- Upcoming U.S. retail sales data is expected to influence market perceptions, building on a recent increase.

- Companies like Target and Anheuser-Busch InBev are poised for potential growth in the retail sector.

- Market analysts are projecting positive earnings reports from leading retail and consumer companies this quarter.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Hedge funds have significantly ramped up their positions in U.S. technology stocks, particularly in semiconductors and hardware sectors. This aggressive buying spree marks the most significant surge in the past five months and comes just as the corporate earnings season for the third quarter gets underway.

The sector is being watched, especially after reports from Taiwan Semiconductor Manufacturing (NYSE:TSM) and ASML (AS:ASML), which have caused considerable market movements. Eagerly anticipated reports from Advanced Micro Devices (NASDAQ:AMD) on October 29 and Nvidia (NASDAQ:NVDA) on November 14 are next on the list.

This week, 100 S&P 500 companies, including Tesla (NASDAQ:TSLA) (Day 23), IBM (NYSE:IBM) (Day 23) and Coca-Cola (NYSE:KO) (Day 22) are set to report their earnings.

Meanwhile, the Philadelphia Semiconductor Index, after a 40% rise in the first half of the year, has dipped and is currently up 25% for the year. It’s worth noting that semiconductors and related stocks account for 11.5% of the S&P 500.

In the face of tech stock buying, hedge funds have been selling consumer stocks and have now sold off for five consecutive weeks.

Upcoming U.S. retail sales will be intriguing after the previous data showed an increase of 0.4%, accelerating from an unrevised uptick of 0.1% in August, according to data from the Commerce Department. Economists had seen the reading at 0.3%.

Together with the interest rate cut, the potential rise in retail sales is expected to boost the accounts of companies in the medium term, including retailers and consumer products manufacturers.

Let's take a look at some of these companies:

1. Target

Target (NYSE:TGT) is an American department store chain and one of the largest retail companies in the United States.

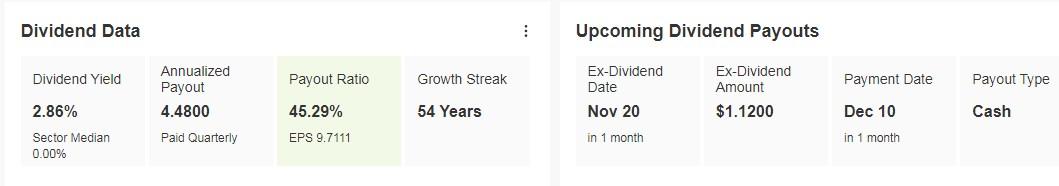

Target will distribute a dividend of $1.12 per share on December 19, with eligibility requiring shares to be held before November 20. The annual dividend yield stands at 2.86%.

Source: InvestingPro

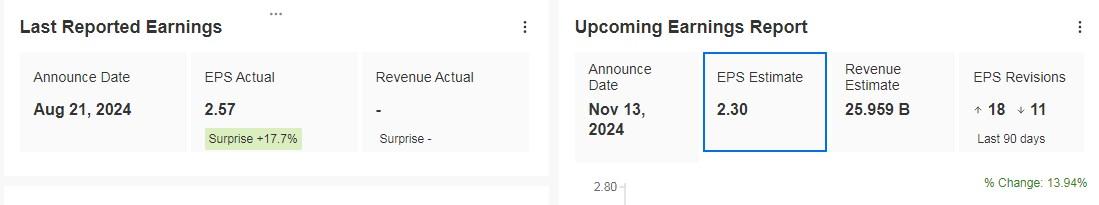

The company is set to release its quarterly results on Nov. 13, with a projected earnings per share (EPS) growth of 13.94%.

Source: InvestingPro

Wall Street believes Target is well-positioned to benefit from evolving consumer behavior. It has successfully positioned itself as a leader in both physical and online retailing, thanks to its innovative approach to store design, product assortment and delivery services.

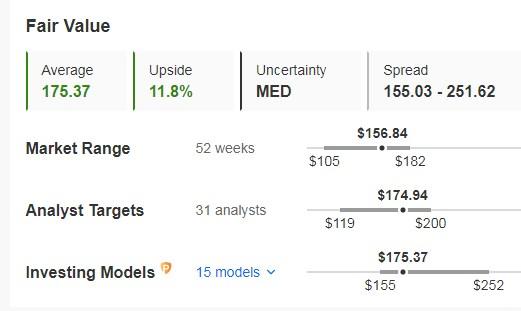

At the end of last week, its shares were 11.8% below its value on fundamentals at $175.37. The market sees potential for it at $174.94.

Source: InvestingPro

2. Carnival

Carnival (NYSE:CCL) is the largest cruise operator in the world, headquartered in Miami, Florida.

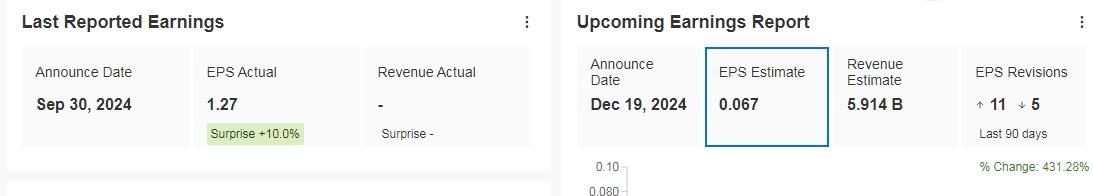

The company's quarterly earnings report is due on December 19, with EPS expected to increase by an astonishing 431.28%.

Source: InvestingPro

Carnival reported record-breaking third-quarter earnings, with revenues approaching $8 billion and net income up more than 60%. Investors have been encouraged by Carnival's strategic initiatives and the overall resurgence of the industry.

Solid earnings are attributed to high cruise demand and increased consumer travel spending, along with significant onboard spending and rising ticket prices.

Carnival's advance bookings for fiscal 2025 already surpass last year’s record levels, with higher prices. In addition, the company has also been expanding its operations and destinations.

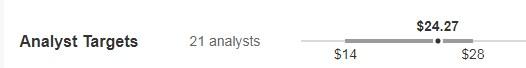

The market forecasts a potential price of $24.27, up more than 13% from the close of the week.

Source: InvestingPro

3. MercadoLibre

MercadoLibre (NASDAQ:MELI) is a multinational e-commerce company in Latin America, headquartered in Montevideo, Uruguay.

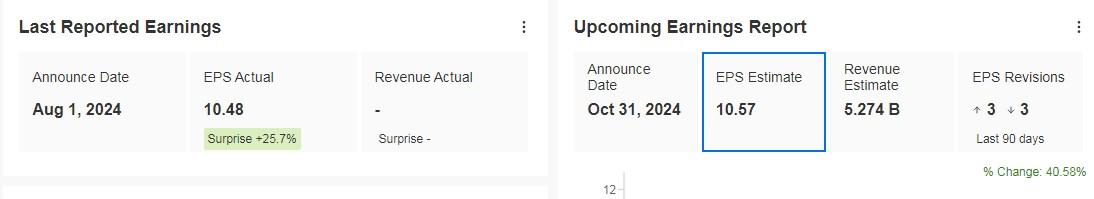

The company is set to release its earnings on October 31, with expected EPS growth of 40.58% and revenue growth of 25.24%.

Source: InvestingPro

MercadoLibre has established a strong presence in the Latin American market, where payments and e-commerce are experiencing substantial growth. Key drivers of its success include its payment platform, Mercado Pago, and its shipping solution, Mercado Envíos.

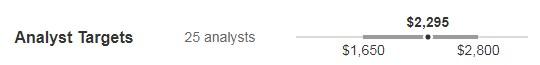

The market sees an average potential price of $2,295.

Source: InvestingPro

4. Anheuser-Busch InBev

Anheuser-Busch InBev (NYSE:BUD) is the world's largest beer maker with brands such as Budweiser, Corona Extra, Stella Artois, and Beck's.

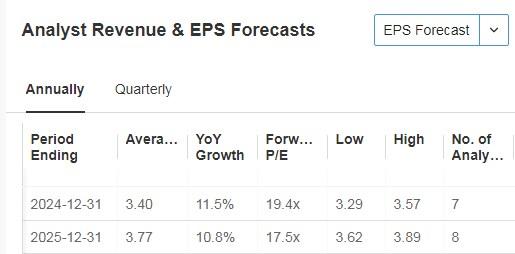

On October 31, it presents its earnings report, expecting an increase in earnings per share of 8.53%. Looking ahead to 2024 and 2025, the expectation is for growth of 11.5% and 10.8% respectively.

Source: InvestingPro

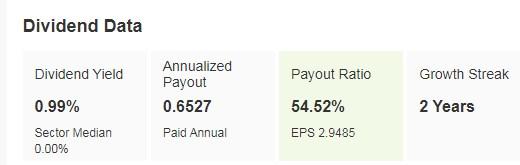

Its dividend yield is almost 1%.

Source: InvestingPro

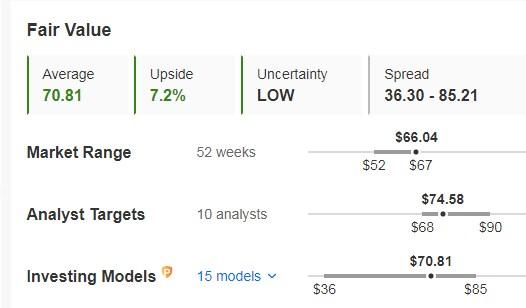

The market assigns it an average price of $74.58, with Barclays being the most cautious at $73.

Source: InvestingPro

It trades at a 7.2% discount to its fair value or fundamental value at the close of the week.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.