870 is increasingly important now. We turned more neutral on Cable on a medium term basis recently following the breakdown below $1.2900 but remain open to the prospect of a ranging formation now. This potential recovery plays into that. Initial resistance is $1.3070.

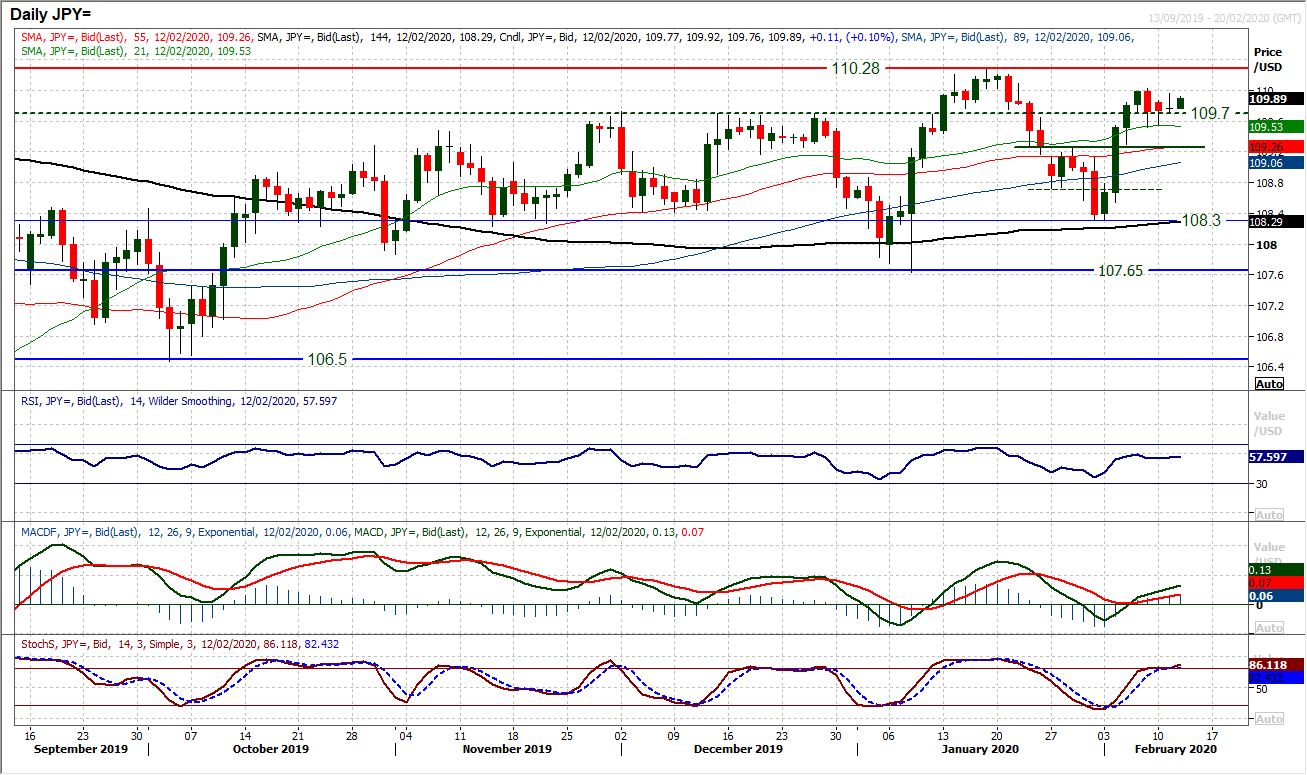

USD/JPY

Dollar/Yen is an interesting chart at the moment as the broad market grapples with a move out of safety and into risk. This should provide support for Dollar/Yen. Subsequently, we find USD/JPY forming support around the old 109.70 key breakout. As part of the ongoing positive bias we see pressure on 110.00 before an expected test of 110.30 in due course. Intraday corrections through a consolidation of the early part of this week have been bought into, and whilst the support of the pivot at 109.25 holds then the outlook will remain positive. Momentum indicators are still retaining their positive bias with the RSI and MACD above their neutral points, and although they also retain upside potential on historical moves, the impetus has ebbed in recent sessions. This is reflected in a perfect doji candlestick yesterday (open and close at the same level, rare in forex). Whilst the market remains stuck under 110.00 the consolidation looks set to continue.

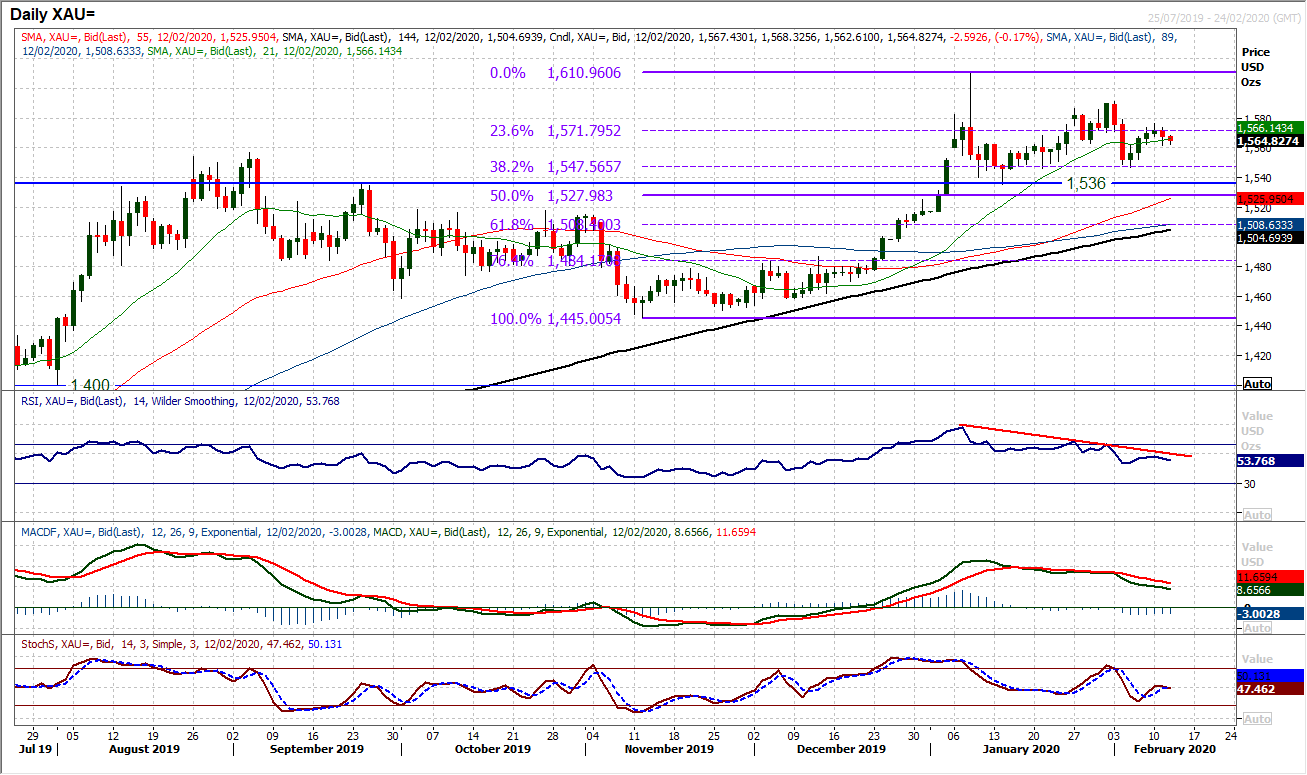

Gold

With renewed positive risk appetite, the gold price has rolled over. A mildly negative session yesterday has bolstered our near to medium term neutral outlook on gold as the market. This comes as the market has started to effectively consolidate between the 23.6% Fibonacci (of $1445/$1611) and 38.2% Fib levels at $1572 and $1548 respectively. The momentum indicators retain their mild corrective/unwinding drift lower which is pulling RSI and MACD lines gradually back towards their neutral areas. In the past few sessions, the Stochastics have also been flattening around 50 (i.e. neutral). The hourly chart shows that initial support at $1562 is being tested now, but is holding initially. This near term pivot level is preventing a continued corrective back towards $1546. Hourly momentum has a very slight negative bias which is a drag lower on the market this morning. Resistance around $1577 is growing as a potential lower high, whilst yesterday’s high just shy of $1574 is bolstering this barrier. Gold has entered a quiet phase as the market tries to work out its next move on Coronavirus.

