This article was written exclusively for Investing.com

The sinking US dollar has sparked a massive move higher in emerging market equity prices. The iShares MSCI Emerging Markets ETF (NYSE:EEM) has soared by more than 85% since its March lows. That easily outperforms the S&P 500 gains of over 70%. Whether these equity markets can continue to rise may lie in the direction of the next significant move in the US dollar.

The falling dollar benefits local economies because it makes it cheaper to pay back US-denominated debt. At the same time, it also sparks a rally in dollar-denominated commodities. The higher-priced commodities help to boost overall revenue and profits for businesses. This has resulted in the markets in technology-heavy export economies like Taiwan and South Korea exploding higher over the past year.

Trend May Be Ready to Reverse

However, a strong dollar could quickly unwind this entire trade, with tailwinds becoming headwinds. While it may be too early to tell if the dollar's trend is finally about to reverse, it has started to show some improvement, with the dollar index stabilizing currently around 89. Meanwhile, the technical trends based on the relative strength index have formed a bullish divergence, as the index has made a series of lower lows. In contrast, the RSI has made a series of higher highs.

Additionally, interest rates in the US have started to move up a bit. The stabilizing dollar and higher yields could be suggesting the market believes that more substantial growth may be about to return to the US economy. If that is the case and the market views better growth in the future, it could further strengthen the dollar.

Emerging Markets That Could Suffer

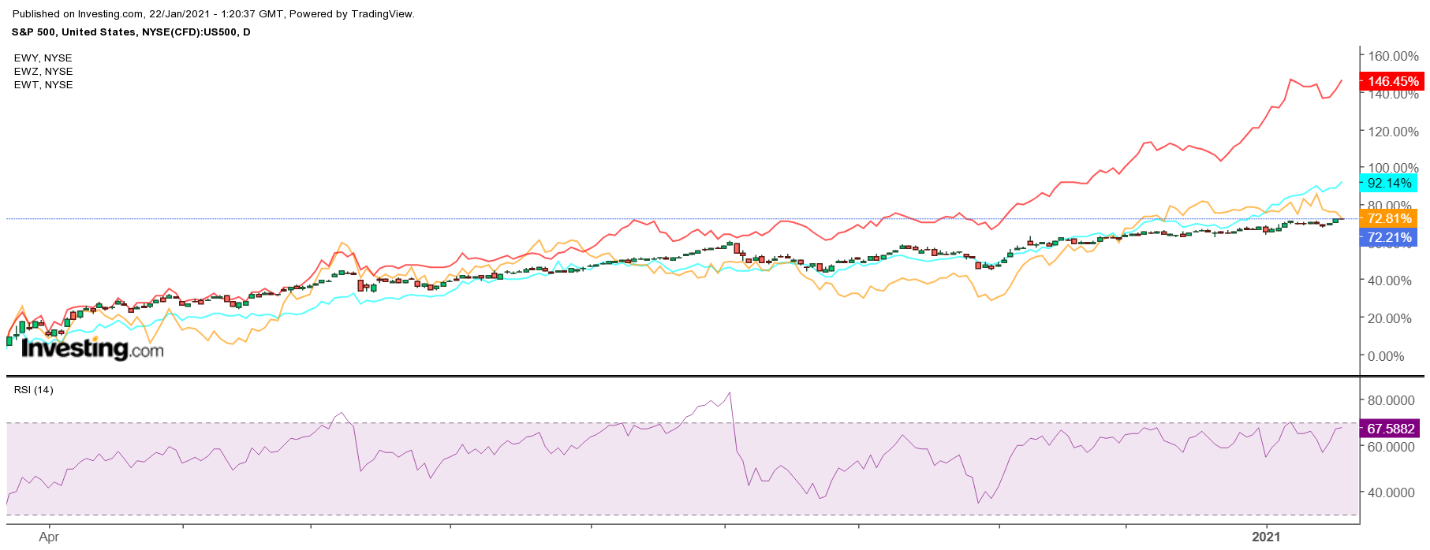

For example, the iShares MSCI South Korea ETF (NYSE:EWY) could be one of those proxies to falter. The ETF has soared by almost 150% from its March lows as it tracks the broader South Korean equity markets. Additionally, the iShares MSCI Taiwan ETF (NYSE:EWT) has just about doubled off its March lows.

Brazil is a heavy exporter of commodities such as Iron Ore and Oil. The weaker dollar has undoubtedly helped lift these exports substantiality over the recent months. This has helped the iShares MSCI Brazil ETF (NYSE:EWZ) rise by more than 70% over the same time.

For Tailwind to Continue

If the dollar continues to stay weak or weaken even further, it is likely to act as a significant tailwind to these markets, helping to lift their equity markets to even higher levels. This is one reason why the dollar's movement is so essential currently. A reversal in the dollar could be the cue that the trade is about to run out of steam.

The dollar may continue to sink, though. The Federal government has plans to issue even more stimulus this year, sending yields higher, not on optimism but because of the additional supply of bonds coming to the market. If rising yields are interpreted negatively, instead of the dollar index stabilizing and moving higher, the higher US spending would likely sink the dollar even further.

The emerging-market trade has clearly been one of the big winners of the post-pandemic melt-up. But that also means which way the dollar heads over the next several months will have a big say on where these markets go from here.