- Zoom is struggling to maintain its pace of growth as many in-person activities resume.

- NVIDIA warned this month that its sales are being hurt by the slowdown in the PC market.

- Salesforce has provided a robust forecast for its annual sales, signaling that demand for business software is holding up.

U.S. equity markets are likely to remain volatile amid the uncertainty about the future direction of interest rates with investors seeming to be moving to the sidelines after a powerful summer rally.

Stocks ended their streak of four-week gains last week on speculation that Federal Reserve Chairman Jerome Powell will reinforce the central bank’s resolve to stamp out inflation when he speaks on Friday during the three-day Wyoming conference.

Stocks have been choppy and lower in the past week as some analysts warned that the summer rebound isn’t justified when inflation is still running high, risking future growth. The S&P 500 finished down 1.2% for the week, its first decline after four weeks of gains.

Aside from interest rates and worries about growth, investors will also be watching some important earnings releases this week. Here are three we're following:

1. Zoom Video Communications

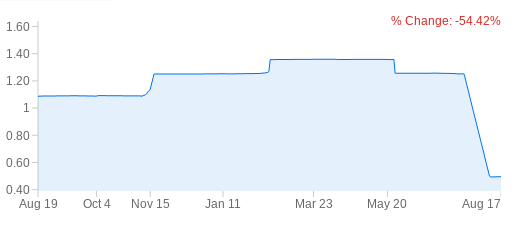

Zoom Video Communications (NASDAQ:ZM) is scheduled to report second-quarter earnings for its fiscal 2023 year after the market closes on Monday, Aug. 22. Analysts expect $0.94 a share profit on sales of $1.12 billion, according to their consensus forecast.

The video communications platform leader thrived during the pandemic, when stay-at-home requirements and remote work trends boosted its sales significantly. During that period, sales and profit had consistently beaten estimates every quarter, and the San Jose, Calif. company kept raising its guidance.

Source: Investing.com

But Zoom is now struggling to maintain that pace of growth amid the resumption of many in-person activities, including office work and classroom teaching. That makes investors skeptical about ZM’s stock’s future potential.

To deal with this slowdown, the company is focusing on business customers who will make up an increasingly larger share of revenue. This year, Zoom unveiled a new cloud contact center product. The company is also selling an Internet-enabled replacement for landline phones and technology to help organizations improve meetings that involve remote and in-office workers.

ZM stock closed on Friday at $99.50, down more than 45% this year.

2. NVIDIA Corporation

Semiconductor giant NVIDIA (NASDAQ:NVDA) will report its second-quarter, FY2023 earnings on Wednesday, Aug. 24 after the market close. Analysts expect the chipmaker to produce an EPS of $0.529 on revenues of $6.83 billion.

NVIDIA, the largest U.S.-based chipmaker by market value, warned this month that its sales are being hurt by the slowdown in the PC market and the company won’t be able to meet its earlier revenue forecast.

The chipmaker now expects revenue of $6.7 billion for the quarter ended July 31, some 17% below the $8.1 billion it had forecast in May, amid a 33% drop in gaming revenue.

NVDA EPS Forecast Trend

Source: InvestingPro+

“Our gaming product sell-through projections declined significantly as the quarter progressed,” Nvidia CEO Jensen Huang said in the statement. “As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our gaming partners to adjust channel prices and inventory.”

Following that announcement, Micron Technology (NASDAQ:NASDAQ:MU), another leading U.S. maker of memory chips, also warned investors that revenue wouldn't meet projections. NVDA stock fell on Friday by about 5% to close at $178.49. They are down 39% so far this year.

3. Salesforce.com

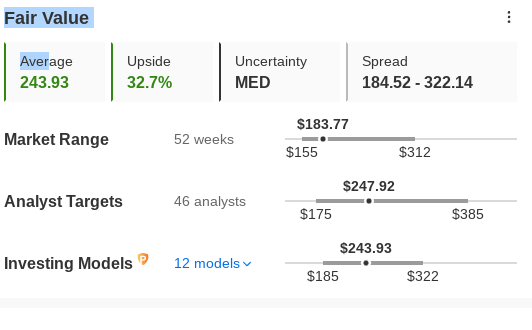

Salesforce.com (NYSE:CRM) is also scheduled to report its fiscal 2023, second-quarter earnings on Wednesday after the market closes. The company, which sells enterprise software and cloud-based services to corporate clients, is forecast to report $7.7 billion in revenue and $1.03 of earnings per share.

In May, the San Francisco-based company provided a robust forecast for its annual sales, signaling that demand for business software is holding up despite a broader downturn for major tech firms.

Source: InvestingPro+

Salesforce expanded its products for business productivity with the $27.7 billion purchase of the messaging platform Slack last year as part of its push to increase the value and utility of its flagship software which lets businesses manage and interact with customers.

CRM shares, which closed on Friday at $183.77, have lost 28% of their value this year as investors sold high-growth names amid recession risk.

Disclosure: The writer doesn’t own shares of the companies mentioned in this report.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »