-

Smaller stocks offer opportunities beyond the big tech companies and the Magnificent 7.

-

Many small-cap stocks have surged by more than +30% year-to-date.

- In this piece, we will take a look at 4 such stocks you can consider adding to your portfolio.

- Investing in the stock market, want to get the most out of your portfolio? Try InvestingPro+! Sign up HERE, and take advantage of up to 38% off your 1-year plan for a limited time!

Since last year, all the attention has been on big tech companies, especially those in the Magnificent 7. That's understandable given their strong performance.

But there's more to the market than just these giants. Today, let's shift our focus to smaller companies.

The S&P 600 Small Cap ETF (NYSE:SPSM) gained 'only' +14% in 2023 compared to the S&P 500's +24.2%, and it's also trailing behind this year.

That doesn't mean there aren't individual stocks performing exceptionally well (up more than +30% this year) and worth considering.

Established in 1994, the S&P 600 consists of small-cap companies closely tied to the domestic market. These companies must have a market capitalization of at least $750 million and have demonstrated solid financial performance over the last four quarters.

Compared to other small stock indexes like the Russell 2000, the S&P 600 has historically delivered higher returns.

Let's delve into some of these companies with the assistance of InvestingPro, which will provide us with essential data and insights.

These stocks share several common traits:

- They've surged more than +30% so far this year.

- Their earnings outlook for 2024 and beyond is promising.

- The market sees significant upside potential for them for the remainder of the year.

1. Kaman (KAMN)

Kaman (NYSE:KAMN) is an American aerospace company, headquartered in Bloomfield, Connecticut.

It was founded in 1945 and for the first ten years was dedicated exclusively to designing and manufacturing helicopters and now manufactures all types of aircraft parts.

It will pay a dividend of $0.20 per share on April 11, and to receive it, shares must be held by March 18. The annual dividend yield is +1.74%.

Source: InvestingPro

On April 30, it presents its results, and revenue is expected to increase by +5.43%. Looking ahead to 2024, the EPS (earnings per share) forecast is for an increase of +70.4%, and in 2025 another increase of +61.9%.

Source: InvestingPro

The company has a valuation of $1.3 billion. Its shares are up +112.24% in the last 12 months and +96.83% in the last 3 months.

The market sees potential for it at $51.50.

Source: InvestingPro

2. AdaptHealth

Adapthealth (NASDAQ:AHCO) is based in Plymouth Meeting, Pennsylvania. It is a network of companies that offer customized products and services to empower patients to live better lives, out of the hospital and in their homes.

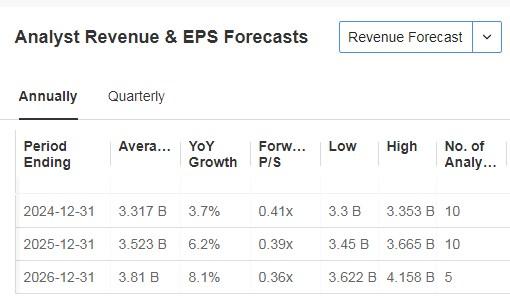

On May 7, we will learn about their bottom line. For the 2024 computation, revenue growth is expected to be +3.7% and for 2025 +6.2%.

Source: InvestingPro

Its shares in the last 12 months are down -24.50% and in the last 3 months are up +33.33%.

It has 10 ratings, of which 6 are buy, 4 are hold and none are sell.

Investing models give it a potential at $15.64.

Source: InvestingPro

3. Ultra Clean Holdings

Ultra Clean Holdings (NASDAQ:UCTT) develops and supplies ultrahigh-purity cleaning components, parts and services for industry. It was founded in 1991 and is based in Hayward, California.

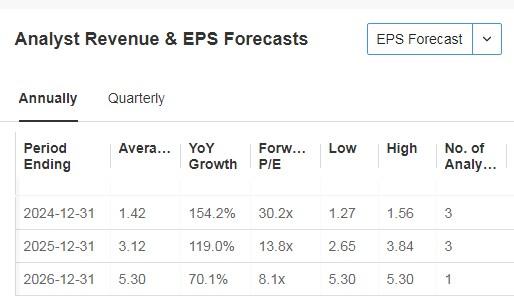

Its accounts will be released on April 24. Looking ahead to 2024, EPS is expected to increase by +154.2% and in 2025 by +119%.

Source: InvestingPro

Its shares in the last 12 months are down -38.72% and in the last 3 months are up +36.82%.

It has 3 ratings and all of them are buy.

Source: InvestingPro

InvestingPro models give it potential at $52.36.

Source: InvestingPro

4. DXP Enterprises

DXP Enterprises (NASDAQ:DXPE) was founded in 1908 and is headquartered in Houston, Texas.

The company for more than 100 years has served as a leading industrial distribution expert specializing in bearings and power transmission, metalworking, industrial supplies.

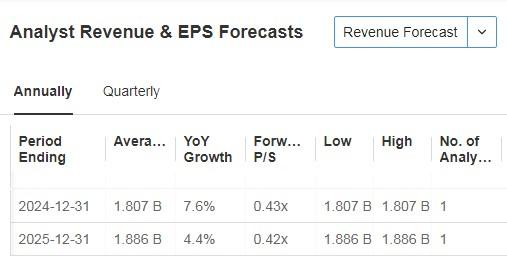

It will report its numbers on May 7, with revenue and EPS expected to increase. Looking ahead to the current fiscal year, expectations are for revenue growth of +7.6% and in 2025 +4.4%.

Source: InvestingPro

The company, which has diversified its end markets, attributes its growth to strategic acquisitions.

The commitment to double the size of its business over the next few years remains firm as it continues to generate substantial free cash flow and invest in its workforce.

Its shares over the last 12 months are down -86.02% and over the last 3 months are up +45.94%.

The market assigns it a potential of $65.

Source: InvestingPro

***

Investing in the stock market? Determine when and how to get in or out, try InvestingPro.

Take advantage HERE & NOW! Click HERE, choose the plan you want for 1 or 2 years, and take advantage of your DISCOUNTS.

Get from 10% to 50% by applying the code INVESTINGPRO1. Don't wait any longer!

With it, you will get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a large amount of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.