- Oracle earnings may show its efforts to move customers to the cloud are working.

- Adobe business is being affected by currency fluctuations, seasonal shifts in demand and the decision to end sales in Russia and Belarus.

- Elon Musk's lawyers are claiming that they have found another breach of a contract in Twitter deal.

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

Inflation and interest rates will likely once again dominate the market trading agenda next week as investors await the August CPI data before the Federal Reserve’s next rate-setting meeting.

Inflation in the U.S. is running close to a four-decade high, pressuring policymakers to continue raising interest rates to reverse the trend. Market participants are expecting the Fed to raise by 75 basis points when its members meet on Sept. 21.

In addition to the monthly CPI release on Tuesday morning, the producer price index inflation reading is scheduled to be released on Wednesday, while retail sales and industrial production reports are due the next day.

Stocks broke a three-week losing streak the past week with the S&P 500 closing at 4,067.6, gaining 3.6% for the week. Amid concerns about inflation and the path of U.S. monetary policy, below are three stocks we’re monitoring closely this week:

1. Oracle

Software and infrastructure giant Oracle (NYSE:ORCL) is set to release its fiscal 2023, first-quarter earnings report on Monday, Sept.12, after the market close. Analysts are projecting $1.08 a share profit on sales of $11.33 billion.

In June, Austin, Texas-based Oracle reported strong earnings for the previous quarter, showing that its efforts to move customers to the cloud are paying off. Plus, the acquisition of health care records provider Cerner Corp (NASDAQ:CERN). was helping accelerate growth.

Oracle has been trying to fuel growth in its cloud business and create a bigger imprint in the fast-growing market, which is led by Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Alphabet's (NASDAQ:GOOGL) Google.

Cloud sales growth had been greater than 20% since Oracle, the second-biggest software maker by revenue, began disclosing it last year. Oracle shares, which closed on Friday at $75.91, are down 12% this year, faring better than the benchmark Nasdaq Index.

2. Adobe Systems

Adobe Systems (NASDAQ:ADBE) is scheduled to release its fiscal 2022 third-quarter earnings on Wednesday, Sept. 14 after the market close. The maker of Photoshop and other software and infrastructure products is expected to report $3.34 a share profit on sales of $4.44 billion.

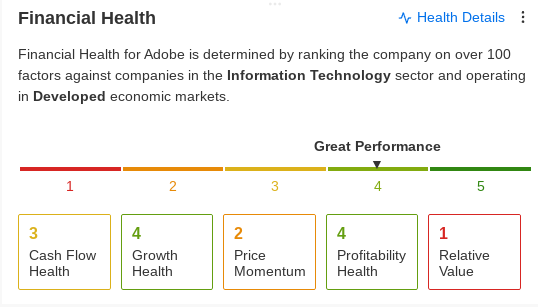

San Jose, Calif.-based Adobe, which competes with Salesforce.com (NYSE:CRM) in the marketing and e-commerce technology segment, is trying to boost growth by expanding its business offerings while strengthening its core creative software business.

In June, Adobe reduced its annual revenue forecast, saying its business would be affected by currency fluctuations, seasonal shifts in demand and the decision to end sales in Russia and Belarus after the invasion of Ukraine. Adobe, with more than 40% of its sales outside the Americas, said its revenue will be reduced about $175 million in the second half of the fiscal year by currency changes.

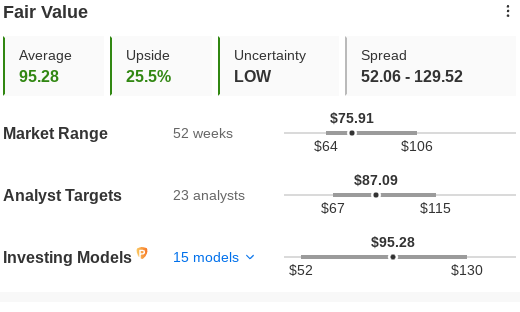

Adobe shares, which closed on Friday at $394.60, have fallen about 30% this year.

3. Twitter

Twitter (NYSE:TWTR) stock may come under pressure after Elon Musk's lawyers claimed on Friday that they have found another breach of a sale contract, providing the richest man in the world with another reason to walk away from his $44 billion purchase of the social-media platform.

Source: Investing.com

Musk’s lawyers, in a filing Friday, said as part of the purchase deal, Twitter needed to notify the billionaire before it spent $7.75 million in a separation agreement on June 28 with Peiter Zatko, the company’s former security chief.

Musk’s lawyers said they learned of Zatko’s agreement Sept. 3, when Twitter filed paperwork in court. Zatko is scheduled to testify before a U.S. Senate committee next week, according to a Bloomberg report, on his concerns about lax security and privacy issues and the number of bots on the platform. He has been subpoenaed to testify in the Twitter lawsuit, as well, Bloomberg reported.

Twitter stock, which closed on Friday at $42.19, has been extremely volatile amid a court battle with Musk, who wants to terminate the company’s acquisition on grounds that the platform misled him and investors about the number of spam and bot accounts among its more than 230 million users. The trial is scheduled to begin from next month,

Disclosure: At the time of writing, the writer owned shares of Microsoft.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »