- Markets have ended February on a bullish note as March gets underway.

- Some stocks have soared, while some have lagged.

- Today, let's explore stocks that analysts recommend, with buy ratings of at least 80%.

- Investing in the stock market? Take advantage of our InvestingPro discounts. More information at the end of this article.

- 1931: +11.37%

- 1986: +7.15%

- 1998: +7.04%

- 1991: +6.73%

- 1945: +6.16%

- 1938: +6.08%

- Constellation Energy (NASDAQ:CEG): +39%

- Ralph Lauren (NYSE:RL): +29.41%

- Nvidia (NASDAQ:NVDA): +28.58%

- Meta (NASDAQ:META): +25.63%

- Quanta Services (NYSE:PWR): +24.46%

- Paramount (NASDAQ:PARA): -24.33%

- Charter Communications (NASDAQ:CHTR): -20.71%

- Insulet (NASDAQ:PODD): -14.08%

- Amgen (NASDAQ:AMGN): -12.87%

- Warner Bros Discovery (NASDAQ:WBD): -12.28%

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add shortly.

The S&P 500 ended February with a gain of more than +5% for the eleventh time in history. The last time we had a February up more than +5% was in 2015.

Throughout history, the best February months have come in the following years:

Among the 500 stocks in the S&P, 350 went up while 150 declined during February.

The top-performing stocks in February were:

On the flip side, the worst-performing stocks were:

Today, we'll delve into stocks listed on Wall Street with a high percentage of buy ratings (at least 80-85%). We'll utilize the InvestingPro tool to access essential data and information.

1. Kratos Defense & Security Solutions

Kratos Defense & Security Solutions (NASDAQ:KTOS) is a US company in the defense sector, specializing in drones, satellite communications, cyber defense, missiles, and combat systems.

It was formerly known as Wireless Facilities Incorporated. It is headquartered in San Diego, California, and was created in 1994.

It reports results on May 1. The previous ones were good with earnings per share (EPS) +42.4% above expectations. Now it is estimated to have +5.07% revenue growth and for the whole 2024 +9.8%.

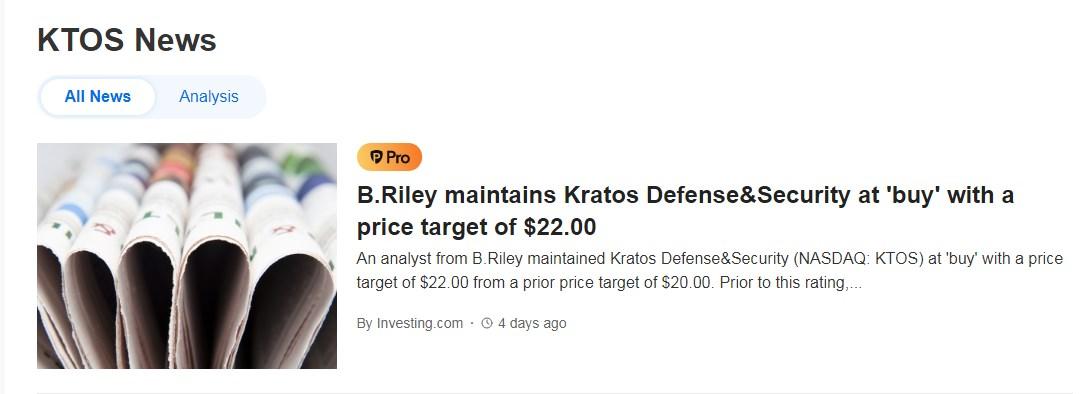

Source: InvestingPro

It has a market cap of approximately $2.62 billion and over the last twelve months through Q4 2023, revenue growth was a remarkable +15.45%.

This growth is a product of the company's expanding operations. In addition, the company's liquid assets exceed its short-term obligations, indicating a stable financial position to meet its immediate liabilities.

Source: InvestingPro

Among its ratings, 75% are buy, 25% hold, and 0% sell.

In the last year, its shares are up +38.59%.

The market gives it a 12-month price target of $21.80.

Source: InvestingPro

2. AAR

AAR Corp (NYSE:AIR) is a U.S. provider of aircraft maintenance services to commercial and government clients worldwide. The company is headquartered in Wood Dale, Illinois, and was established in 1951.

On March 19 we will know its accounts and its revenues are expected to increase by +9.78%. For 2024 the expectation is +13.7% and for EPS +16.4%.

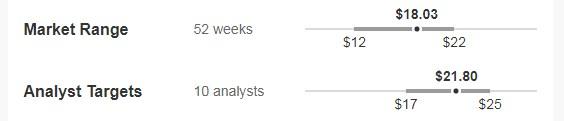

Source: InvestingPro

The company has acquired Triumph Group's (NYSE:TGI) components business, which manufactures engine structures, airframes, and accessories for $725 million. The deal will close in the first half of the year.

Source: InvestingPro

Among its ratings, 100% are buy and it has no hold or sell ratings.

Its shares have risen by +18.82% in the last year.

The market sees a 12-month potential at $78.

InvestingPro

3. Howmet Aerospace

Howmet Aerospace (NYSE:HWM) is a company that provides advanced engineering solutions for the aerospace and transportation industries worldwide.

The company was formerly known as Arconic. It was founded in 1888 and is headquartered in Pittsburgh, Pennsylvania.

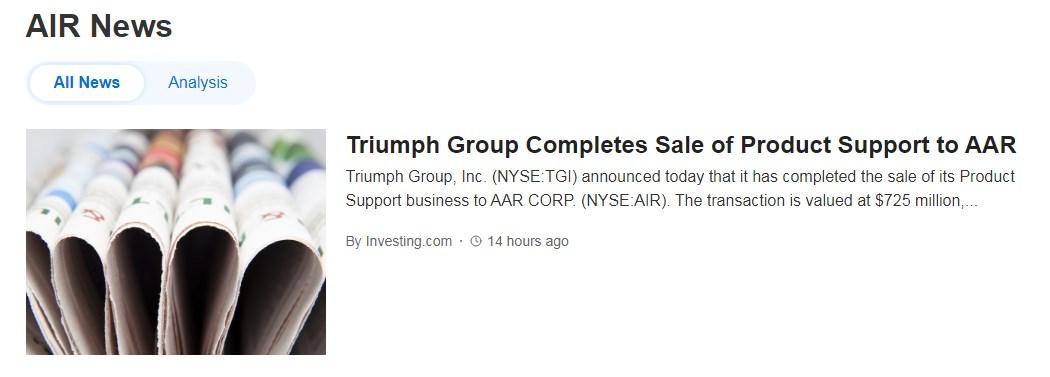

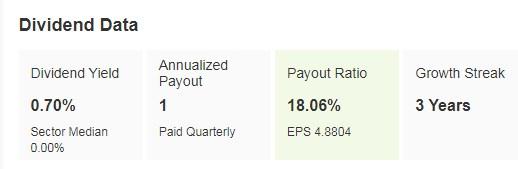

Its dividend yield is +0.30%.

Source: InvestingPro

On April 30 we will know its accounts and it is expected an increase in revenues of +8.31%. By 2024 the increase would be +7.7% and earnings per share (EPS) +19.8%.

Source: InvestingPro

It presents 85% of its ratings as buy, 15% as hold, and no sells.

Its shares are up +55.11% in the last year.

Jefferies just raised its price target to $74.

Source: InvestingPro

4. Woodward

Woodward (NASDAQ:WWD) designs control solutions services for the aerospace and industrial markets worldwide. The company was founded in 1870 and is headquartered in Fort Collins, Colorado.

Its dividend yield is +0.70%.

Source: InvestingPro

On April 29 we will have the report of its accounts and an increase in revenue of +12.06% is expected. By 2024 the increase would be +11.4% and earnings per share (EPS) +27.5%.

Source: InvestingPro

80% of its ratings are buy, 15% hold and 5% sell.

Its shares are up +41.67% in the last year.

Its potential is at $156.70.

5. PDD

PDD Holdings (NASDAQ:PDD) focuses on bringing companies and people into the digital economy. It was formerly known as Pinduoduo and changed its name in February 2023.

It was incorporated in 2015 and is based in Dublin, Ireland. It is listed on Nasdaq.

On March 13 it will release its numbers and is expected to increase revenues by +56.08%. By 2024 the increase would be +36.6% and earnings per share (EPS) +26.7%.

Source: InvestingPro

The company is known for its innovative approach to e-commerce in China and has been the subject of interest for investors looking to take advantage of the fast-growing digital economy in the country.

85% of its ratings are Buy, 15% Hold and none Sell.

Its shares are up +32.47% over the past year.

The market gives it a potential at $173.81, although Morgan Stanley (NYSE:MS) raises it to $181.

Source: InvestingPro

***

Do you invest in the stock market? Set up your most profitable portfolio HERE with InvestingPro!

Take advantage HERE AND NOW! Use code INVESTINGPRO1 and get 40% off your 2-year subscription. With it, you will get:

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.