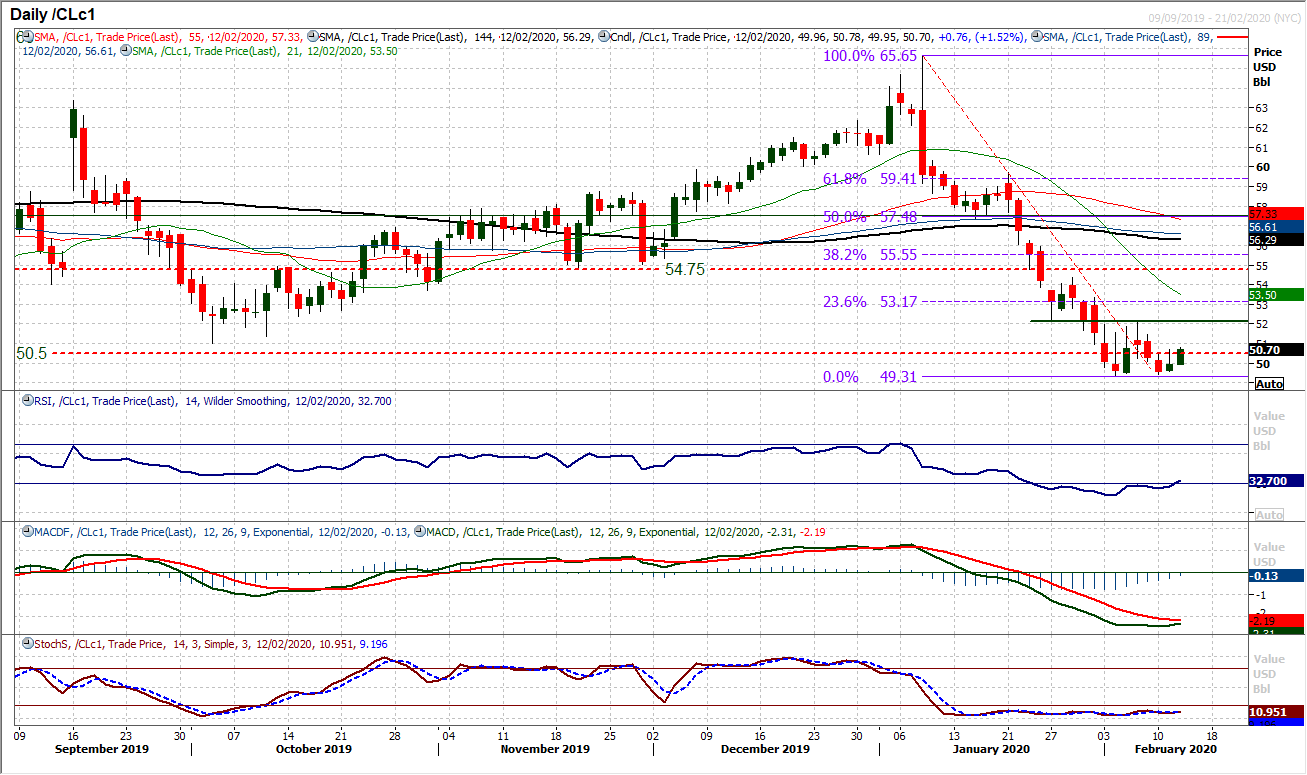

WTI Oil

The potential for a recovery has been growing over the past 24/36 hours. A growing floor of support is forming at $49.30 and if the market can now build on yesterday’s slightly positive candle, then a base pattern may not be out of the question. A second positive candle today would go a long way towards this process. There are early hints on momentum, with the RSI crossing back above 30 for the first time in almost three weeks, whilst MACD lines are bottoming. Interestingly, the sensitive Stochastics have not yet picked up (largely due to yesterday’s close having been below the session mid-point), but a decisive bull candle today may begin to shift this. The hourly chart shares these recovery hints, with the hourly MACD lines rising above neutral for the first time in a few days, whilst hourly RSI is also ticking higher. The real resistance that needs to be overcome is at $52.15 which is a pivot and above which is a completed base pattern. The market now holding on to $49.70 support but also building above $50.00 would be a sign of intent that the selling pressure has dissipated. Still very early days, but at least encouraging signs for a change.

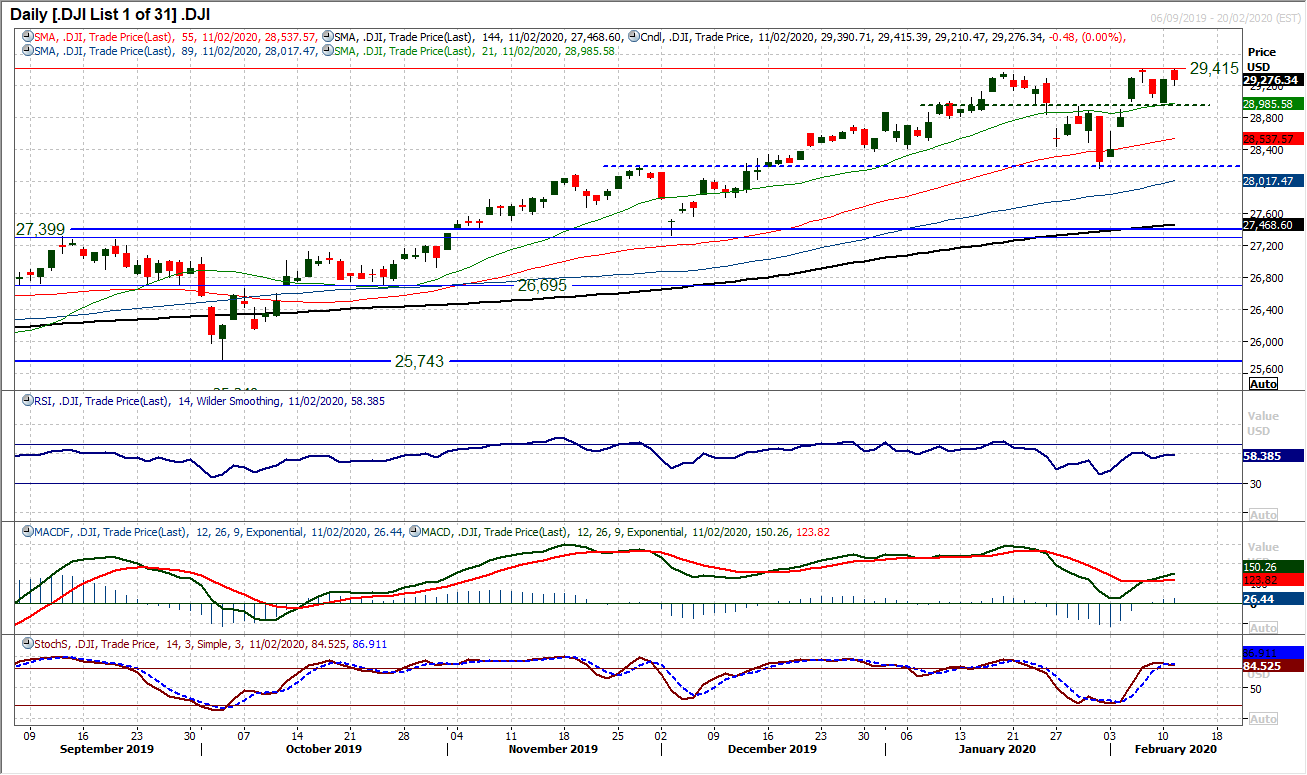

Dow Jones Industrial Average

Wall Street just has a bit of a pause for thought yesterday as moves to all-time highs were pared. The Dow is still playing catch up on the S&P 500 and NASDAQ, so only yesterday did it see an all-time high, with a handful of ticks of breakout before seeing the rest of the session trading lower. The resulting negative candlestick does not change the renewed positive outlook, but it does give the bulls something to think about. This is a period where there is still uncertainty surrounding how to play the Coronavirus and intraday moves reflect this lack of trend. Despite this though, there is still a positive bias on momentum (RSI up above 50, MACD lines rising above neutral and Stochastics above 80) so there is an appetite to be long. The support of the pivot at 28,950/29,000 is increasingly important. Weakness is a chance to buy and a close clear of the now all-time high of 29,415 opens 30,000.

DISCLAIMER: This report does not constitute personal investment advice, nor does it take into account the individual financial circumstances or objectives of the clients who receive it. All information and research produced by Hantec Markets is intended to be general in nature; it does not constitute a recommendation or offer for the purchase or sale of any financial instrument, nor should it be construed as such.

All of the views or suggestions within this report are those solely and exclusively of the author, and accurately reflect his personal views about any and all of the subject instruments and are presented to the best of the author’s knowledge. Any person relying on this report to undertake trading does so entirely at his/her own risk and Hantec Markets does not accept any liability.